Why Your Seed Phrase Matters More Than Your Password

If your email gets hacked, you reset the password.

If your seed phrase or private keys leak, you reset your net worth to zero.

That’s the core problem: most people treat their seed phrase like a password, but it’s actually a *master key* that can’t be revoked. That’s why any guide on how to securely store seed phrase and private keys must be closer to physical security planning than typical “create a strong password” advice.

Let’s unpack practical setups, real horror stories, and a few tricks professionals use that almost nobody talks about.

—

Real-World Screwups (And What They Teach Us)

Кейс №1: Фото для «на секунду»

A trader I consulted with had a solid setup: hardware wallet, pin, passphrase.

Then he did one thing: took a clear photo of his seed phrase “so I don’t lose it” and sent it to himself on email.

Months later, his email got compromised through an old password leak. The attacker simply searched for “seed phrase” and “backup” in his Gmail. The wallet was drained in under an hour.

Lesson:

If your seed phrase ever touches an internet-connected device (camera, cloud, messenger, printer), treat it as *compromised*. You might be safe today, but not forever. Cloud storage is like a time bomb: the leak may happen years later, when the coins are finally worth serious money.

—

Кейс №2: Бумага + Влажность + Насекомые

Another case: a long-term HODLer wrote his backup on paper, put it in a cheap “fireproof” safe, and didn’t touch it for 4 years.

When he opened it, humidity and mold had eaten parts of several words. Some letters were barely legible. He spent days brute-forcing combinations to restore the seed; he got lucky. Many others don’t.

Lesson:

Paper isn’t just vulnerable to fire. It’s weak against moisture, time, UV light, and the occasional cockroach feast. If you’re serious about long-term storage, you need to move beyond just a sheet of paper.

—

Choosing the Right Medium: Hardware, Paper, Metal

Hardware wallet vs paper wallet for private key security

Let’s break this down in human language:

– Paper wallet

– Pros: offline, cheap, easy to create.

– Cons: easy to damage, easy to photograph, easy to copy without you noticing, easy to lose. Almost no protection if someone finds it.

– Hardware wallet

– Pros: keeps private keys isolated from your phone/PC; protects against many common malware attacks; can require PIN and passphrase; often supports multi-account and multisig.

– Cons: costs money, can be lost or broken, still depends on how safely you store the seed phrase.

The smart strategy:

Use a *hardware wallet* for daily access and transaction signing, and treat any *paper wallet* strictly as a transitional step (e.g., jotting down the phrase before transferring it onto a more robust medium like metal).

—

Metal: The Boring but Effective Upgrade

If you want robust long-term seed phrase metal backup for crypto wallet protection, steel beats paper every time. Fire, flood, time – metal handles it much better.

But here’s where people mess up:

They buy a metal backup, neatly engrave or punch the full phrase, and store it in an obvious place (like the same drawer as the hardware wallet). It’s durable, yes—but also now a perfectly preserved, permanent leak if found.

Durability is one side of the equation. Stealth and access control are the other two. You need all three.

—

Core Principles: How the Pros Think About Seed Phrase Security

Instead of memorizing dozens of dos and don’ts, lock in these principles:

1. Never digitize your full seed phrase or private key in plain form

No screenshots, no photos, no notes app, no Excel, no PDF, no printing, no copy-paste into cloud notes. If you absolutely must use digital, you encrypt *properly* (we’ll touch on it later), and even then, never keep the decryption key with the file.

2. Assume future attacks, not just today’s

AI-based OCR on your old photo backups. Cloud providers handing data to unknown parties. Old laptop hard drives sold on eBay. You’re planning for 5–20 years, not 5 weeks.

3. Separate what you know, what you have, and where it’s stored

– Part in your head (passphrase, hint, or extra word),

– Part on a physical medium (paper/metal),

– Part in location separation (different rooms/cities/people).

4. Rehearse worst-case scenarios

Lost house, fire, divorce, travel ban, illness, memory loss. Can *future you* or your family still recover funds?

—

Practical Setup: From “Basic” to “Battle-Ready”

Basic but Solid (For Small–Medium Funds)

For a normal user who wants strong protection without going off the deep end:

1. Buy a reputable hardware wallet directly from the manufacturer.

2. Generate a new wallet *on the device itself*, not via browser wallet extensions.

3. Write down the seed phrase by hand on paper. Double-check each word.

4. Transfer it to a metal backup, or at least a higher-quality, archival-safe medium.

5. Destroy the original paper if your environment is risky (easily accessible, shared house).

6. Store the metal in a place only you know, protected from moisture and obvious discovery.

Already here you’ve beaten 90% of casual users.

