Why crypto scams on social media exploded – and why beginners are main targets

Over the last three years, social networks have turned into a hunting ground for crypto scammers, and beginners are their favorite prey. According to Chainalysis, crypto scams stole around $10.9 billion in 2021, about $5.9 billion in 2022 and roughly $4.6 billion in 2023, and a huge share of initial contact happened through social platforms. The US Federal Trade Commission reported that since 2021 people have lost over a billion dollars’ worth of crypto to fraud that started on apps like Instagram, Facebook, Telegram and TikTok, with 2023 showing record levels of social‑media‑initiated investment scams overall. Losses per victim are usually much larger than in classic online shopping fraud, because once someone is convinced to “invest,” they often empty savings or even take loans. That’s why a beginner‑friendly, realistic crypto scam protection guide is no longer optional; it’s a survival manual for anyone even casually scrolling through “crypto content” feeds.

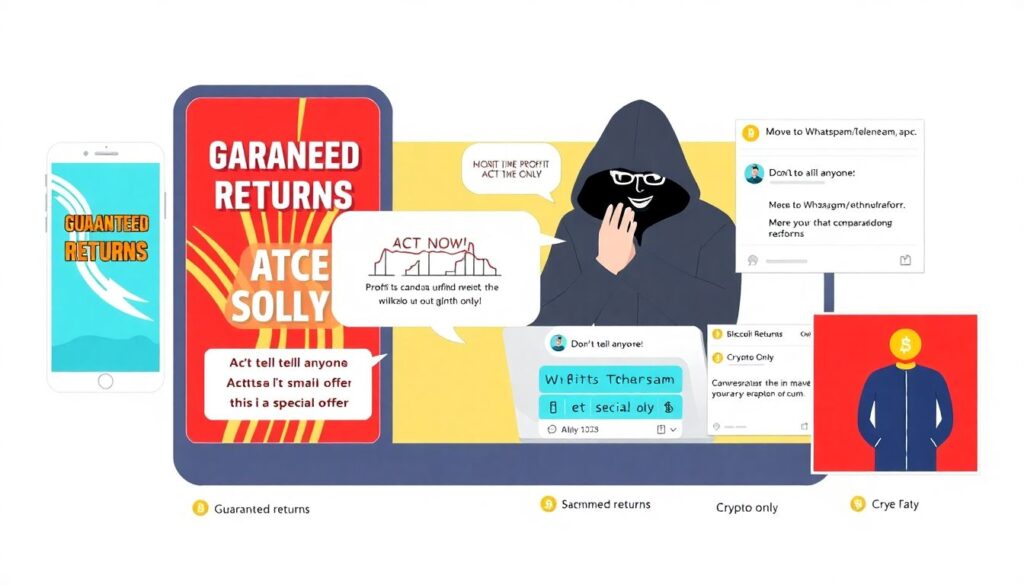

How social media crypto scams usually work

Typical scam formats you’ll actually see in your feed

Most attacks don’t look like sophisticated hacking movies; they look like ordinary posts, stories and DMs. The most common format is the “too good to be true” investment opportunity: a friendly account or polished ad promising 30–100% monthly returns, sometimes backed by fake testimonials, doctored screenshots of profits, or even deepfaked videos of celebrities “endorsing” a platform. In 2022–2024, regulators repeatedly warned that these “investment managers” on WhatsApp, Instagram and Telegram were behind a big share of reported crypto losses. Rug‑pull meme coins are another favorite: a token appears from nowhere, influencers hype it, a crowd rushes in, and the creators vanish after pumping the price. Then there are classic impersonation scams where a profile mimics a real exchange, project founder or support desk, convincing people to “verify” their wallets by sending funds or seed phrases.

Why smart people still fall for all this

The psychology behind these attacks is surprisingly systematic. Scammers lean on urgency (“last spots,” “airdrop ending in 30 minutes”), social proof (fake likes, bots, paid shout‑outs), and authority (posing as verified experts or big brands). Social media amplifies all three: algorithms push viral content, status badges create an illusion of trust, and DMs feel intimate and personal. Newcomers are hit hardest because the crypto learning curve is steep: they hear that early adopters made life‑changing money, but they don’t yet know how exchanges, wallets and blockchains actually work. Add 2021’s bull‑run stories and the 2024 mini‑rallies, and you get a crowd primed to believe that “the next big thing” is just one link away. A realistic guide on how to avoid crypto scams on social media has to address this emotional layer, not just technical checklists.

Comparing different protection approaches: behavior vs technology

Education and habits: the first – and cheapest – defense line

If you strip things down, there are two broad ways to protect yourself: change your behavior, or use technology. Behavioral defenses start with skepticism: assuming that anyone promising guaranteed profits in crypto is either misinformed or malicious. Over the last three years, countries that invested in consumer education campaigns saw lower average losses per victim, even when scam attempts stayed high, which shows that habits actually work. Simple rules like “never send crypto to strangers,” “double‑check URLs,” and “verify identities through official websites, not DMs” sound trivial, but they break the scripts scammers rely on. The downside is that education demands attention and discipline; busy newcomers scrolling after work may forget all these rules the moment they see a convincing video or get a message from what looks like a trusted influencer.

