Cold vs Hot Wallets in Plain Language

Before arguing about what’s “best”, let’s decode the jargon. A hot wallet is any crypto wallet that stays online: mobile apps, browser extensions, web wallets on exchanges. They’re like having cash in your jacket pocket: super handy, but you really don’t sleep well with your life savings in there. A cold wallet is crypto storage that stays offline: hardware devices, paper wallets, even an old laptop with Wi‑Fi ripped out. That’s more like a safe in the basement. The real trick isn’t “pick one”, but deciding how much money belongs in your pocket and how much in the safe, then building habits that make this division hard to screw up accidentally.

How Hot Wallets Actually Work (and Why People Love Them)

Hot wallets connect to the internet to sign transactions quickly. Your private keys live either on your phone/computer or on a remote server controlled by an exchange. This makes sending funds as simple as tapping “Send” while you’re in a café. Traders like this because they can react in seconds, and beginners like that they don’t have to think about seed phrases at first. But here’s the catch: any device online can be hacked, phished, stolen or infected with malware, which turns that convenient app into an unlocked door. The more often you sign, click links and install plugins, the wider this door quietly opens.

What Makes a Wallet “Cold”

A cold wallet keeps your private key offline while still letting you sign transactions when needed. Hardware devices, metal seed backups and even air‑gapped old smartphones fall into this bucket. When people search for the best cold wallet for cryptocurrency, they often overlook the boring piece: your recovery setup. A fancy hardware gadget is only as strong as where you hide its seed phrase and how you protect it from fire, water and nosy visitors. Cold storage shines for savings you rarely touch, because the friction of plugging in a device and confirming on a tiny screen acts as a built‑in “are you sure?” pause before any risky move or emotional trade.

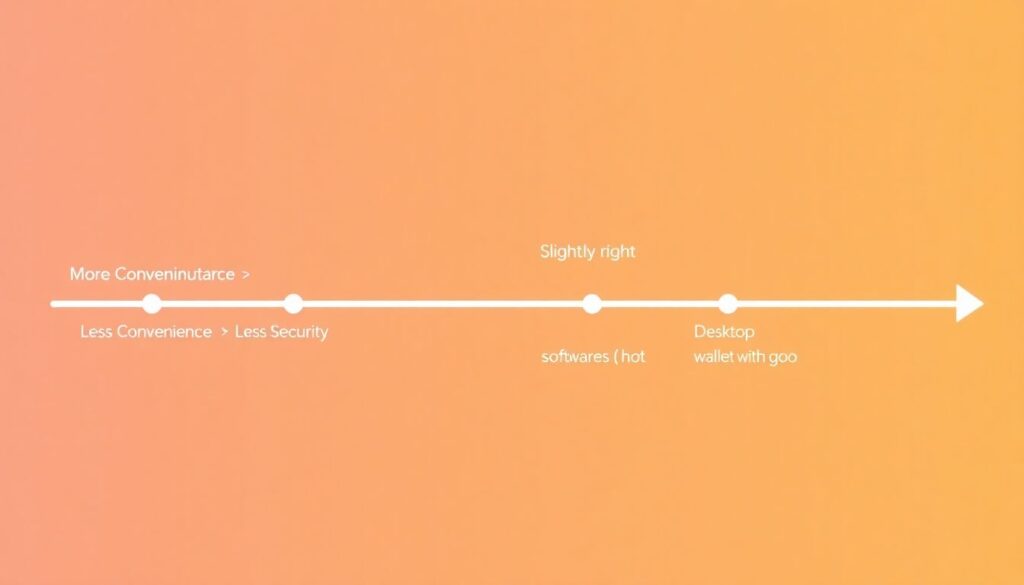

Text Diagram: Hot vs Cold at a Glance

[Diagram: Imagine a horizontal line. Left side: “More Convenience → Less Security”. Right side: “Less Convenience → More Security”. Place markers along it. On the far left, “Custodial exchange wallet (very hot)”. Slightly right, “Mobile software wallet (hot)”. In the center, “Desktop wallet with good OPSEC (warm)”. Further right, “Hardware wallet (cold)”. Far right, “Air‑gapped device + metal seed (very cold)”. This hot vs cold crypto wallet comparison isn’t about gadgets only; it shows a spectrum. You choose your position based on how often you transact and how badly it would hurt if everything vanished overnight.]

