Why crypto market history matters more than hot tips

If you’ve been in crypto for more than a few weeks, you’ve already noticed: prices move in wild waves, news flips from euphoric to apocalyptic, и newcomers keep repeating the same mistakes. Learning from crypto market history and cycles isn’t “nice to have” – it’s the difference between treating this as a casino and treating it as a serious, long‑term game. Instead of hunting for the next magic signal, you want to understand *why* cycles happen, how they usually unfold, and where you are likely standing in the current one in 2025. That perspective calms emotions, frames risk, and helps you ignore noise.

Step 1. Get the big picture: the four major crypto cycles

Let’s start with a simple historical map. Since Bitcoin launched in 2009, the market has gone through several major boom‑and‑bust cycles. The rough pattern repeated around 2013, 2017, 2021 and is now evolving again into the mid‑2020s. Each time, we saw a powerful uptrend, a blow‑off top, a brutal downturn, then a long “boredom” phase before the next wave. The specifics differ, but the rhythm is familiar. When you study charts from every major cycle side by side, the emotional script is almost identical, even though the headlines and narratives change.

Historical context: the early days vs. today

Back in 2011–2013, crypto was a niche playground for cypherpunks and tech geeks. Market depth was tiny, regulation almost nonexistent, and a single exchange hack could crash prices. Fast‑forward to 2017: ICO mania pulled in retail investors worldwide. By 2021, we had DeFi, NFTs, institutional products, and huge media coverage. Now, in 2025, you’re looking at spot Bitcoin ETFs, more mature derivatives, and states openly debating digital asset strategies. Despite all that evolution, the cyclical behavior driven by liquidity, greed, and fear remains stubbornly similar, which is exactly why history is so instructive.

Step 2. Understand the anatomy of a crypto cycle

Most major uptrends share a recognizable structure. First comes stealth accumulation, when prices are relatively low and interest is muted. Then early uptrend: positive news builds, narratives form, and “smart money” increases exposure. The parabolic phase follows, with rapid price appreciation, aggressive leverage, and explosive headlines. Eventually, the top forms; it’s usually messy, with several failed new highs. The downtrend that follows tends to be fast at first, then slow and grinding. Finally, a long sideways “disbelief” phase sets in, where many people lose interest just before the next big move begins.

Emotional stages: from disbelief to euphoria and despair

Every price phase has a matching emotional stage. During the early accumulation period, most people still call crypto “dead.” As prices start climbing, sentiment shifts to cautious optimism. Later, in full bull mode, social media fills with overnight success stories, and even skeptics feel forced to join in. Near the top, you’ll hear bold predictions about a new paradigm where crashes are “impossible.” After that, panic, anger, and regret dominate as portfolios shrink. Finally, apathy takes over; many walk away, selling near the bottom. Recognizing these moods in real time helps you avoid being swept up in the crowd’s worst decisions.

Step 3. Learn from each major historical cycle

Look at the 2013 cycle: massive gains driven mostly by Bitcoin adoption hype, followed by a crushing bear market. In 2017, the ICO boom repeated the pattern with altcoins: crazy token offerings, little due diligence, and then a spectacular implosion. The 2020–2021 run was fueled by institutional interest, cheap money, DeFi and NFTs, culminating in the peak and subsequent crash of 2022. Each wave had its own buzzwords and villains, from Mt. Gox to Terra and FTX, but the recurring lesson is that unsustainable leverage and unfounded narratives always eventually unwind.

What 2018–2020 and 2022–2023 bears actually taught us

The 2018–2020 bear market showed how long pessimism can last. Prices didn’t just fall; they dragged sideways, draining patience. Builders kept building, but most retail investors tuned out. The 2022–2023 downturn added a new dimension: large centralized players failing publicly. That hammered home the danger of counterparty risk and blind trust in big brands. If you look closely, many of today’s stronger projects emerged from those “quiet” years. For your own learning, pay attention not only to the explosions at the top, but to who survives and grows in the dark stretches between bull runs.

