Why document security in crypto matters more than ever

If you trade crypto in 2025, you’re sitting on a pile of highly sensitive documents, even if it doesn’t feel like it:

– Passport scans and selfies from KYC

– PDFs with bank statements

– Screenshots of wallets and tax reports

– Contracts with OTC desks or funds

All of that is a goldmine for attackers.

Not just for stealing coins, but for opening loans in your name, laundering funds, and blackmail.

The paradox: people obsess over cold wallets, but keep KYC PDFs in a random “Documents” folder or, worse, in cloud drives with weak passwords. This guide is about fixing exactly that — how to treat your documents with the same rigor as your private keys.

—

Step 1. Map what you actually need to protect

Before jumping into tools, you need an inventory. Otherwise вы’re just encrypting chaos.

Make a simple “sensitive data map”

Look through your devices and list what you have related to crypto:

– Personal identity docs: passport, ID card, driver’s license, utility bills, selfies for KYC

– Financial info: bank & card statements, loan docs, tax forms, PnL reports

– Crypto-specific data:

– Screens or exports from exchanges

– OTC agreements, fund onboarding packs

– Excel files with wallet addresses, counterparties

– Access-related data (very dangerous):

– Seed phrases (even partial)

– Private keys, keystore files, JSON exports

– 2FA backup codes and scratch codes

Mark three things for each item:

1. Where is it stored? (phone, laptop, cloud, email, messengers, USB)

2. How critical is it? (identity theft risk, money loss, reputational risk)

3. Who has copies? (exchanges, accountants, lawyers, family, partners)

You already see the problem: copies everywhere. The goal of the rest of the guide is to reduce copies and harden what must remain.

—

Step 2. Decide what should never be stored in the open

Some types of data should not exist in plain text at all.

Red zone: data that must always be encrypted or offline

Put these in the “absolute protection” category:

– Full scans of passport or ID + address + selfie on one device

– Docs that contain both identity + bank details

– Seed phrases, private keys, wallet backup files

– Spreadsheets that map real identity to large holdings

– Exported 2FA recovery codes

If someone gets this bundle, they can impersonate you across multiple platforms.

For these, your standard should be:

– No unencrypted storage on any online device

– No sharing via email or messengers (even “temporarily”)

– Backup only in encrypted form, with a clear procedure

Everything else (like generic market notes or anonymized PnL summaries) can live under lighter protections, but still within a structured system.

—

Step 3. Build a secure “vault” for documents

Think of this as building a private “mini data center” for your identity.

Choose where the vault lives

You have three main options:

– Local only: encrypted container on your laptop or separate mini‑PC

– Local + encrypted cloud: container stored in a cloud drive, but encrypted before upload

– Dedicated encrypted device: small computer or encrypted external SSD used only as a document vault, kept offline most of the time

For most active traders, local + encrypted cloud is the best trade‑off between convenience and safety, as long as encryption happens before syncing.

—

Step 4. Use strong encryption properly (not just a ZIP password)

Password‑protected ZIPs and PDFs are not enough in 2025. You need proper, audited tools.

What to look for in encryption tools

When searching for the best encryption software for crypto documents, focus on:

– Open, well‑reviewed encryption standards (AES‑256, ChaCha20, Argon2, etc.)

– Independent security audits and active development

– Cross‑platform support (Windows/Mac/Linux, maybe mobile)

– Ability to create encrypted containers or “vaults,” not just lock individual files

– Strong password‑derivation (to resist brute force)

Combine software choice with a strong passphrase:

– At least 5–7 random words or 16+ characters

– Use a phrase not tied to you personally

– Store it in an offline password manager or on paper in a safe, never in plain text on the same device as the vault

If managing all this feels overwhelming, consider reputable crypto security services for traders that include consulting on encryption setup and periodic audits of your personal security posture.

—

Step 5. How to securely store KYC documents for crypto trading

KYC is now required on almost every serious exchange, and every round of verification spawns new copies of your documents.

