Crypto scams in 2025 don’t look like the clumsy “send me 1 BTC, I’ll send 2 back” messages from years ago. Now you’re dealing with deepfake voices imitating support staff, telegram “friends” who know your trading history, and phishing sites that perfectly clone major exchanges. To protect yourself from crypto phishing and social engineering attacks, you have to assume that your attention, not your wallet, is the primary target. Attackers study how you think: your fear of missing out, your panic when funds seem stuck, your trust in well-known brands. If you treat every interaction around your coins as a potential psychological test, you naturally slow down, verify, and reduce the odds of falling for a cleverly staged trick disguised as urgent help or a once-in-a-lifetime opportunity.

At the same time, you shouldn’t live in constant paranoia. The goal is to build simple, repeatable habits and a few technical defenses so that even on a bad day—tired, distracted, or stressed—your system still catches most traps before you click. Think of it as putting guard rails around your future self.

Necessary tools and mental models

Before talking about specific apps and gadgets, it’s worth defining your mental toolkit. At a minimum, you need a rule that no one—including support, admins, or “devs”—ever gets your seed phrase or private keys. You need a second rule that you never sign a transaction or message that you don’t fully understand. Around these rules you build layers: a password manager for strong, unique logins; an authenticator app or hardware security key for 2FA; a browser dedicated only to crypto; and reliable crypto phishing protection software that blocks known malicious domains and flags suspicious dApps. Add one more layer with the best hardware wallet for crypto security you can reasonably afford, so that even if your laptop is compromised, an attacker still can’t move funds without physically touching your device and getting past its PIN and confirmation prompts.

On top of that, consider softer tools: a written playbook for yourself that says how you respond to various situations—“urgent support DM,” “airdrop claim,” “KYC issue,” “staking upgrade.” When you’ve already decided in advance, under calm conditions, that you will never click a link from a direct message and will always type exchange URLs manually, you reduce decision fatigue later. If you’re just starting out, a structured crypto security course for beginners can shortcut years of painful trial and error by walking you through real attack examples, showing you blockchain explorers, and helping you read transaction data so signatures stop feeling like magic and start looking like verifiable instructions.

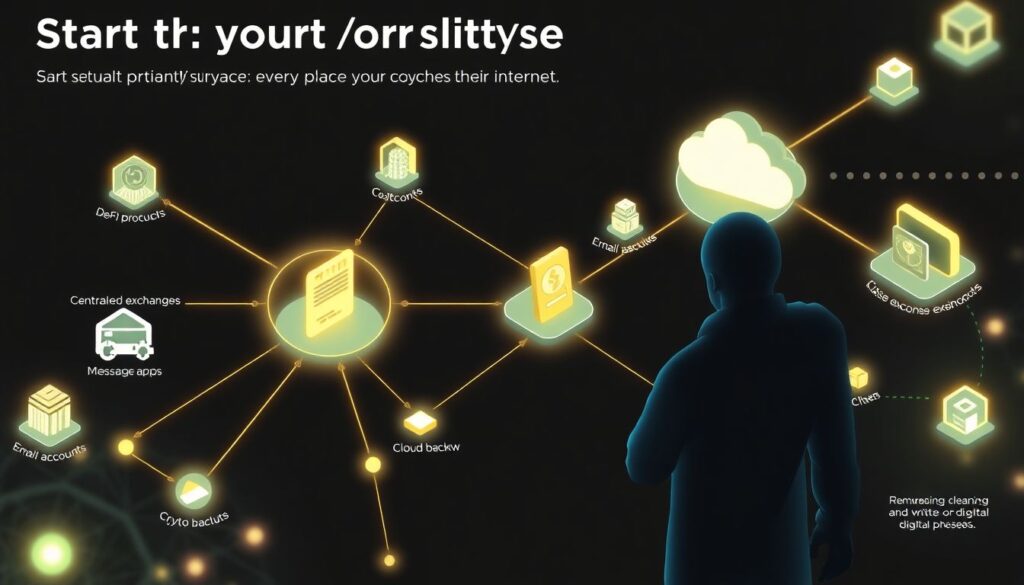

Step-by-step process: how to protect crypto wallet from scams

Start with your “attack surface”: every place your crypto touches the internet. That includes exchanges, DeFi protocols, wallets, email accounts, messaging apps, and even cloud backups. Clean up first by removing any abandoned wallets, closing unused exchange accounts, and deleting seed phrases and private keys from screenshots, notes apps, or cloud drives. Then harden what remains. Use a reputable non-custodial wallet, connect it to a hardware device, and segment funds: a “hot” wallet with only small, spendable amounts and a “cold” vault never used with experimental dApps. Apply strong, unique passwords through a password manager and replace SMS codes with app-based 2FA or security keys. This drastically narrows the range of attacks that can succeed with just a leaked password or SIM-swap.

