Why smart contract wallet security matters even more in 2025

If you’ve been in crypto since the ICO boom or at least since DeFi Summer 2020, you’ve seen the evolution from simple EOAs (Externally Owned Accounts with a seed phrase) to modular, programmable smart contract wallets. In 2025, these wallets power complex DeFi strategies, DAO treasuries, on-chain subscriptions, and even payroll. That’s amazing – but it also makes security failures vastly more expensive. A compromised smart contract wallet isn’t just “one bad transaction”; it can mean automated strategies going wild, governance rights stolen, or entire team treasuries drained. Understanding smart contract wallet security best practices is no longer a “nice to have” for power users – it’s baseline survival knowledge for anyone actively interacting with on-chain finance.

A quick historical detour: from seed phrases to programmable accounts

How we got from EOAs to smart contract wallets

Back in the early Ethereum days, the model was simple: EOAs with private keys controlled by a seed phrase. Functionally, your address was tied directly to a single key. Lose it – funds gone. Leak it – funds stolen. No middleware, no granular permissions, no recovery logic. As DeFi protocols matured (Uniswap, Compound, Aave and the like), people started to hit UX and security limitations: no social recovery, no built‑in spending limits, no session keys for apps, no multi‑device logic without hacks around it.

This pressure led to the rise of smart contract wallets like Gnosis Safe (now Safe{Wallet}), Argent, and others, which introduced modular auth, recovery mechanisms, role‑based access, and deep protocol integrations. Account abstraction (e.g., ERC‑4337 and later refinements) then pushed this further by allowing smart contract wallets to behave like first‑class accounts with gas sponsorship, batched transactions, and programmable validation logic. By 2025, a secure smart contract wallet for DeFi is essentially a full‑blown security policy engine on-chain – and that complexity is both a strength and a new attack surface.

Historical hacks that shaped current best practices

If you look back, major incidents nudged the industry toward better design. The DAO hack in 2016 showed how re‑entrancy vulnerabilities could annihilate a supposedly “decentralized investment fund”, leading to a fork and a massive reputational hit. Then the Parity multi‑sig library bug in 2017 froze hundreds of millions of dollars due to a logic flaw in wallet initialization and ownership. DeFi Summer brought flash‑loan‑driven attacks, price oracle exploits and logic bugs in composable protocols. Each of these incidents contributed patterns and norms we now consider obvious: formal verification for critical modules, timelocks for governance, separated upgrade authority, and rigorous audit services for smart contract wallets and DeFi infrastructure.

Core threat model: how smart contract wallets are actually attacked

Technical angles attackers use in 2025

To stay secure, you need a mental model of how to protect smart contract wallets from hacks in the real world, not just in neat blog diagrams. Attackers don’t only brute‑force keys; they look for systemic weaknesses. They target wallet modules, signers, and your behavior around them. With programmable wallets, there are more moving parts to exploit, but also more knobs you can tune in your favor if you understand them.

Common attack vectors in 2025 include:

– Malicious modules or plugins added to a wallet that silently gain withdrawal rights or manipulate transaction flows.

– Phishing dApps that trick you into signing “meta‑transactions” or permit approvals that give attackers token spending rights indefinitely.

– Compromised guardians or social recovery contacts, where an attacker convinces or takes over a subset of your recovery set.

– Exploits in DeFi protocols that your wallet is programmatically interacting with (automated strategies, vaults, and leveraged positions), causing indirect loss even if the wallet contract itself is sound.

Human layer: social engineering and UX traps

While the code layer gets most of the headlines, in practice a huge part of smart contract wallet compromises still comes from the human side. Browser extensions leaking approvals, fake wallet interfaces, DNS hijacks, and carefully staged “support” scams on social networks continue to be efficient. Because smart contract wallets often run team funds, attackers invest time into targeted spear‑phishing of founders, CFOs, and DAO treasurers. When your wallet can batch arbitrary calls and interact with many protocols, one signed transaction can encode a sophisticated, harmful flow that’s hard to spot in a tiny interface, especially on mobile.

Inspiring examples: teams that turned security into a strength

From painful incident to robust security culture

Some of the most security‑minded projects in 2025 are those that learned the hard way. More than one DAO has endured a partial treasury drain due to a faulty module or poorly configured multisig. Instead of shutting down, they responded with public post‑mortems, open‑sourcing incident response runbooks, and investing heavily into formalizing smart contract wallet policies: distinct wallets for ops, strategy, and reserves; strict signer rules; mandatory delays on large transfers; verified build pipelines for their wallet front‑ends. Within a year, these DAOs not only restored trust but also attracted more sophisticated capital, precisely because investors saw a mature, transparent approach to risk.