Tools and automation: wallets, security apps and platform filters

The second approach is technological: using wallets, browser extensions and platform settings that block or at least warn about danger. Hardware wallets keep your private keys offline, password managers generate and store strong passwords, authenticator apps add a second factor on logins, and some browser extensions flag suspicious domains or known phishing links. In 2022–2024, big social platforms also expanded automated detection of scam keywords, mass DM campaigns and fake ads, reducing the visibility of some schemes. The strength of this approach is that once set up, it works in the background, catching mistakes you might make when tired or distracted. The weakness is that tools can give a false sense of security: no device can protect you from freely sending coins to a scammer you emotionally trust, and no filter catches every new domain or Telegram channel. The best ways to protect yourself from crypto scams combine both strategies instead of choosing one.

Pros and cons of popular protection technologies

Wallet types, 2FA and password managers

For crypto security for beginners, the first big choice is wallet type. Custodial wallets on major exchanges are easier to use; you just log in with an email and password, and the platform handles keys. Paired with strong, unique passwords and app‑based two‑factor authentication, they protect most newcomers from basic account takeovers. The drawback is that if you fall for a social media scam and voluntarily withdraw funds to a bogus address, the exchange will usually not be able to reverse it. Non‑custodial software wallets give you full control, but that makes your seed phrase the single point of failure: anyone who tricks you into revealing it owns your funds. Hardware wallets add a strong layer of physical security, because transactions must be confirmed on the device; however, for a beginner they can feel clunky, and scammers now increasingly target the setup process with fake support chats and malicious “firmware update” links circulating in groups and channels.

Anti‑phishing tools, on‑chain analytics and platform features

Browser anti‑phishing extensions and built‑in warnings on modern browsers do a respectable job of blocking known fake sites, especially those imitating major exchanges or wallets. That helps against classic “support” scams in which you’re lured from a DM to a clone website. The limitation is that brand‑new domains or invitation‑only platforms, especially those advertised in private groups, may not be flagged in time. On‑chain analytics tools that trace stolen funds and mark risky addresses are powerful but are mostly used by exchanges and law enforcement, not ordinary users. Social networks themselves have added report buttons and automated detection for obvious fraud phrases, yet scammers adapt language and move to semi‑private spaces like Discord servers and Telegram channels where moderation is weak. So while the technical landscape is improving, it still assumes you apply basic crypto safety tips for beginners: double‑check identities, distrust unsolicited investment offers, and verify everything through official, independently found links rather than whatever pops up in your chat window.

Practical recommendations for beginners

A simple step‑by‑step playbook you can actually follow

A beginner‑friendly defense plan does not need to be complicated. Start by separating “learning mode” from “money mode”: for your first months, explore crypto content using a social account and device that are not linked to any wallet or exchange logins. That way, even if you click something naive, you’re less exposed. When you do decide to buy crypto, open accounts only through URLs you type yourself or from links on official websites of reputable exchanges, not from influencer bios or story swipes. Turn on app‑based 2FA for your email, exchange, and major social accounts so a stolen password or SIM‑swap cannot instantly drain holdings. Before sending funds to any address you got via DM, ask yourself: have I independently verified that this is the correct address from a trusted, official source? If the answer is anything less than an enthusiastic yes, stop and re‑check.

Recognizing red flags and using social proof the right way

Over the last three years, regulators have repeatedly emphasized the same five red flags: guaranteed returns, pressure to act fast, secrecy (“don’t tell anyone, this is a special offer”), requests to move conversations off‑platform, and instructions to pay in crypto only. If a “mentor,” “trader” or “project admin” hits more than one of these notes, assume you are inside a script, not a unique opportunity. Use social proof defensively instead of blindly trusting it: look for independent reviews on forums that are not controlled by the promoter, check whether the project’s founders are traceable beyond Twitter handles, and see if they’ve been around longer than one hot market cycle. Remember that in 2021–2023 many of the biggest social media rug pulls were loudly endorsed by seemingly serious influencers who later claimed ignorance. Realistic crypto safety tips for beginners therefore include a boring but powerful rule: if something feels rushed, complex, or emotionally charged, sleep on it before sending any money.

Trends and threats in 2025

Deepfakes, AI bots and more personalized scams

By 2025, the biggest change is not the existence of scams but their realism. AI‑generated deepfake videos and cloned voices are increasingly used to “prove” that a famous entrepreneur or analyst supports a token or trading bot, and these clips spread fast on short‑video platforms before they are taken down. Chatbots in DMs now hold seemingly intelligent conversations, adapting to your doubts and even referencing public posts to appear more convincing. Meanwhile, data from 2022–2024 show that scammers are shifting from mass‑spam tactics to more targeted “relationship building,” sometimes chatting for weeks before suggesting an “exclusive” investment. That makes emotional defenses just as critical as technical ones: in 2025, being cautious of flattery, urgency and manufactured intimacy online is as important as checking SSL certificates and contract addresses. The arms race will continue, but awareness of these AI‑driven tactics gives you a head start.

Regulation, platform responses and what to expect next

Regulators worldwide are reacting to the last three years of losses with tighter advertising rules, know‑your‑customer requirements for exchanges, and crackdowns on unregistered “investment schemes” that flourish on social media. Some regions now require clearer risk warnings on crypto ads, and platforms are experimenting with pre‑screening paid promotions that mention tokens, airdrops or trading bots. These moves will likely reduce the visibility of the most blatant frauds, but they will not remove the need for personal vigilance. Scammers adapt faster than laws, quickly shifting to private chats, cross‑border operations and disposable accounts. For newcomers, this means the best ways to protect yourself from crypto scams will always be a moving target, blending updated tools with timeless skepticism. Treated this way, any beginner‑oriented crypto scam protection guide is not just a static checklist but a mindset: assume your attention and trust are valuable assets, guard them carefully, and let technology support – not replace – your judgment.