Market context and volatility

Historical background of crypto market cycles

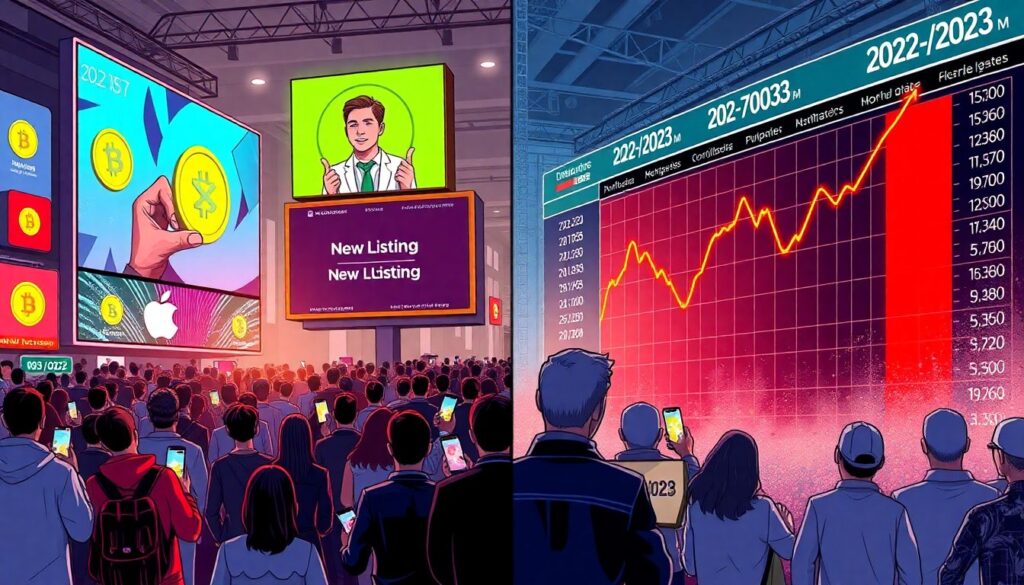

Over the last three years crypto has gone through a full boom‑and‑bust‑and‑recovery loop, which is crucial context for any beginner. After the late‑2021 peak near 3 trillion USD total market cap, 2022 saw a drawdown of over 70% with the aggregate value dipping around 800–900 billion USD amid the Terra, Celsius and FTX collapses. In 2023 the market started to normalize: capitalization fluctuated roughly between 1 and 1.8 trillion, while Bitcoin’s dominance climbed back above 50% as liquidity fled risky tokens. By mid‑2024, supported by spot ETFs and regulatory clarity in the US and EU, the market cap again exceeded 2 trillion, confirming that serious projects survive full cycles.

Volatility as a feature, not just a bug

Volatility in crypto is no longer just a meme; it is a structural property of an asset class still priced by relatively thin order books and speculative flows. Between 2022 and 2024, 30‑day realized volatility of Bitcoin ranged mostly between 20% and 80%, while many altcoins regularly showed intraday moves above 10–15%. For a beginner this means that “price action” alone is almost useless as a filter of project quality: both scams and robust protocols can drop 60% in a bear phase. Learning how to find legit cryptocurrency projects therefore starts from looking beyond the chart to fundamentals, governance design and on‑chain data.

Core principles of identifying credible projects

Fundamental due diligence basics

If you want a practical framework for how to research crypto projects before investing, think in terms of four layers: team, technology, token, and traction. The team must be identifiable, with public profiles, prior track record and clear jurisdiction; fully anonymous founders raise the bar for all other checks. The technology should have open‑source code, documentation, external audits and a realistic roadmap instead of buzzword‑heavy decks. Tokenomics needs transparent supply schedules, meaningful utility and no hidden insiders with huge unlocked stakes. Finally, traction is best measured by real users, protocol revenue and partnerships, not by followers or paid influencers.

- Verify the legal entity, key contributors and investors using official registries and professional networks.

- Read the whitepaper and developer docs; compare claims with what is actually deployed on mainnet.

- Check audit reports, bug bounties and incident post‑mortems to gauge security maturity.

On‑chain, market and governance signals

Once you’ve filtered projects by basic fundamentals, move to quantifiable signals. On‑chain metrics such as active addresses, transaction count and total value locked help to distinguish hype from adoption. From 2022 to 2024, protocols that kept or grew their TVL share through the bear market — for instance some leading L2s and DEXs — were statistically far more likely to recover strongly during the following uptrend. Market data matters too: deep liquidity on reputable exchanges, narrow spreads and reasonable funding rates reduce manipulation risk. Governance is another marker of credibility: transparent DAO forums, on‑chain voting and documented upgrade processes indicate institutional‑grade discipline instead of ad‑hoc decisions by a single founder.

Practical examples and case studies

From blue chips to applied altcoins

When people search for the best cryptos to invest in 2025, they usually start with “blue chips” like Bitcoin and Ethereum because they have multi‑cycle survival proofs, institutional adoption and relatively predictable token economics. Yet meaningful upside often comes from top altcoins with real use cases: L2 scaling networks with measurable throughput gains, DeFi protocols generating sustainable fee revenue, or infrastructure projects that other developers actively build on. Between 2022 and 2024 user metrics show that networks with strong developer communities and grants programs maintained higher retention and faster recovery of fees than meme‑driven chains, demonstrating that utility gradually outweighs pure speculation.

- Look for recurring protocol revenue or fee burn mechanisms tied to real usage, not just inflationary rewards.

- Assess ecosystem depth: number of third‑party dApps, integrations with wallets, bridges and tooling.

- Compare roadmaps with delivered milestones over at least 12–18 months, ignoring freshly launched hype.

Low‑cap opportunities without gambling

Beginners are often attracted to the most promising low cap crypto projects because of the theoretical “100x” upside. The data from 2022–2024, however, is brutal: the majority of micro‑caps listed on minor exchanges lost over 80% from initial listing prices and never recovered. The small subset that did well shared specific traits: audited contracts, gradual token release schedules, early‑stage venture backing with lock‑ups, and visible on‑chain growth in users or TVL before large price moves. Treat low caps as venture‑style bets: allocate only a tiny share of capital, diversify across themes and time entries instead of chasing social‑media driven spikes.

Typical mistakes and myths

Frequent misconceptions in volatile markets

A major misconception is equating exchange listings or influencer endorsements with legitimacy. Several high‑profile failures between 2022 and 2023, including exchange‑promoted tokens that later went to zero, showed that listing standards are inconsistent and often commercially driven. Another myth is that high APY yields imply a safe, productive protocol; in reality, unsustainably high emissions were behind many collapses in DeFi TVL, which dropped by more than 60% from early 2022 highs before slowly recovering. Finally, beginners often assume regulation instantly eliminates risk. While clearer rules in the US, EU and parts of Asia improved consumer protection, they did not remove smart‑contract bugs, governance attacks or market manipulation.

Building a resilient personal process

The best antidote to these myths is a simple, repeatable checklist you apply before every trade, regardless of market mood. Define your risk budget, time horizon and thesis for each asset; if you cannot clearly explain in two sentences why the token should accrue value, skip it. Track a small dashboard of metrics — on‑chain activity, liquidity depth, unlock schedule — and revisit it monthly rather than reacting to hourly charts. Over the 2022–2024 window, investors who stuck to rules like “no more than 5–10% of portfolio in unproven micro‑caps” and “no leverage on illiquid tokens” generally experienced much smaller drawdowns and were able to rotate into more robust narratives as the cycle turned.