Why crypto taxes feel different in 2025

If you’re just getting into crypto trading in 2025, the tax side probably feels way more serious than it did a few years ago. That’s not your imagination. Since around 2021, tax authorities in the US, EU, UK and parts of Asia have treated crypto as a mainstream asset class, not a niche hobby. In the US, the IRS has a dedicated digital asset unit; European regulators are rolling out MiCA and the DAC8 rules that will force exchanges to report user data across borders. Chainalysis estimated that global crypto transaction volume passed the $1 trillion mark again in 2023 despite the bear market, and regulators followed the money. The trend is clear: as adoption grows, tax reporting gets stricter, and “I didn’t know” stops working as an excuse, even for beginners.

So the goal now isn’t to dodge attention, but to learn the basic rules early and build good habits. That’s how you keep more of your gains and sleep at night when tax season hits.

How crypto trades are usually taxed

Let’s unpack the core idea in plain language. In most major jurisdictions, crypto is treated like property or an investment asset, not like cash. That means every time you dispose of a coin or token — selling for fiat, trading BTC for ETH, or even paying for something with crypto — you trigger a taxable event. If you made money compared to what you originally paid (your cost basis), that’s a capital gain; if you lost, that’s a capital loss. Short‑term gains (held under a year) are often taxed at higher, income‑like rates; long‑term gains usually get a discount. On top of that you might have ordinary income when you earn staking rewards, yield from DeFi, airdrops, or get paid in crypto for freelance work. Different countries tweak the details, but the mental model is the same: income when you receive coins, capital gains or losses when you get rid of them.

If you remember just one thing, it’s this: every trade is data, and that data eventually becomes numbers on a tax return.

What’s changed recently: data sharing and enforcement

The big shift as we roll through 2025 is the level of transparency. Major exchanges now routinely send user data to tax authorities, much like traditional brokers do. The OECD’s Crypto‑Asset Reporting Framework aims to standardize this globally, and regions like the EU are already wiring it into local law. In the US, new broker reporting rules are set to cover more platforms and more types of transactions. Governments saw the gap between reported crypto income and on‑chain activity and decided to close it. For you as a beginner, this means two things: first, assuming “small amounts don’t matter” is risky; second, clean records are your best protection. When regulators can cross‑check exchange reports, blockchain analytics, and your tax return, missing trades or claiming ignorance becomes a real liability, even if it was accidental.

In other words, the future of crypto tax isn’t anonymous; it’s automated.

Economic backdrop: why taxes matter to your returns

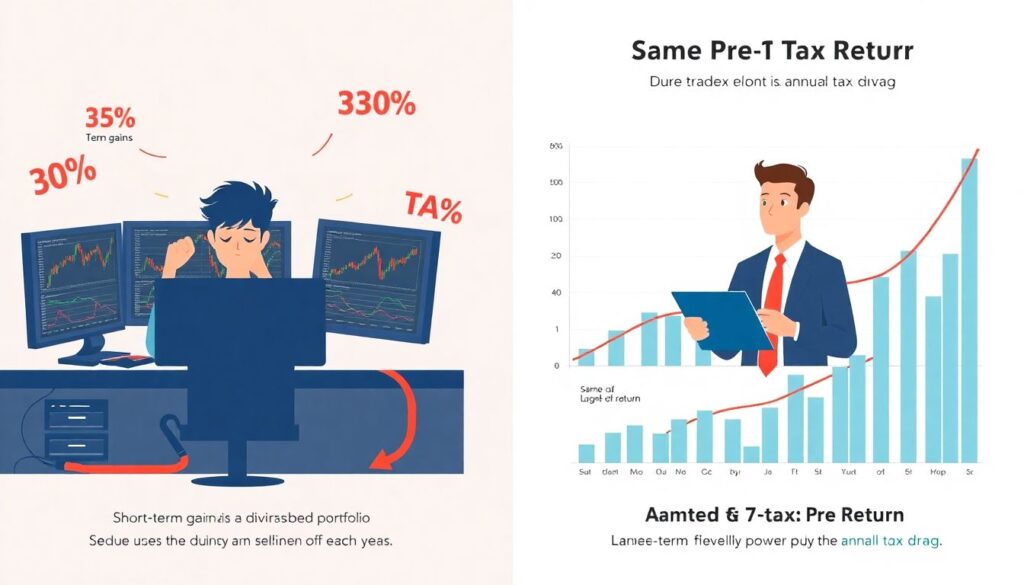

Most new traders obsess over entry prices and ignore tax drag, but the numbers are brutal. If you’re paying, say, 30% on short‑term gains every year, you’re effectively handing over a big chunk of your compounding power. Imagine two portfolios earning the same pre‑tax return, but one is churned with frequent taxable trades while the other is optimized for long‑term holding. After a decade, the tax‑efficient approach can be worth dramatically more, even with identical market performance. This is why institutional players obsess over tax structure and timing; they know net, after‑tax returns are what actually build wealth. As crypto increasingly plugs into traditional finance — ETFs, structured products, tokenized funds — those same economic realities spill over into retail trading. Your strategy isn’t just about picking winners; it’s about not leaking profit to the tax man unnecessarily.