Analogy: Cash, Bank Account, and Safe Deposit Box

Think of crypto storage the way you handle money offline. A hot wallet is cash in your pocket: perfect for coffee, tips, a spontaneous dinner. Your main bank account is like a more secure software setup: still accessible, but with extra checks. A cold wallet is a safe deposit box in a different building. You don’t keep grocery money there, but you’d be comfortable leaving an inheritance for years. When people ask hardware wallet vs software wallet which is safer, the better question is, “For which role?” For daily spending, maximum safety kills usability; for life savings, convenience isn’t just unhelpful, it’s a risk multiplier that tempts you to move funds too often.

Non‑Obvious Strategies: Mix, Layer, Segregate

You’re not limited to “one hot” or “one cold” wallet. A more robust, slightly unconventional approach is to run several wallets with distinct jobs. For example, maintain a tiny hot wallet for daily transactions, a “warm” desktop or mobile wallet for medium sums, and a secure crypto wallet for long term storage on a hardware device disconnected by default. Go further: use different wallets for speculation, income, and savings. That way, a risky DeFi experiment in your “casino” wallet can’t nuke your rent or retirement funds, because the keys literally never touch the same browser or phone. Segregation beats paranoia.

Step‑by‑Step: How to Choose the Best Wallet for Digital Assets

1. List your goals: daily spending, trading, saving, or receiving salary in crypto.

2. Decide time horizons: what you won’t touch for 3+ years should lean cold.

3. Estimate risk tolerance: if losing 10% hurts badly, don’t keep it on an exchange.

4. Map your tech skills honestly; simpler is safer than features you don’t understand.

5. Combine tools: one hot, one cold, and a backup method, instead of one “perfect” wallet.

Treat this as a design exercise, not a shopping trip, and wallets become components in your personal “money system”, not magic objects to obsess over.

Weird but Effective Cold Storage Ideas (Use with Care)

You can build a DIY cold wallet from an old smartphone with Wi‑Fi, Bluetooth and SIM permanently disabled, installing a reputable wallet and using it only for offline signing. Another unusual method is a split seed: write half the words on one steel plate, half on another, stored in different locations; without both, recovery fails. For serious sums, some users adopt a “travel wallet” approach: keep only limited funds in any hot environment while the bulk sits in a secure crypto wallet for long term storage, whose seed phrase is recorded in a language or code only you and a trusted partner understand, reducing social‑engineering risk.

Practical Hot Wallet Safety Upgrades

If you must stay hot, you can still harden your setup. Use a dedicated browser profile just for crypto, with no random extensions. Turn on hardware‑level security like secure enclaves and biometric unlocks, and never store seed phrases in screenshots, notes apps or cloud drives. Maintain a strict “no clicking links from DMs” rule and navigate to sites by bookmarks only. One surprisingly effective trick is to keep a small, deliberate “burner” wallet you assume will eventually be compromised; you use it to test new dApps, while your larger hot wallet never connects to anything experimental. In practice, this mental model stops impulsive mistakes.

Pulling It Together: Balancing Risk, Time and Attention

Instead of hunting for a mythical single “best” device, see wallets as trade‑off machines. The best cold wallet for cryptocurrency is the one you can actually operate correctly under stress, with backups you’ve tested. A hot wallet that stays minimal, compartmentalized and treated like loose cash can coexist with deep‑cold storage that you rarely touch. In the end, hot vs cold isn’t a binary fight; it’s a slider you adjust as your portfolio, skills and threat model change. Regularly re‑check this mix once or twice a year, the same way you’d revisit insurance or investments, and your digital assets stop being a constant source of low‑level anxiety.