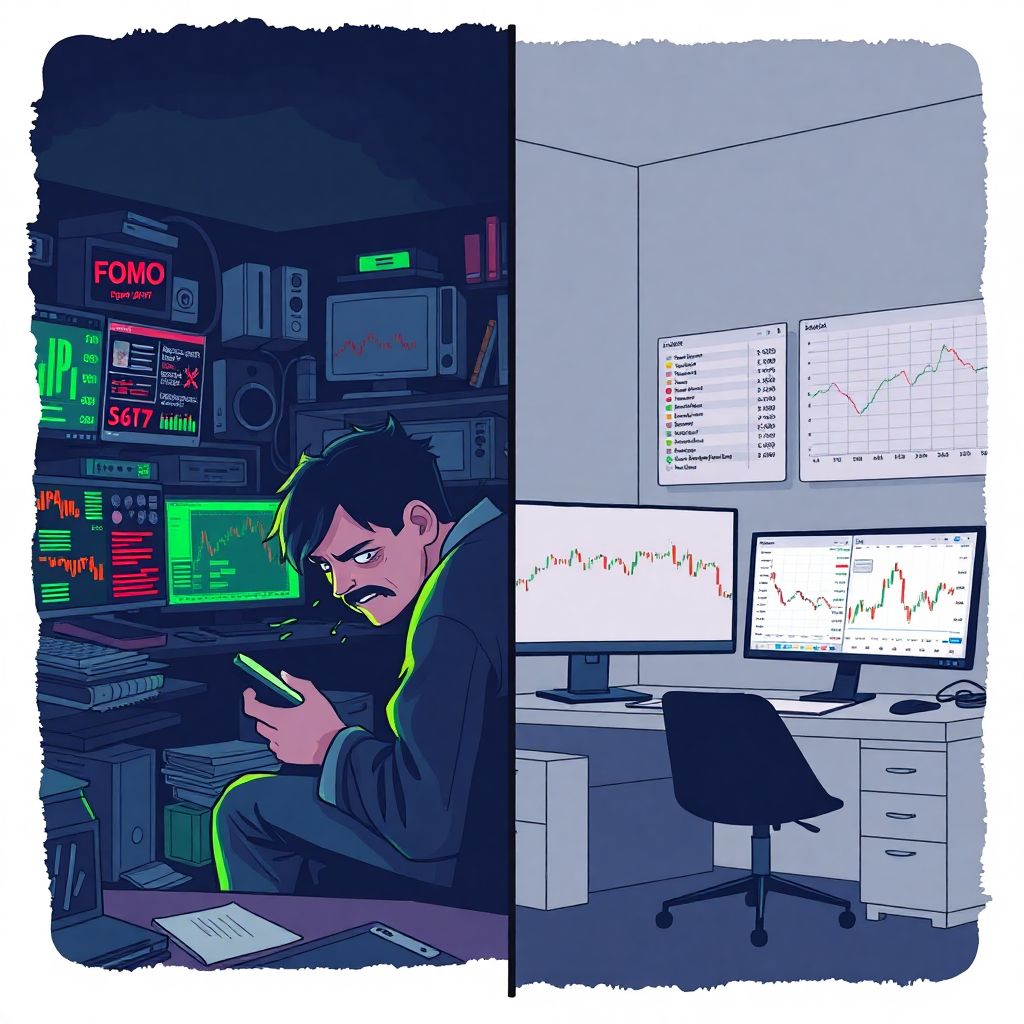

Learning crypto trading can feel like trying to drink from a firehose: charts, news, volatility, FOMO, influencers, “alpha” chats — and on top of that, a day job and family. No surprise many beginners quietly burn out before they ever become profitable. Over the last three years, global data on work and investing shows the same pattern: chronic stress is up, attention spans are down, и people chase quick gains just when their nervous system is least able to handle risk. Surveys from large brokerages and investor platforms between 2022 and 2024 consistently report that roughly half of active retail traders experience high stress, and around a third admit to sleep problems linked to market activity. So if you feel overwhelmed, it’s not a personal weakness — it’s a predictable reaction to a highly stimulating environment.

Why crypto trading is unusually stressful

Crypto markets run 24/7, updates fly in every second, and social media amplifies every price swing into a “once-in-a-lifetime” opportunity or catastrophe. From a neuroscientific point of view, that’s basically a machine for triggering your fight-or-flight system. Studies on day traders and high-frequency investors over the last three years show patterns similar to emergency workers: elevated cortisol, irregular sleep, and a tendency to overreact under pressure. The twist is that you don’t have a team of colleagues or supervisors watching your workload. Many beginners follow a crypto trading course for beginners and unknowingly add even more pressure by trying to “catch up” with advanced strategies before they’ve built emotional resilience or solid risk habits, turning education into another stressor instead of a support.