Step 4. Build your own cycle playbook

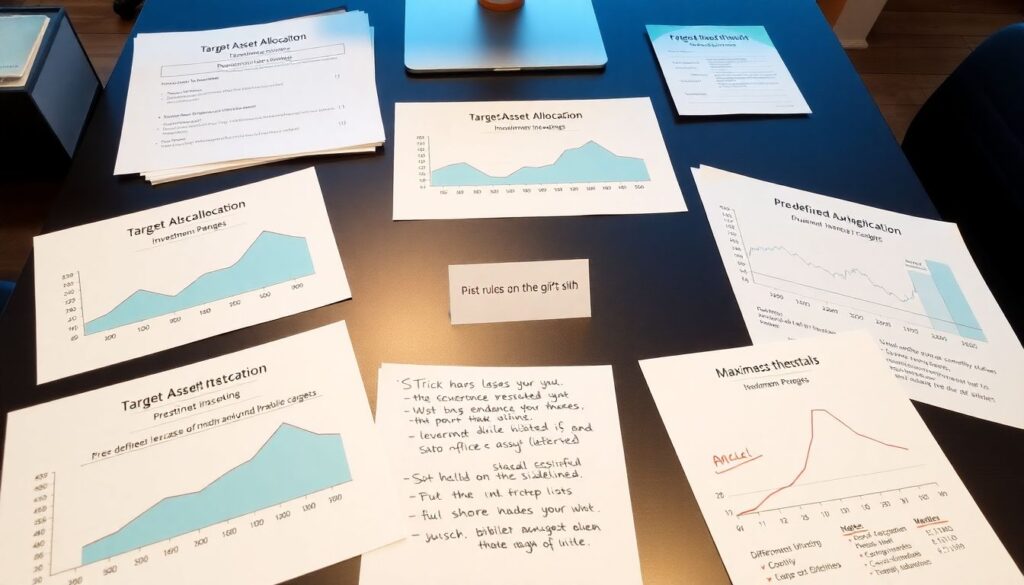

Reading history is useful, but turning it into a practical crypto market cycles strategy is where the real value lies. Start by defining your rules for each phase: how you behave when markets are cheap, when they’re trending up, when they’re euphoric, and when they’re collapsing. Map these rules to actual price and sentiment data instead of vague feelings. For example, you might decide that when funding rates are extreme and everyone on social media is posting profit screenshots, it’s time to take chips off the table. Make your “if X then Y” logic explicit and write it down.

Key components of a cycle‑aware plan

A decent plan includes target allocation ranges for different phases, pre‑defined profit‑taking levels, and maximum drawdown you’re willing to tolerate. It also includes rules about leverage (or a decision to skip it entirely), diversification limits, and how much cash you keep on the sidelines. Most importantly, it includes hard rules for risk: when to cut losers, when to reduce position size, and how to avoid doubling down just because price is dropping. Your goal isn’t to predict exact tops and bottoms, but to align your behavior with the broader phase of the cycle instead of reacting impulsively.

Step 5. Use data and tools instead of hunches

To time your decisions around cycles, you’ll need basic metrics and charts rather than vibes. Start with long‑term Bitcoin and Ethereum price charts on weekly or monthly timeframes, then add indicators that reflect cycle conditions: realized price, long‑term holder supply, funding rates, and market cap to GDP comparisons. Combine those with on‑chain analytics that show how old coins move, and with macro data like interest rates or liquidity indexes. Good crypto market analysis tools for cycle timing won’t guarantee accuracy, but they anchor your decisions in repeatable signals instead of the latest influencer thread.

On‑chain and macro: how they fit together

On‑chain data tells you how participants behave inside the network: which wallets accumulate, who’s spending, how fees evolve. Macro data tells you how the broader environment supports or suppresses risk assets. In previous cycles, aggressive money printing and low interest rates fueled risk‑taking; tighter policies later helped burst bubbles. When you combine both perspectives, you see why some bull runs start earlier or last longer. Don’t obsess over every metric; pick a small set you understand well and track them consistently over months and years, not minutes and hours.

Step 6. Study the Bitcoin halving cycle

Many investors frame their long‑term view around the roughly four‑year rhythm of Bitcoin’s supply cuts. Every halving reduces the block reward, lowering new supply. Historically, strong uptrends often followed these events with a lag, although correlation is not destiny. A thoughtful bitcoin halving cycle investment strategy doesn’t blindly buy before the halving and sell after; instead, it acknowledges that attention, narratives, and liquidity tend to cluster around these milestones. Use past halvings as a loose timing framework, not a rigid rule, and remember that as the market matures, the impact of each halving could gradually weaken.

2025 context: what’s different this time?

In 2025, you’re not dealing with the same environment as in 2012 or even 2016. Spot ETFs, larger institutional positions, derivatives markets and more sophisticated participants all shape price behavior. Regulatory clarity in some jurisdictions and crackdowns in others can shift capital flows. That means past halving‑driven patterns may stretch, compress, or partially break. Instead of copying old playbooks, treat them as scenarios: “If behavior resembles past post‑halving cycles, I’ll do X. If volatility stays muted longer, I’ll do Y.” History guides, but doesn’t command.