Once the basics are in place, focus on how you interact with links and messages. Develop a two-step verification habit: first, verify the channel, then verify the content. If “support” writes on Telegram, check whether the platform even offers direct support there; most major exchanges don’t. If a friend sends a “must-try” DeFi link, confirm via a second channel—call them or ping them on another app. For sites, never trust a link in email, social media, or chat; instead, search the official project name, confirm the domain from multiple sources, and bookmark it for future visits. Each time you connect your wallet, read the URL carefully, inspect the SSL certificate, and pause before clicking “Connect,” because most crypto phishing hinges on a single hurried confirmation.

Next, train yourself to interpret signature prompts. When a dApp requests permissions, ask: what exactly is it asking to move or approve, and for how long? If the wallet interface shows “unlimited spending” for a token, that’s a red flag unless you deeply trust the contract and understand why it needs that scope. Learn to revoke token approvals using block explorers or trusted revocation tools, making it a habit to audit approvals monthly. This way, even if you sign something too generous once, you’re not leaving that door open forever. Combine that with regular software updates, browser hygiene—no sketchy extensions on your “crypto browser”—and backups of your seed phrases written by hand and stored offline in at least two separate secure locations.

Finally, factor in human pressure, which is where social engineering thrives. Any message that pairs urgency with secrecy (“don’t tell support, we are fixing it for VIPs,” “offer expires in 10 minutes”) should trigger automatic skepticism. Build a cooling-off rule: if something feels rushed, you wait at least 15 minutes and verify through an official channel. Many attacks collapse under the weight of time, because scammers can’t maintain their script when you stop responding instantly or start asking detailed, technical questions. Over time this habit flips the script: instead of you defending, scammers waste their own time and abandon you as an unprofitable target.

Troubleshooting and damage control

Even with strong defenses, there’s a chance you’ll click the wrong link or sign a malicious transaction. What matters is how quickly and methodically you respond. The moment you suspect compromise—unexpected approvals, strange pop-ups, or assets moving without your intent—assume your current device and wallet environment are not trustworthy. Disconnect from the internet, stop interacting with the suspicious site, and avoid entering any more credentials. From a separate, clean device, create a new wallet, preferably secured by hardware, and immediately transfer any remaining safe funds from the old one. If token approvals might be abused, use a reputable revocation tool via your new setup to cut off the attacker’s permissions. Acting within minutes can be the difference between a partial and total loss.

If funds are already gone, traditional banks won’t reverse blockchain transactions, but there are still practical steps. Document everything: timestamps, transaction hashes, addresses involved, messages exchanged. Report the incident to the platforms touched—exchanges, NFT marketplaces, or wallets—because they can sometimes flag or freeze assets passing through centralized points. Law enforcement in many countries has specialized cybercrime units now familiar with on-chain tracing. In parallel, cautiously explore crypto scam recovery services, but treat them with deep suspicion; that niche is itself infested with scammers preying on desperate victims. Legitimate firms won’t promise guaranteed recovery or ask you to send more crypto “to unlock” what was lost. When in doubt, seek community feedback in well-moderated forums or from security researchers with a visible track record, not from random DMs offering miracles.

One more troubleshooting layer involves your identity, not just your coins. Many phishing and social engineering attacks collect KYC documents, selfies, or exchange login data, which can later be reused for account takeovers or synthetic identity fraud. If you’ve ever uploaded sensitive documents to a suspicious site or shared them in chat, monitor your credit reports and exchange logins more closely, enable all available security features—including withdrawal whitelists and withdrawal delays—and consider changing primary email addresses tied to large holdings. Think of it as a containment strategy: the attack already happened, but you can still stop its ripple effects from reaching other wallets, banks, or long-term investments.

Looking forward, expect the line between human and machine social engineering to blur even more. By late 2025, large-scale attackers are already using AI to generate personalized scam messages that mimic your writing style, reference your on-chain history, and even imitate voices from past voice chats. Deepfake video support agents guiding you through “security checks” will become normal. At the same time, defensive tools will improve: next-generation browsers and wallets will integrate behavioral analysis, flagging abnormal signing patterns, and advanced crypto phishing protection software will cross-check domains, contracts, and known scam clusters in real time. The safest posture will combine education, hardware isolation, and automated anomaly detection. If you invest a bit now in learning, practicing disciplined habits, and using the right tools, you position yourself not just to survive that future, but to navigate it with confidence instead of fear.