Necessary tools for calm, sustainable learning

Before you even think about sophisticated strategies, it helps to think of your setup as “mental health infrastructure.” Of course, you need basic crypto risk management tools for traders: an exchange account with clear position sizing options, a portfolio tracker, maybe a simple journal app. But equally important are tools that limit exposure and protect your attention. Over the past three years, behavioral finance research has repeatedly shown that traders who use alarms, screen time controls, and pre-defined rules (like automatic take-profit and stop-loss orders) report less anxiety and fewer impulsive trades. A structured crypto trading mentorship program online can also act as a protective tool: it gives you external constraints, feedback, and community norms that make it easier to say “no” to random signals and “yes” to your plan, reducing the feeling that you must decide everything alone in real time.

Digital tools that help your brain, not just your portfolio

Stress in trading is often less about actual losses and more about constant uncertainty. That’s why the most valuable digital tools are the ones that reduce “decision noise.” A simple calendar where you pre-schedule learning sessions and market review times keeps you from refreshing prices all day. Notification filters on your phone cut out 90% of meaningless alerts. Over 2022–2024, time-use and productivity studies have shown that heavy multitaskers feel significantly more burned out, and traders are classic multitaskers: juggling charts, chats, and news feeds, often while at work. So even if you look for the best crypto trading strategies for working professionals, focus first on strategies that fit into defined time blocks, like swing trading or weekly rebalancing, instead of ultra-short-term scalping that demands constant monitoring and invites chronic stress.

Step-by-step process: how to trade cryptocurrency without stress

Managing stress in crypto doesn’t mean numbing yourself or ignoring risk; it means designing a process where big emotions have less room to hijack your decisions. Over the last three years, mental health data from remote workers and self-directed investors shows a clear pattern: people who follow predictable routines — fixed start and end times, predefined breaks, and weekly reviews — report significantly lower burnout and higher perceived control. Translating that into trading, your goal is to turn “reactive, always-on gambling” into “deliberate, time-boxed practice.” You’re not trying to be the fastest or most aggressive; you’re trying to be the most consistent.

1. Define your role and time budget

Instead of calling yourself a “trader” immediately, define your role more precisely: “I’m a learner who spends five to seven hours a week on markets.” This simple frame shift matters psychologically, because it lowers the expectation that you must be profitable right now. Over 2022–2024, investor surveys show that unrealistic return expectations are one of the strongest predictors of giving up within a year. Decide how many hours per week you can realistically dedicate without harming sleep, relationships, or your job. If you’re employed full-time, that might mean three evenings and part of one weekend morning. Once you set a cap, trade only inside that window. The market is 24/7, but your brain shouldn’t be.

2. Separate “learning time” from “trading time”

Burnout often comes from blending learning and risk-taking. You’re watching a tutorial, an idea appears, you impulsively open a position, then stress about it the rest of the day. A more resilient structure is to use “learning blocks” without real money, then separate “execution blocks” where you only apply what you already practiced. Over the last three years, retention studies in online education show that people who keep practice and assessment in distinct blocks stay more engaged and less anxious. If you’re following a crypto trading course for beginners, treat it like you would a language course: you don’t book an international flight mid-lesson; you just practice vocabulary, then test yourself later. In trading terms, that means demo accounts, paper trading, and small fixed-size positions only after repeated dry runs.

3. Start with tiny, boring position sizes

Stress spikes when any single trade matters too much. Physiological monitoring of active traders (heart rate, skin conductance) in studies from 2022–2023 showed that perceived risk, not actual risk, drives the body’s alarm response. One way to lower perceived risk is to make each trade financially trivial at first — so trivial that a full loss wouldn’t affect your monthly budget at all. That might feel slow, but it’s how you train your nervous system to stay calm while you build skills. Over time, as your process becomes more automatic, you can scale up carefully. Many aspiring traders burn out because they jump straight to emotionally significant capital, then associate learning itself with anxiety and shame, quitting just when real skill development would have started.

