Category: Security Tips

-

Master crypto fundamentals with this practical guide for long term success

Before we dive in, one quick note: this is not financial advice, but a practical framework to help you think clearly about crypto and risk. Your money, your decisions, your responsibility. Why fundamentals matter more than hype Большинство приходят в крипту ради быстрых денег, а не ради понимания. Это и есть главная ловушка. Пока рынок…

-

How to plan a crypto portfolio that aligns with your personal values

Why values-based crypto planning matters in 2025 In 2025, разговор о криптоинвестициях уже давно вышел за пределы простого поиска максимальной доходности; инвесторы все чаще задаются вопросом, как их капитал влияет на климат, конфиденциальность и финансовое неравенство. После цикла ICO 2017 года, DeFi‑экспериментов 2020–2021 годов и последующих регуляторных разборок стало очевидно, что рынок не является нейтральным:…

-

How to evaluate a token’s user base and traction: a practical guide

A practical lens on token user bases in 2025 If you strip away the buzzwords, evaluating a token’s user base and traction boils down to one question: “Are real people actually using this thing, and is that usage growing sustainably?” In 2025, with tens of thousands of tokens across multiple L1s and L2s, you can’t…

-

Practical guide to evaluating an exchanges privacy features securely

Why privacy on exchanges is getting harder (and more important) If you started with crypto in the early days, you probably remember how easy it was to move coins around without tying everything to your real name. Those times are mostly gone. Today, regulators push hard, exchanges collect huge amounts of personal data, and chain…

-

Security-first thinking in crypto trading: how to build a lasting safe habit

Why “security-first” has to become your default in 2025 In 2025, crypto trading feels more mainstream than ever, но атаки стали изощрённее. Биржи страхуют часть средств, регуляторы пишут новые правила, а вредоносные боты уже умеют анализировать блокчейн в реальном времени. Если не вырабатываешь привычку думать о защите автоматически, то фактически играешь против профессиональных атакующих. Подход…

-

How to stay motivated and consistent with daily crypto study for long term success

Why Daily Crypto Study Feels So Hard (And Why It’s Normal) You’re not lazy if you can’t sit down every day to read charts or on‑chain data. Крипта требует одновременной концентрации на шансах разбогатеть и на риске все потерять, а мозг такое ненавидит. Он выбирает быстрый дофамин: соцсети, сериалы, бесконечные чаты в Telegram. Поэтому стабильная…

-

Cryptographic signatures and verification: a practical guide for beginners

Why cryptographic signatures suddenly matter to everyone (including you) In 2025, cryptographic signatures quietly sit behind almost everything you trust online: your banking app, software updates, messaging apps, even your car’s firmware. You don’t see them, but every time your device checks, “Is this really from who it claims to be, and was it changed…

-

A practical guide to evaluating crypto airdrop eligibility and risk

If you’ve ever watched people brag about airdrop gains on X and thought “what am I missing?”, this guide is for you. Evaluating eligibility and risk isn’t magic; it’s a repeatable process you can actually systematize. The trick is to think like a skeptical accountant and a curious hacker at the same time: verify, log,…

