Why airdrop evaluation matters in 2025

In 2025 the airdrop world is nothing like the wild west of 2017–2021. Back then, people farmed anything with a token logo and often got rewarded just for connecting a wallet. Today, competition is higher, sybil filters are smarter, and scams are more polished. A solid crypto airdrop guide for beginners must therefore focus less on “free money” and more on methodical evaluation of eligibility criteria and project risk. If you just jump into every campaign, you burn time, pay pointless gas fees and expose your data. When you treat airdrops like early-stage investments in your attention and capital, you start asking better questions: what are my odds of qualifying, and what’s the downside if everything goes wrong?

Step 1: Understand how we got here (short history of airdrops)

The first famous wave of airdrops came with projects like Stellar and early Ethereum token launches, usually basic giveaways to create buzz. Then DeFi summer around 2020 changed the game: Uniswap, 1inch, dYdX and others rewarded real users with large token allocations, turning casual experimenters into serious hunters. By 2022–2023, layer‑2s, NFT platforms and bridges ran massive campaigns, which attracted bots and sybil farms. In response, teams introduced complex point systems, KYC, allowlists and activity scores. Now, in 2025, learning how to qualify for crypto airdrops means navigating this matured, more selective environment, where projects reward consistent, organic behaviour over spammy farming.

Step 2: Decode the usual eligibility criteria

Most projects recycle similar conditions, even if the branding looks unique. They track on‑chain actions (swaps, bridging, staking, NFT mints), off‑chain behaviour (social tasks, testnet feedback, governance), and sometimes identity checks. Your first task is to identify which of these really matter. Read official docs, blogs, Discord announcements and X threads from the core team, not random influencers. Check whether eligibility is based on snapshots, cumulative volume, or some scoring system. A good airdrop hunting strategy and risk management mindset treats every requirement as a cost: gas, time, personal data and opportunity. If a task feels vague or endlessly grindy, the risk is that rewards will disappoint.

Common signals of strong criteria design

Projects with thoughtful eligibility rules usually emphasise real usage and long‑term alignment over spam. They may prioritise on‑chain volume over social media tasks, reward early testers of core features instead of simple referrals, and disclose at least a rough framework before the snapshot date. When trying to spot the best airdrops to claim now, look for teams that publish transparent methodologies, even if they keep exact formulas secret to avoid gaming. Conversely, if eligibility is dominated by retweets, invite links and endless “quests,” you’re probably being used as cheap marketing. Those campaigns might still pay something, but the signal for sustainable value and serious token economics is much weaker.