You can use these stories as motivation: a single mistake doesn’t have to define your journey if you convert it into systemic improvements. Many of the widely referenced “security playbooks” floating around in 2025 were born from a previous breach. That’s not a reason to be careless, but a reminder that the mindset of continuous learning and upgrading your defenses is far more powerful than chasing an illusion of perfect safety.

Smart contract wallets enabling safer collaboration

There are also positive‑first stories: protocol teams and DAOs that never suffered a major exploit precisely because they designed with security first. For instance, some grants programs run entirely via modular smart contract wallets with fine‑grained roles: one module handles grant approvals with on‑chain votes, another batches payouts with configurable rate limits, and another enforces multi‑sig confirmation for any deviation from predefined policies. By using hardware wallet compatible smart contract wallets for high‑value signers and separating operational roles, they’ve scaled to tens of millions in throughput without a headline hack. Their approach proves that smart contract wallets, when configured thoughtfully, can provide a security posture that’s realistically stronger than any single seed-phrase EOA setup.

Practical configuration: building a resilient wallet setup

Secure architecture for individuals and small teams

Even if you’re “just” a power DeFi user and not running a nine‑figure DAO treasury, you can borrow the same design patterns. Your goal is to make every catastrophic failure require multiple independent things to go wrong at once. That means layering not only key types but also permissions, devices, and human processes around your smart contract wallet. Think of your wallet as a programmable security policy where you explicitly define how money moves rather than treating it as a “bag of tokens”.

Useful design principles:

– Use multi‑sig or multi‑factor validation even if you are a single person (e.g., a phone, a hardware wallet, and a backup device, all required or threshold‑based).

– Separate a “daily spending” smart contract wallet from a “vault” wallet with stricter policies and no direct dApp interaction.

– Limit your exposure by using different wallets for experimentation, long‑term holdings, professional trading, and DAO operations.

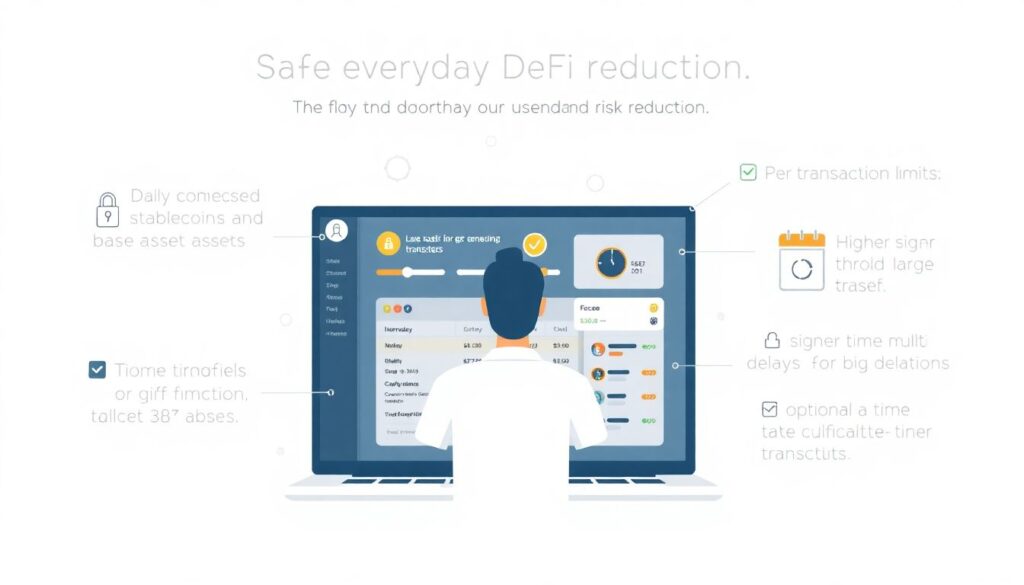

Concrete smart contract wallet security best practices

Here are some operational habits that significantly reduce risk while staying practical for everyday DeFi use:

– Configure daily and per‑transaction limits, especially for stablecoins and base assets. Make large transfers require higher signer thresholds and possibly time delays.