-

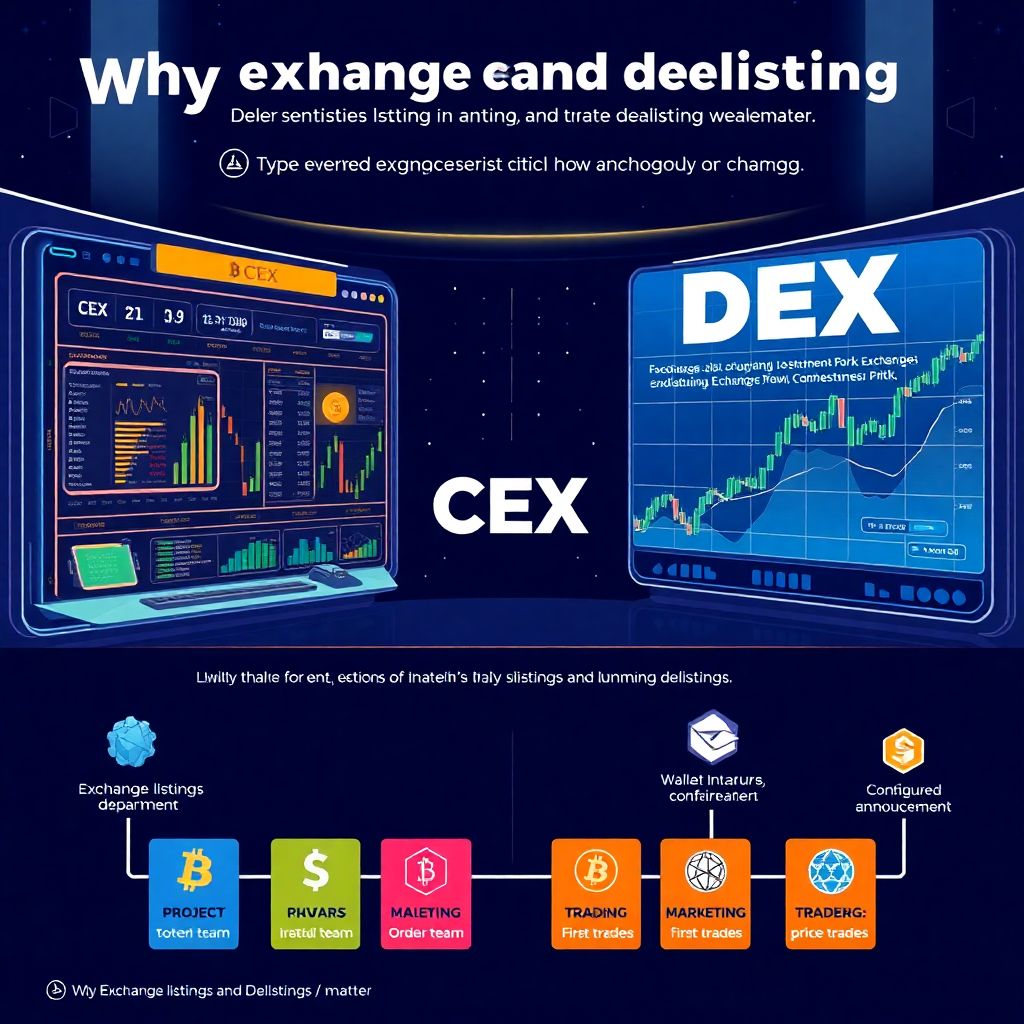

Practical guide to evaluating token exchange listings and delistings

Why exchange listings and delistings deserve your attention When люди обсуждают токены, обычно говорят про технологию, команду, токеномику. Но в реальной торговле часто решает совсем другой фактор — где именно токен торгуется и насколько устойчив этот листинг. Листинг — это формальное добавление токена на биржу с возможностью торговли и, как правило, с поддержкой депозитов и…

-

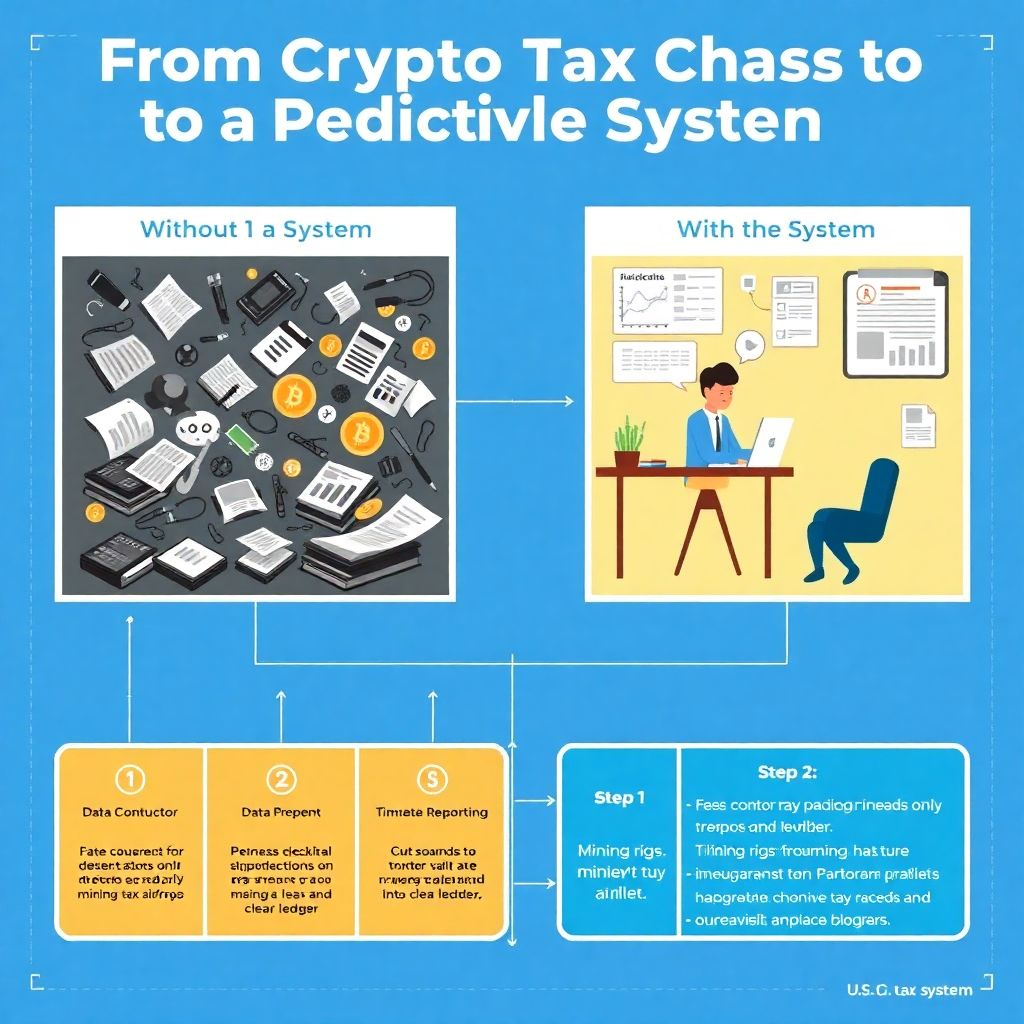

Crypto tax reporting for miners and airdrops: how to navigate Irs rules

Why crypto taxes feel messy (and how to make them boringly predictable) When люди говорят, что налоги на крипту — это хаос, они обычно смешивают в одну кучу трейдинг, стейкинг, майнинг и airdrops. В итоге возникают пропуски в учёте, которые потом приходится латать в последний момент перед дедлайном. Если подойти аналитически, crypto mining tax reporting…