Step 7. Learn how to profit from bull and bear markets without gambling

The real advantage of cycle awareness is that it changes how you approach both extremes. Thinking ahead about how to profit from crypto bull and bear markets keeps you from improvising under stress. In bulls, your main challenge isn’t finding coins; it’s controlling greed and securing gains. In bears, your edge lies in patience and selective accumulation rather than trying to trade every bounce. Both sides require discipline more than genius. Your goal is to survive the harsh parts of the cycle with enough capital and mental energy to benefit when conditions turn.

Practical tactics for each phase

During late bear or early recovery, gradually build core positions in assets you understand, using small, regular buys. As the uptrend strengthens, you can add momentum trades with tight risk controls. When euphoria shows up—parabolic moves, wild leverage, meme coin frenzies—shift focus from buying to harvesting profits and de‑risking. In sharp downturns, avoid knee‑jerk revenge trading; instead, follow pre‑planned stop levels and consider only well‑researched dips. Over many years, this pattern of steady accumulation, disciplined profit‑taking, and conservative behavior in extremes compounds far more reliably than “all‑in” bets.

Step 8. Avoid classic mistakes newcomers repeat every cycle

New participants tend to arrive in the loudest phase of the market, right when risk is highest. They often chase whatever pumped yesterday, join communities they barely understand, and treat paper gains as permanent. Another frequent mistake is ignoring liquidity and position sizing; putting too much into thinly traded coins makes exits impossible when panic hits. Leverage is a special trap: in euphoric conditions it looks like free money until one sudden move wipes the account. The market punishes overconfidence, but it’s remarkably forgiving to those who focus on survival first.

Behavioral traps and how to dodge them

Watch for FOMO driven by screenshots, doomscrolling during crashes, and over‑reliance on a single influencer or chat group. When you catch yourself thinking “this time is different” or “it can’t possibly go down from here,” pause and review past charts. Ask what people were saying near prior tops and bottoms; the language is strikingly similar. Use simple protections: never invest money you can’t afford to lose, don’t borrow to speculate, and split entries and exits into several steps. Boring rules like these don’t look glamorous, but they keep you in the game long enough to actually learn.

Step 9. Build your own learning system, not just a one‑off plan

Treat market history as an ongoing course you’re enrolled in for years. Instead of hunting for the “best crypto trading course for market cycles” and expecting it to solve everything, create your own curriculum. Save charts of major turns, keep a simple trading journal with reasons for every decision, and review it monthly. After each major move—whether a surge or a crash—write down what surprised you, what worked, and what failed. Over a couple of cycles, this habit turns vague impressions into concrete, personal knowledge that no webinar or signal group can replace.

Simple step‑by‑step routine for continuous learning

1. Once a week, review long‑term charts (weekly/monthly) for BTC, ETH, and your main holdings.

2. Once a month, note key macro and on‑chain signals you track and how they changed.

3. After big moves, document your emotions and actions in a journal.

4. Every quarter, compare your behavior with your written plan and adjust rules if needed.

5. Once a year, re‑read case studies of past cycles and check how today’s environment rhymes with them.

This rhythm builds a feedback loop: observe, act, review, refine.

Step 10. Choosing tools and education without getting scammed

In 2025, there’s no shortage of platforms promising perfect signals or guaranteed returns. Approach them with skepticism. Focus on tools that give you transparent data, not secret algorithms: solid charting platforms, on‑chain dashboards, and reputable news aggregators. Be wary of anything that pressures you to act fast or share account access. Educational resources should show actual track records, clear risk discussions, and examples of losing trades, not just wins. If a course promises you’ll “never lose again,” that’s your cue to close the tab and move on.

Using resources wisely instead of endlessly hoarding them

Pick a small set of tools and sources and stick with them long enough to understand their strengths and limits. Constantly switching platforms or chasing every new indicator only adds confusion. A grounded approach to tools aligns well with a robust crypto market cycles strategy: simple indicators, clear rules, and consistent application. Over time, you’ll trust your own framework more than any single analyst, which is exactly where you want to be if your goal is long‑term survival rather than short‑term thrills.

Bringing it all together

Learning from crypto market history and cycles isn’t about memorizing dates; it’s about recognizing how human behavior, liquidity, and narratives repeatedly interact. You don’t need to be a prophet to benefit—you need a plan that respects uncertainty, a habit of reviewing past cycles, and the humility to adapt when facts change. Use history as a compass, not a script, combine data with clear rules, and treat each bull and bear as another chapter in your ongoing education. Over several years, that mindset is far more powerful than any single trade or setup.