– Regularly review and revoke lingering token approvals and session keys, especially for older or abandoned protocols.

– Use hardware‑backed signers where possible, and never sign arbitrary messages on devices or browsers you also use for random downloads, gaming, or unvetted browser extensions.

– Favor wallets and modules that have undergone independent review and can demonstrate ongoing audit services for smart contract wallets, not one‑off reports from years ago.

DeFi‑specific risks and how to manage them

What makes a secure smart contract wallet for DeFi in 2025

DeFi usage today isn’t just “swap and lend”. It includes cross‑chain messaging, L2 bridges, leveraged strategies, intent‑based order flow, and increasingly complex MEV‑aware routing. A secure smart contract wallet for DeFi therefore has to understand and manage composability risk. It’s not enough for the wallet contract itself to be safe; it must operate within a dangerous ecosystem where other protocols can be exploited.

When choosing and configuring your wallet for DeFi:

– Prefer wallets with built‑in transaction simulation and human‑readable decoding, especially for batched or meta‑transactions.

– Make sure your wallet is updated frequently to adapt to protocol changes and new attack patterns (e.g., gas griefing, cross‑chain messaging bugs).

– Use allowlists where possible: predefined, vetted protocols your wallet is “allowed” to talk to directly, with higher friction or stricter rules for everything else.

Managing protocol, bridge, and chain‑level risk

The most sophisticated users in 2025 treat DeFi risk like a portfolio: not just asset allocation, but protocol and chain allocation. They cap exposure per protocol, treat exotic yield as inherently loss‑tolerant, and avoid putting core capital into novel contracts until those have real‑world battle testing. For smart contract wallets, this means you define which modules or strategies get access to serious capital and which are sandboxed to “play money”. If you interact with experimental bridges or L3s, it’s wise to route those through a separate wallet that you can afford to lose, so that even a total compromise doesn’t threaten long‑term holdings.

Development mindset: if you’re building or customizing wallets

Recommendations for teams building on smart contract wallets

If you are a developer or part of a protocol team, your responsibility goes beyond your own funds. You’re effectively shipping an operating system for other people’s money. That requires a disciplined engineering process and a culture that rewards boring, incremental security improvements rather than speed‑only shipping. Embed security from the design phase: threat‑model your modules, simulate attack scenarios, and design for graceful failure where possible.

Some foundational recommendations:

– Use battle‑tested libraries and standards for core wallet logic; innovate at the edges, not in critical primitives like signature verification or ownership storage.

– Prioritize upgradability safety: explicit upgrade paths, transparent governance, and emergency pause/rollback that can’t be hijacked.

– Keep admin and guardian roles minimal, well‑documented, and distributed, with strict constraints on what they can change without community visibility and delay.

Developer‑focused security practices and tooling

On the engineering side, adopt a modern security toolchain rather than relying on intuition. Static analyzers, fuzzing frameworks, formal verification for key invariants, and staged testnets with adversarial testing are standard in 2025 among serious teams. Make it explicit in your docs how to protect smart contract wallets from hacks when integrating your SDK or modules: recommended signer setups, risk flags, and common misconfigurations.

Consider also:

– Integrating simulation and risk scoring directly into your wallet UI or SDK, giving developers and users warnings on potentially dangerous flows.

– Maintaining an open bug bounty with transparent scope, especially around wallet modules and governance logic.

– Documenting failure modes clearly: what happens if a module is compromised, a guardian goes rogue, or an upgrade is blocked?

Successful case studies: when security becomes a competitive edge

Protocols and DAOs that grew by being boringly secure

Several major DeFi and infrastructure projects in 2025 have turned “boring but robust” wallet security into a brand. They launched with conservative smart contract wallet architectures, multi‑layer sign‑offs for treasury operations, and transparent, externally verifiable governance. As more speculative competitors suffered hacks and governance capture, capital gradually consolidated in these more predictable ecosystems. Their treasuries are managed via smart contract wallets with granular modules for grants, operations, incentives, and reserves, each with different signer rules and limits. This compartmentalization meant that even when a single vertical had issues, contagion was limited and quickly addressed, reinforcing community trust.