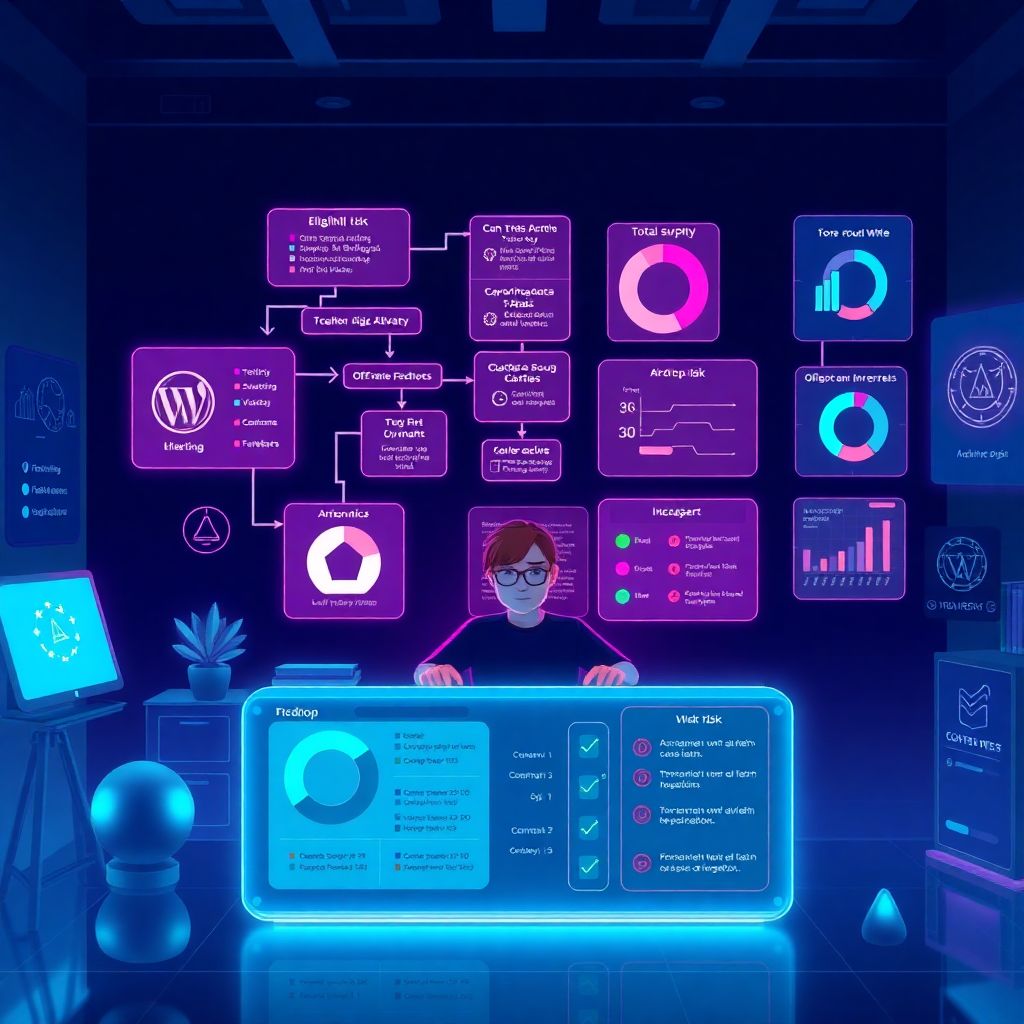

Step 3: Build a simple personal risk checklist

Before interacting with any new airdrop, walk through the same short checklist. Start with contract risk: are you signing transactions with a reputable wallet, and have you double‑checked contract addresses from official links only? Then platform risk: is the protocol audited, open‑sourced, or at least battle‑tested by other users without major incidents? Finally, incentive risk: could tasks push you into overleveraging, risky yield farms or obscure bridges just to “increase points”? Newcomers often underestimate how quickly gas fees, slippage and bad trades can eat potential rewards. Treat each interaction like a trade: what am I putting at risk, and is there a realistic chance the airdrop will compensate me?

Red flags to pause immediately

– Requests to “import” or reveal your seed phrase or private key, even “just to check eligibility”

– DApps asking for unlimited token approvals with no clear reason or revoke option

– Projects pushing you to deposit large sums into unaudited contracts solely for points

– Aggressive countdowns, guaranteed returns, or promoters promising fixed airdrop values

If any of these appear, step back. There are always more campaigns; no single drop is worth a catastrophic wallet compromise.

Step 4: Analyse the project behind the airdrop

An airdrop is only as good as the token you receive, and that token is only as strong as the project’s fundamentals. Look at the problem they claim to solve, how credible the team is, and whether there’s real user demand. Anonymous teams are not automatically bad, but in that case you want extra confidence from code quality, community due diligence and investor backing. Does the roadmap look realistic, or filled with buzzwords like “AI, gaming, DeFi, metaverse” with no specifics? A token that exists just to reward hunters, without fees, governance or utility, is likely to dump quickly. When learning how to find safe crypto airdrops, this fundamental screening step filters out a lot of noise.

Key elements to check as a beginner

– Documentation: concise whitepaper, clear token utility, understandable governance model

– Ecosystem fit: integrations, partnerships, or at least coherent plans to attract users

– Communication: responsive team, transparent updates, honesty about delays or changes

These elements don’t guarantee success but reduce the chance you’re farming vaporware that disappears after distributing tokens.

