Category: Product Reviews

-

Beginner guide to cryptographic nonces: understanding and secure usage

Why cryptographic nonces matter more than you think When people first bump into the word “nonce”, it usually feels like pointless jargon. In reality, a cryptographic nonce – literally “number used once” – is one of those tiny details that quietly keeps the modern internet from falling apart. Any time you log into a banking…

-

Defi security for beginners: a practical guide to evaluating protocols

Why DeFi security should be your first concern, not an afterthought If you’re just starting with DeFi, it’s tempting to focus on juicy APYs, colorful dashboards and “passive income” promises. But by 2025, the story of decentralized finance is also a story of hacks, rug pulls and painful lessons. Billions of dollars have been lost…

-

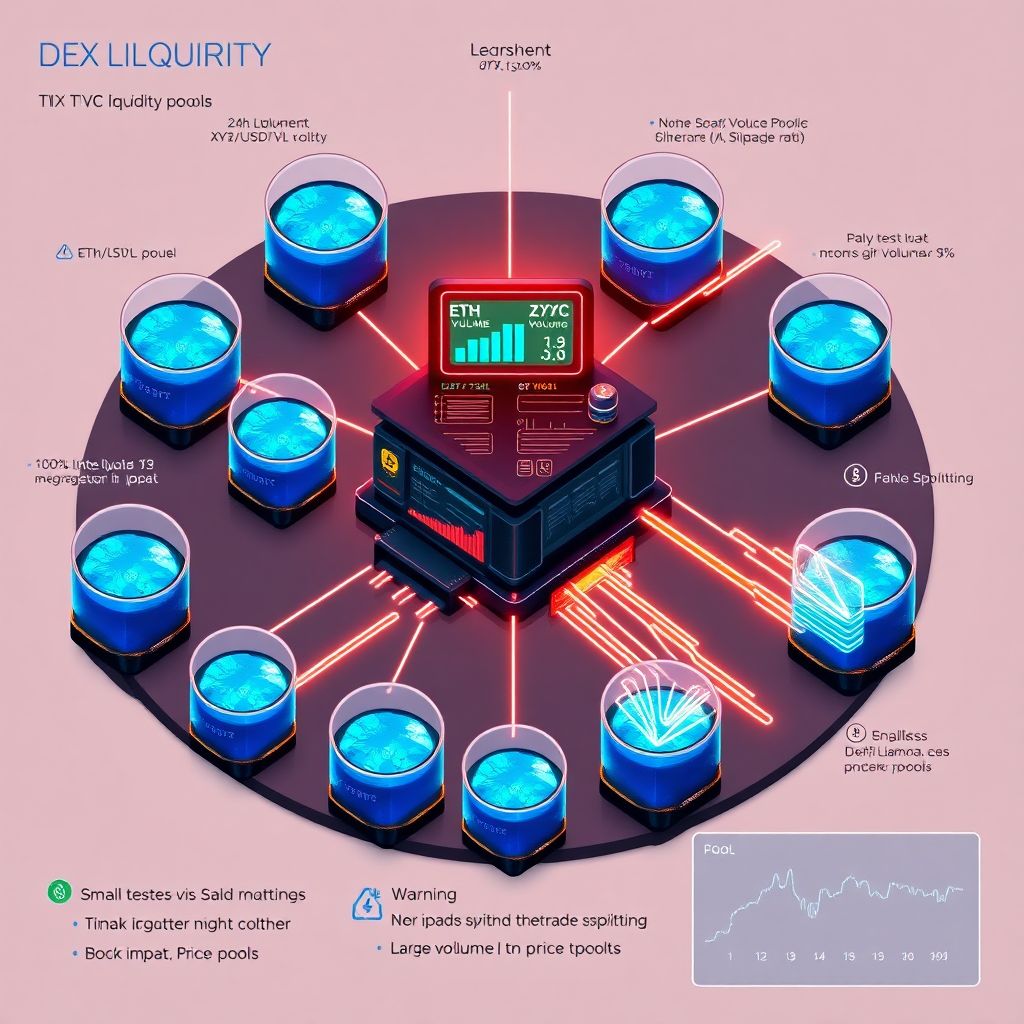

Evaluating liquidity on decentralized exchanges: a practical step by step guide

Why liquidity on DEXes matters more than you think If you mostly trade on centralized exchanges, «liquidity» часто воспринимается как что‑то абстрактное: есть стакан, есть объём — значит всё ок. На децентрализованных платформах всё сложнее: ликвидность размазана по куче пулов, сетей и протоколов. Ошибка в оценке приводит к тому, что своп на $5 000 уводит…

-

How to choose a crypto broker for beginners: key steps and safety tips

Why crypto brokers matter in 2025 In 2025 рынок крипты уже не напоминает дикий запад, но и полностью безопасным его не назовешь. Новичкам сложнее всего: десятки сервисов обещают идеальные условия, но за красивым маркетингом часто скрываются завышенные комиссии, слабая защита и путаные интерфейсы. Вместо того чтобы искать абстрактные best crypto brokers for beginners, полезнее понять,…

-

Beginner guide to crypto tax implications for miners and how to stay compliant

Why crypto taxes matter for miners at all When people talk about “crypto tax for miners”, it often sounds like something only accountants and lawyers care about. In reality, tax rules decide whether your mining hobby is mildly profitable or silently eating your future earnings. Most tax agencies treat mined coins as income the second…