Inspiring examples for individuals and small collectives

On a smaller scale, many on‑chain collectives – from NFT art DAOs to research cooperatives – have showcased that disciplined wallet practices are not only for billion‑dollar labs. By documenting their multisig policies, publishing monthly signer rotation logs, and open‑sourcing emergency runbooks, they’ve created templates that others can easily copy. For individual power users, public write‑ups of “never hacked in five years” are increasingly detailed: people describe their mix of hardware wallets, devices, vault accounts, and “hot” smart contract wallets, as well as the mistakes they almost made. You can use these stories as blueprints, adapting them to your own risk tolerance and technical comfort.

Hardware and key management: foundational resilience

Blending smart contract logic with strong key hygiene

No matter how advanced your wallet contract is, you still have to keep the actual signing keys safe. Hardware wallets remain a critical tool in 2025, but their role has shifted: rather than being the only interface to funds, they often act as one signer in a broader smart contract wallet architecture. The key idea is to move from “if this one device fails, I lose everything” to “it would take multiple coordinated failures across devices and people to move large amounts of money”.

Practical patterns:

– Use at least one hardware device for any wallet that holds long‑term or high‑value funds, with a dedicated computer or mobile device for interacting with it.

– Avoid reusing the same seed phrase for different roles; treat vault, operations, and experimental wallets as distinct security domains.

– Maintain clear, tested recovery procedures: who has access to backups, where they are stored, and how quickly you can rotate compromised keys and guardians.

Why hardware wallet compatible smart contract wallets matter

One particularly important trend is the growth of hardware wallet compatible smart contract wallets, which combine the UX and flexibility of programmable accounts with the robust signing guarantees of hardware devices. These setups let you keep your most powerful permissions – like upgrading modules or moving large chunks of capital – gated behind offline‑generated keys, while still allowing lower‑risk actions to be delegated to more convenient devices through session keys and limited‑scope permissions. This layered approach significantly narrows the window of opportunity for attackers, especially those relying on browser exploits or mobile malware.

Learning resources and continuous skill development

How to keep levelling up your security knowledge

Staying safe isn’t a one‑time configuration task; it’s an ongoing skill in a moving environment. The good news is that by 2025, the ecosystem offers far more structured education than during the early DeFi chaos. You can learn not only the basics of private keys and seed phrases, but also advanced topics like transaction simulation, cross‑chain risk, and account abstraction internals. Think of it as developing “operational security literacy” for on‑chain life, much like learning personal finance in the fiat world – except the rules change faster, so your learning cadence needs to be higher.

Useful resources to explore include:

– Deep‑dive blog posts and documentation from leading wallet providers and security firms, focusing on real incidents and concrete mitigation techniques.

– Long‑form explainer series about account abstraction, DeFi internals, and wallet design, published by research‑oriented teams and foundations.

– Community‑driven forums and Q&A hubs where experienced users dissect specific hacks, wallet misconfigurations, and rescue operations in detail.

Concrete places to start and habits to build

To make your learning sticky, pair theory with small, safe experiments and consistent habits. Don’t just read about new security models – spin up a low‑value wallet, try out multisig approvals, play with transaction simulation, or test social recovery flows with friends you trust. The point is to make the tools feel familiar before you need them under pressure during an incident.

Here are practical steps you can take:

– Subscribe to a couple of high‑signal security newsletters so that major wallet and DeFi exploits hit your radar quickly and with proper analysis.

– Follow reputable security researchers and wallet teams on social platforms; mute the noise, keep the signal.

– Periodically run through a personal “security audit” checklist: device hygiene, backup integrity, wallet configuration, and protocol exposure.

Putting it all together: a secure smart contract wallet lifestyle

A realistic, sustainable security posture

By 2025, staying secure with smart contract wallets isn’t about paranoia; it’s about structured, layered defense that still lets you enjoy the power of on‑chain finance. Aim for a setup where everyday operations are convenient but tightly scoped, larger moves require deliberate ceremony and multiple checks, and catastrophic failures would demand multiple unlikely events happening together. Combine robust wallet architecture, healthy key management, cautious DeFi usage, and ongoing education, and you’ll be positioned far better than most participants in the space.

If you treat your smart contract wallet not as “an app on your phone” but as critical infrastructure you’re responsible for, your decision‑making will naturally shift. You’ll question that one‑click “Connect” button a bit more, scrutinize new protocols before putting serious capital in, and keep iterating on your setup. And in an environment where new exploits keep emerging, that mindset – adaptive, informed, and deliberate – is ultimately your strongest security primitive.