Step 5: Evaluate tokenomics and allocation

Tokenomics tell you how much your future tokens might be diluted and who else shares the pool. Check total supply, vesting schedules for team and investors, and the share reserved for the airdrop. If only a tiny fraction goes to users while insiders control most tokens with short lockups, your upside is limited and sell pressure can be brutal once those cliffs unlock. Also pay attention to how the airdrop is split: are there whales getting massive allocations, or a wide base of smaller holders? For airdrop hunters, a broad distribution is usually healthier. Scarcity matters too: if the token can be minted indefinitely, inflation can quietly erode value over time.

Step 6: Estimate realistic reward vs. effort

A useful habit is to roughly estimate the potential payoff before diving into tasks. Look at similar past campaigns by comparable projects, not cherry‑picked success stories. For example, layer‑2 airdrops in 2023–2024 often rewarded consistent usage with four to five‑figure sums in strong markets, but many smaller DeFi protocols ended up paying less than the gas cost. As a beginner, avoid over‑optimised grinding across dozens of chains if you don’t yet understand bridges, security tools and fee structures. Instead, pick a few ecosystems, learn them deeply, and accept that some efforts won’t pay. Over time you’ll develop an intuitive sense of whether a campaign is worth a handful of transactions or months of active farming.

Typical beginner mistakes to avoid

– Chasing every new campaign without tracking what you’ve done or why

– Paying high gas fees on congested chains for low‑probability, low‑value drops

– Ignoring security hygiene (approval revokes, separate wallets, hardware devices)

– Following influencers’ “secret lists” without verifying basic project details

A calm, analytical approach saves you from burnout and keeps your risk contained.

Step 7: Design a basic airdrop hunting strategy and risk management plan

Treat your time, capital and mental energy as a limited portfolio. Decide upfront how many hours per week and how much money you are willing to risk on gas, testnet bridging and small trial deposits. Segment your approach: perhaps 60% of effort on reputable ecosystems (major L2s, well‑known DeFi protocols), 30% on mid‑risk experiments, and 10% on moonshot projects that might fail completely. Use a spreadsheet or tracking app to log what you did, with which wallet, on which date, so you can later verify eligibility and spot patterns. Over months, this transforms your behaviour from random clicking into a structured process where you can tweak strategy based on actual outcomes.

Step 8: Prioritise security infrastructure

Security is not optional once you interact with multiple experimental DApps. Start with wallet segregation: keep a “cold” wallet for long‑term holdings and one or more “hot” wallets only for airdrop hunting. Consider a hardware wallet for serious amounts. Regularly review token approvals with tools that list contracts allowed to move your assets, and revoke anything you no longer use. Learn to read transaction prompts instead of signing blindly; suspicious functions or unknown spenders are reasons to cancel. As campaigns increasingly use cross‑chain bridges and experimental rollups, be extra conservative about where you send funds. In a field where some projects never deliver tokens, your best guaranteed return is protecting what you already own.

Step 9: Use history, not hype, as your teacher

Looking back from 2025, earlier airdrop cycles show repeating patterns: outsized early winners, followed by copycats, then consolidation. Many people remember the biggest payouts and forget the dozens of zero‑value tokens they farmed along the way. Let that history inform your decisions without pushing you into FOMO. When you see viral threads listing the best airdrops to claim now, cross‑check each name against the criteria in this guide: project quality, tokenomics, risk, and realistic reward. The goal isn’t to catch every opportunity but to build a repeatable process that keeps you solvent, improves your skills and gradually increases your odds of catching genuinely transformative drops.

Step 10: Turn airdrop hunting into structured learning

Approach every campaign as a chance to learn a new protocol, wallet feature or security practice, with the airdrop as a potential bonus. This mindset shift reduces stress and makes the grind more sustainable. Over time, you’ll understand not only how to qualify for crypto airdrops, but also how to evaluate early‑stage projects before they’re widely known. That skill is valuable even if token rewards shrink or regulations tighten. By combining a clear personal risk framework, disciplined execution and lessons from past cycles, you can navigate modern airdrops with more confidence—treating them as one tool in a broader crypto journey, rather than a lottery you desperately need to win.