—

Level Up: Splitting and Obfuscation

For larger amounts, the best way to back up crypto wallet recovery phrase usually involves some form of splitting or obfuscation:

– Physical split (2-of-2)

Divide your 24 words into two sets of 12. Store them in different locations.

Downside: if you lose one part, you lose everything.

– Physical split with redundancy (e.g., 2-of-3)

Create 3 overlapping shares, where any 2 can reconstruct the full phrase.

Example (simplified):

– Share A contains words 1–16

– Share B contains words 9–24

– Share C contains words 1–8 + 17–24

Any two shares can reconstruct all 24.

– Obfuscation with a “decoy twist”

Write down the correct words, but add an extra decoy word at a fixed position (that only you know) or replace one word with a synonym and keep the correction in your memory.

Warning: if you overcomplicate this, future you might outsmart present you in a very bad way.

—

Non-Obvious Solutions That Actually Work

1. Shamir’s Secret Sharing (But Used Sanely)

Some wallets support Shamir backups (SLIP-39). It lets you split a seed into multiple shares with customizable thresholds (e.g., any 3 of 5 shares can restore the wallet).

Pros:

– Great for distributing risk across locations and people.

– Resistant to a single point of failure.

Cons:

– Complexity. If no one but you understands the scheme, your heirs are in trouble.

– Vendor specificity: Shamir shares aren’t as universally supported as standard BIP-39 seed phrases.

Use it if:

You’re comfortable documenting the process clearly enough that a non-technical heir can follow it with the help of a lawyer or trusted person.

—

2. “Half in Your Head” Passphrase Strategy

Many hardware wallets let you add an extra “passphrase” on top of your seed phrase. This passphrase is *not* written anywhere; it’s additional entropy only you know.

Pattern that works well:

– Write down the standard 12/24-word seed on metal.

– Memorize a short but non-obvious passphrase (like several unrelated words, not your birthday or pet’s name).

– Store written instructions for your heirs that mention “an additional password is required,” which you share with them separately (or via sealed letter, lawyer, etc.).

Even if someone steals your metal backup, they still can’t access your funds without the passphrase. Just don’t choose something guessable.

—

3. Encrypted Digital Backup as a Secondary Layer

Sometimes, pure physical storage is risky (frequent travel, unstable region, small city where everyone knows everyone). Then a properly encrypted digital backup *as a secondary layer* can make sense:

– Use strong, audited encryption tools (e.g., age, GPG, or a well-configured password manager).

– The file contains *only* the seed phrase, nothing else.

– The encryption password is not reused anywhere and ideally is itself backed up separately (written down and stored physically).

This is not for beginners. But in some threat models, “strong crypto + solid passphrase + offsite storage” is safer than a single physical copy hidden in an obvious apartment hiding spot.

—

Alternative Methods for Different Risk Profiles

Cold Storage for “I’ll Check It in 5 Years” Money

If you have long-term holdings you barely touch:

– Use a dedicated hardware wallet that never connects to random computers; ideally, only to an air-gapped device or a system you keep clean just for finance.

– Store its seed phrase in metal, split across at least two locations (like home safe + bank safe deposit box).

– Document the restore process in a human-friendly way for your future self or heirs, without revealing the actual seed.

Your goal isn’t just “no one can steal it”; it’s also “I can still unlock it after a house move, a hard drive failure, or five years of life chaos.”

—

“Hotter” Wallets for Everyday Spending

For smaller amounts you use often, stricter setups can backfire because you’ll cut corners out of frustration. Instead:

– Keep a moderate balance in a hot or mobile wallet.

– Set up daily and total limits, if supported.

– Frequently sweep profits into cold storage.

Here the focus is less on extreme seed phrase gymnastics and more on simple crypto wallet security best practices for private keys and backups: lock screen, device encryption, up-to-date OS, no shady apps, and quick revocation if your phone is lost.

—

Professional Lifehacks Many Never Hear About

1. Practice a Full Recovery Before You Need It

Most people never test their backup. They just assume it works.

Professional move:

1. Take your seed phrase.

2. On a separate, fresh hardware wallet or software wallet (offline), try to fully restore the wallet using only the backup.

3. Check that addresses and balances match.

4. When done, securely wipe the test device.

This one exercise will uncover 90% of errors: missing words, bad handwriting, wrong word order, forgotten passphrase.