How to legally reduce crypto taxes: mindset and rules of thumb

Let’s talk about how to legally reduce crypto taxes without doing anything shady. First, stretch your holding period whenever you reasonably can. Shifting a trade from a 10‑month hold to a 13‑month hold can turn a short‑term gain into a long‑term one in many countries, often cutting the tax rate significantly. Second, be intentional about when you realize gains: taking profit late in a year when you’re already in a high bracket is very different from spacing realizations over multiple tax years. Third, match gains with losses. If you have profitable trades, you can offset them by realizing losses elsewhere in your portfolio, staying within your risk limits. Fourth, separate “investment” activity from “trading” mentally. Constant scalping or leverage can turn what you think is a hobby into something tax authorities might treat more like business income, with different rules. None of this requires exotic setups; it just means planning ahead instead of treating every pump as an emergency sell signal.

The basic playbook is simple: trade a bit slower, think in years not weeks, and integrate taxes into your strategy instead of bolting them on at the end.

Tools and people that make the boring part easier

Manually tracking every swap, bridge, and airdrop in a spreadsheet is a fast way to hate both crypto and taxes. That’s why using crypto tax software for beginners has basically become mandatory once you go beyond a handful of trades. Modern tools can pull data from centralized exchanges, DeFi wallets, and even NFT marketplaces, then calculate gains, losses, and income categories under different tax rules. They’re not perfect — you still need to review and label weird transactions — but they save you from drowning in CSV files. For more active traders, finding the best crypto tax accountant for traders can be a huge edge. Someone who understands perpetual futures, options, staking, and cross‑border issues can spot deductions, clarify grey areas, and stop you from making expensive mistakes. At a higher level of capital, investors are also turning to crypto tax planning services for investors, which treat your digital assets as part of a broader wealth plan: where you live, how you structure entities, and how your on‑chain activity meshes with your traditional portfolio.

Think of it this way: you’re outsourcing the paperwork brain‑damage so you can focus on your edge in the market.

Choosing software and advisors without getting burned

When you pick tools or professionals, avoid the extremes: you don’t want a generic accountant who fears crypto, but you also don’t want a “degen influencer” with zero formal tax background. Check whether the software supports the chains and DeFi protocols you actually use, and whether it keeps up with rapid protocol changes. For advisors, look for real credentials plus demonstrable crypto literacy, not just a marketing page with buzzwords. In 2025 the market for these services is crowded; the good news is that competition is pushing prices down and quality up, but the burden is still on you to filter the hype. Remember, you’re giving these people and tools the keys to your financial history — due diligence is non‑negotiable.

Using a crypto tax loss harvesting strategy without sabotaging yourself

You’ve probably heard about tax‑loss harvesting from stock investors, but it’s just as relevant to digital assets. A well‑designed crypto tax loss harvesting strategy means deliberately realizing losses to offset current or future gains, while trying to keep your market exposure intact. In practice, that might look like selling a token that’s underwater and immediately buying a close substitute, or rotating from spot holdings into a futures position with similar risk. One modern twist is regulatory: many jurisdictions have strict “wash sale” rules for stocks but are still catching up on how they apply to crypto. Some countries explicitly extend these rules to digital assets; others don’t yet, but that can change quickly. Because of this moving target, harvesting shouldn’t be a frantic December ritual; it should be monitored throughout the year, with an eye on both current law and likely changes. And remember the economic reality: harvesting is most powerful when you’re offsetting large, high‑tax gains, not when you’re mindlessly locking in small losses that damage your long‑term compounding.

Used well, harvesting rounds off the sharp edges of volatility; used badly, it just crystallizes pain.

Portfolio design: tax‑aware from day one

A simple way to minimize tax friction is to design your portfolio so that the most frequently traded strategies sit in the most tax‑efficient “buckets” you have access to. In some countries that might mean using tax‑advantaged accounts where possible; in others it might mean keeping high‑turnover, speculative trades in lower‑tax entities and holding core positions personally for the long term. Even at a small scale, you can separate “long‑term conviction” wallets from “short‑term trading” wallets to keep your behavior — and your records — clean. It sounds like overkill for a beginner, but in 2025 the line between hobbyist and serious investor can blur quickly. A bull run, some leverage, and a lucky narrative, and suddenly your casual trades have real tax consequences.

Broader economic and industry impact of smarter tax behavior

As more retail traders learn to handle taxes properly, the market itself starts to behave differently. When a large share of participants plan around long‑term holding periods and tax‑efficient exits, you tend to see less panicked selling on every bounce and more measured rebalancing around calendar milestones. There’s already evidence of this from traditional markets, where year‑end tax‑loss selling and January rebounds form recognizable patterns; crypto is beginning to show similar seasonality as professional money flows in. On the macro side, governments now view digital asset tax revenue as a non‑trivial budget line. That creates an odd kind of alignment: states have an incentive to keep the industry alive and taxable rather than banning it outright, but they also push harder on enforcement. Meanwhile, exchanges, wallets, and DeFi front‑ends are racing to integrate compliant reporting tools to stay on regulators’ good side. The result is a slow convergence: crypto doesn’t lose its innovative edge, but it does start to look more like the rest of finance in how money is tracked and taxed.

Looking ahead: trends to watch and how to stay ready

As we move further into 2025, expect three big tax trends: more automatic reporting from platforms, clearer guidance on tricky areas like NFTs and DeFi yields, and growing pressure on cross‑border traders who think jurisdiction hopping is a magic shield. For you as a beginner, the winning formula is surprisingly straightforward: track everything from day one, use decent software, check in with a pro at least once when your portfolio size justifies it, and let tax considerations nudge you toward slower, higher‑conviction trading. That won’t make taxes fun, but it will turn them from a scary unknown into just another part of your strategy — and that shift alone can save you a lot of money over the next cycle.