4. Use simple, rule-based strategies at the beginning

Complex strategies demand more decisions, and more decisions mean more chances for doubt and second-guessing. Recent cognitive research consistently shows that decision fatigue is a major contributor to burnout, especially for knowledge workers and self-directed learners. For the first year, focus on one or two simple setups with clear entry and exit rules you can write in one or two sentences. This applies even if you’re ambitious and following advanced materials: you can still log sophisticated ideas, but you only trade your basic playbook. Even many of the best crypto trading strategies for working professionals are, at their core, disciplined variations of simple ideas: trend following, mean reversion, or structured dollar-cost averaging with defined risk. Simplicity doesn’t just protect your capital; it protects your attention.

Monitoring your mental state: early signs of burnout

Burnout rarely arrives as a dramatic collapse; it creeps in through small changes. Over the last three years, major health organizations have reported rising rates of sleep disturbance, irritability, and emotional exhaustion among people who work or invest heavily online. In trading contexts, early warning signs often look like this: you check prices compulsively, even when you promised yourself a break; you feel numb after wins and disproportionately crushed after losses; you start hiding your screen time or PnL from friends or partners. These are not moral failings; they’re signals that your system is overloaded. Ignoring them usually leads to more impulsive risk-taking, not better discipline. Treat each sign as a prompt to adjust your process, not as evidence that you’re “not cut out” for markets.

Building routines that protect your energy

To keep learning sustainable, design “off-ramps” into your week — built-in moments where you must disengage from markets. That might be a fixed “no charts after 9 p.m.” rule or tech-free blocks on weekends. Over 2022–2024, longitudinal studies on digital wellbeing found that people who maintained at least one full day per week with sharply reduced screen time reported significantly better mood and lower fatigue. If you treat your body and brain like infrastructure for your trading business, then sleep, movement, and offline hobbies become strategic assets, not guilty pleasures. This also means being honest about caffeine, alcohol, and late-night screen binges: they might feel like short-term relief but usually worsen anxiety and decision quality the next day, especially when combined with volatile price action.

Troubleshooting: what to do when stress is already high

Everyone eventually hits a point where the mix of volatility, personal life, and expectations becomes overwhelming. When that happens, the worst response is to double down with more screen time and bigger bets in a desperate attempt to “fix” recent losses. Behavioral data from trading platforms over the last three years show that many of the biggest drawdowns occur in exactly these emotional spirals. A healthier troubleshooting approach is to temporarily shrink the game instead of trying to win it back. That might mean closing all open positions, taking a week off, and reviewing your last 20 trades to identify patterns. You’re not “quitting”; you’re performing maintenance on the machine that actually generates your decisions: your mind.

Redesigning your setup after a rough period

If you’ve already hit a wall, use it as data. Ask three practical questions: which times of day lead to your worst trades, which emotions show up right before you break your rules, and which sources of information (specific chats, influencers, or indicators) most often push you into FOMO? Over 2022–2024, studies on digital addiction and compulsive trading behavior found that environmental cues — phone notifications, highly emotional content, and social comparison — are often more powerful triggers than any internal character trait. So effective troubleshooting often means subtracting: mute or leave hyperactive groups, unfollow voices that constantly shout urgency, reduce the number of indicators on your charts, and lower leverage or position size. Each subtraction reduces cognitive load and gives your prefrontal cortex more room to think.

Using mentorship and community without burning out

Community can be both a cure and a cause of stress. A structured crypto trading mentorship program online can help you normalize setbacks, learn realistic pacing, and adopt tested routines that prevent overtrading. At the same time, oversized communities obsessed with posting wins and “instant success” stories can quietly increase your sense of inadequacy. Over the last three years, social comparison research has shown that heavy exposure to curated success feeds reliably worsens mood and increases risk-taking in financial contexts. When choosing mentors or communities, look for those that explicitly discuss losses, risk, and mental health, not just entries and exits. A good mentor will slow you down when you’re heated and push you to rest, not just to “grind harder.”

Putting it all together: a realistic path to mastery without burnout

Managing stress while learning crypto trading is not about becoming emotionless; it’s about engineering your environment so that intense emotions are less likely to dictate your actions. Over the last three years, the broad pattern across workplace, mental health, and trading research is consistent: people do best when they combine clear routines, modest initial expectations, limited stimuli, and supportive communities. Translate that into your own context by capping your weekly trading hours, separating study from execution, starting with small positions and simple strategies, and regularly checking in on your sleep, mood, and relationships as seriously as you check your PnL.

If you treat your learning journey as a marathon that might last a decade, not a sprint of a few months, then each step toward calmer, more deliberate practice becomes a competitive edge. Many will burn out chasing every move; your advantage can be the opposite — patiently building skills and psychological resilience so that, when real opportunity appears, you’re not exhausted, you’re ready.