—

2. Threat Modeling Like a Pro

Write down answers (just for yourself) to:

1. Who is realistically most likely to attack me?

2. What’s more probable: theft by a stranger or “curiosity” by someone close?

3. Is my biggest risk digital (hacks, malware) or physical (burglary, coercion)?

4. Do I trust my future self to remember all my clever tricks?

If family or roommates are your main risk, you need *stealth* (non-obvious hiding places, decoy setups).

If online hacks are your main risk, you need *strict isolation* (no digital traces, devices dedicated to crypto only).

—

3. Decoy Wallets and Plausible Deniability

For some people (high-crime regions, visible lifestyle), a decoy setup is not paranoia; it’s survival.

– Have a visible wallet with a small amount on it.

– Have the real funds behind a hidden passphrase or on a completely separate seed.

– Train yourself to behave as if the visible wallet is the main one.

Some hardware wallets and setups support multiple passphrases leading to different accounts. If someone forces you to “unlock everything,” you reveal the decoy level. Again, this is an advanced tactic—only use it if your environment justifies it.

—

4. Document for Heirs Without Handing Them the Keys

A very common professional mistake: they build a brilliant multi-layer system… and nobody else on earth can use it if something happens to them.

Simple approach:

1. Write a clear, non-technical explanation of:

– which wallet brand you use,

– what type of backup exists (metal, paper, encrypted file),

– roughly where it can be found (e.g., “in a safe deposit box under my name at [bank]”),

– who to call for help (lawyer, trusted tech friend, instructions to find a reputable local expert).

2. Store this document with a will or legal papers, *without* the actual seed phrase.

3. Separately store the actual seed and/or passphrases in secure physical locations.

You decouple *knowledge of funds & process* from *direct access to the keys*.

—

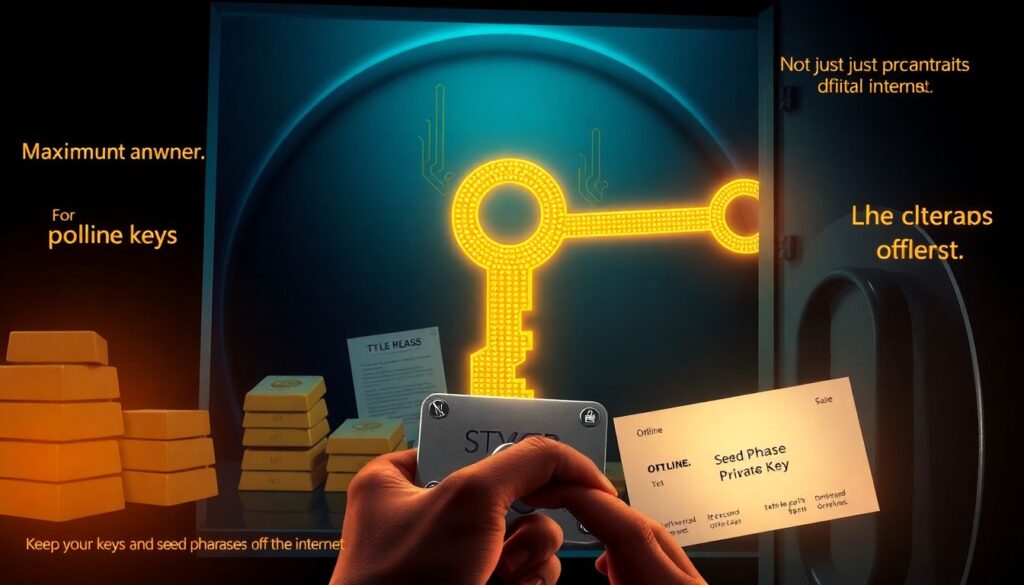

Putting It All Together

Seed phrases and private keys aren’t just another password. They’re the skeleton key to everything you hold on-chain. Treat them like you’d treat a combination of gold bars, title deeds, and offshore accounts, all in one.

If you remember only this:

1. Keep your keys and seed phrases off the internet.

2. Use sturdy physical backups (preferably metal), in more than one location.

3. Consider splitting or adding a passphrase if your holdings justify the complexity.

4. Test your recovery process before reality does it for you.

5. Plan not just against thieves, but also against your own future forgetfulness.

Do that, and you’re already way past “typical user” and into “borderline professional” territory—without needing a PhD in cryptography or a bunker in the mountains.