-

Beginner guide to evaluating a projects risk disclosures and documentation

Why risk disclosures matter more than ever Risk sections used to be an afterthought that most retail investors skipped. In the 1970s–1990s, disclosures in annual reports were sparse, often limited to a few vague sentences about “market fluctuations.” After Enron and the dot‑com bust, regulators forced companies to spell out risks in more detail, and…

-

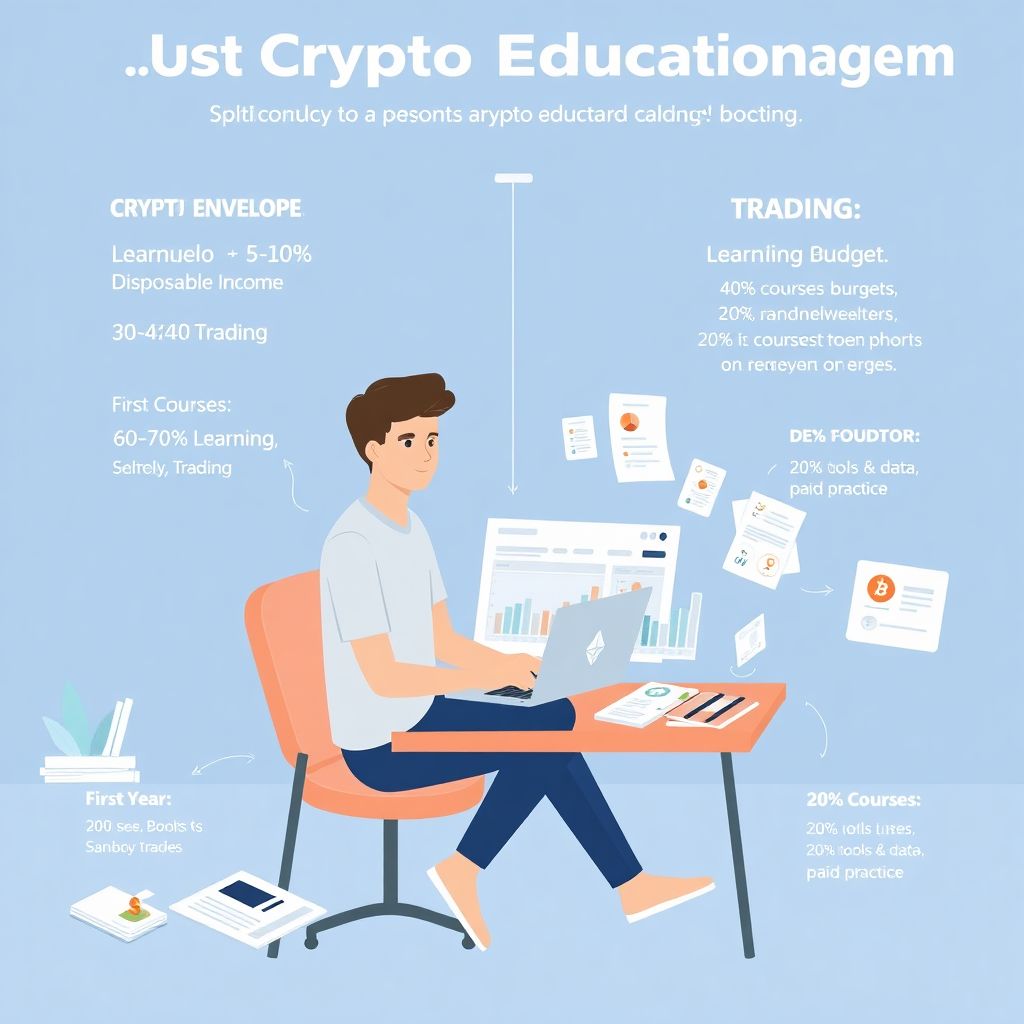

Personal crypto learning budget: a practical guide to investing in yourself

“`markdown Why you need a *learning* budget before a trading budget Most people jump straight into “How much should I put into Bitcoin?” when the better first question is: “How much can I safely spend to become *competent* with crypto in the next 6–12 months?” Think of it this way: If you’re ready to risk…

-

Beginner guide to evaluating a project’s token distribution and health

Почему разбор распределения токенов важнее, чем красивый сайт When you buy a token, you’re not just betting on tech or hype – you’re stepping into a tiny economy. Token distribution shows who holds power in that economy, кто может обвалить цену одной транзакцией и насколько честно поделили пирог между командой, инвесторами и сообществом. For a…

-

Beginner guide to token distribution models and their key implications

Why token distribution models matter more than you think Token distribution sounds like скучная бюрократия, но на деле именно тут решается, выживет ли проект. Кто, когда и сколько токенов получает, напрямую влияет на цену, мотивацию команды, поведение инвесторов и риск дампов. Когда вы видите обещание «честный запуск» или «community-driven», за этим почти всегда стоят конкретные…

-

Beginner guide to identifying credible crypto projects in volatile markets

Market context and volatility Historical background of crypto market cycles Over the last three years crypto has gone through a full boom‑and‑bust‑and‑recovery loop, which is crucial context for any beginner. After the late‑2021 peak near 3 trillion USD total market cap, 2022 saw a drawdown of over 70% with the aggregate value dipping around 800–900…