Minimize KYC document spread

A few practical habits:

– Prefer platforms with solid security track records and transparent breach disclosures

– Before sending docs, check:

– 2FA options

– Session management

– Data protection statements

– Avoid sending KYC files through:

– Generic support emails

– Personal Telegram/WhatsApp of a “manager”

– Unsigned Google Drive / Dropbox links

If you must send via web forms:

– Upload from a hardened device (patched OS, no suspicious extensions, antivirus on)

– Remove unnecessary metadata or extra pages from scans

– After successful verification, archive and encrypt your KYC folder locally, then delete unencrypted versions from the machine and the “Downloads” folder.

This is the practical core of how to securely store KYC documents for crypto trading: they should not sit in plain view on every device you own.

—

Step 6. Organize documents like a pro, not like a digital junk drawer

Even the best encryption won’t help if your file structure is chaos.

Simple structure that actually works

Inside your encrypted vault, use a clear hierarchy:

– `/identity/` – IDs, passports, proof of address

– `/exchanges/` – each exchange as a folder; subfolders for KYC, statements, exports

– `/defi-and-wallets/` – documentation, but never raw keys in clear text

– `/tax-and-reports/` – annual summaries, reports for accountants

– `/contracts/` – OTC deals, SAFTs, NDAs, power of attorney docs

Benefits:

– You always know where a doc should live

– Easier to detect duplicates and delete them

– Simpler to share a limited subset (e.g., only tax docs with accountant)

Combine this with:

– Versioning by date in filenames: `binance_kyc_2024-11-02.pdf`

– Read‑only exports when sharing, to avoid accidental edits

—

Step 7. Passwords, 2FA and identity protection

Docs are only one side of the story. Your accounts and identity must be hardened too.

Non‑negotiable security basics in 2025

– Unique, long passwords for every exchange and wallet‑adjacent service

– Hardware‑based 2FA (U2F/FIDO keys) where supported

– App‑based 2FA instead of SMS where hardware keys aren’t possible

– No password reuse between email, cloud drives and exchanges

For extra resilience, using an identity protection service for crypto investors can be reasonable once your capital and exposure cross a certain threshold. The better services:

– Monitor dark‑web markets for leaked identity fragments

– Alert you when your email, phone, or ID numbers appear in breaches

– Help with remediation (freezes, disputes, legal templates) if you’re targeted

Think of this as “insurance for your name,” complementary to your technical defenses.

—

Step 8. Choosing third‑party services without getting burned

You can outsource convenience, but not responsibility. That said, some tools are genuinely helpful if selected carefully.

What to demand from document‑handling services

When you look at secure document management solutions for cryptocurrency exchanges, law firms or accountants, pay attention to:

– End‑to‑end encryption for file uploads and storage

– Access controls per user and per document

– Clear retention policies (how long they keep your docs)

– Breach notification procedures and previous incident history

– Jurisdiction and regulatory compliance (GDPR, local privacy laws)

For individual traders, considerations are similar:

– Cloud storage: enable client‑side encryption or use encrypted containers

– Accounting/tax apps: see where servers are located and how exports are handled

– E‑signing platforms: use those that support strong identity verification and TLS, and do not store documents forever by default

If a service handles your passport or PnL reports but cannot clearly explain its security model in one short page, it doesn’t deserve your data.

—

Step 9. Backups that won’t betray you

Backups are critical — and also a massive leakage vector if done sloppily.

Practical backup strategy for crypto docs

– Rule #1: Only back up already‑encrypted containers, not raw files

– Keep at least two physically separate backups (e.g., encrypted SSD + encrypted USB)

– Store one backup offsite (office safe, bank deposit box, trusted family member with clear instructions)

– Test recovery every 6–12 months:

– Can you open the vault on a clean machine?

– Are passwords/keys still accessible and readable?

Avoid:

– Automatic photo backups that capture KYC selfies and document scans

– Generic system backups that include your decrypted vault in plain text

– Sharing backup drives with “everything else” in your digital life

—

Step 10. Everyday behavior that reduces risk dramatically

Most compromises happen not through sophisticated exploits, but through small everyday shortcuts.

Habits that pay off

– Don’t leave document scans open while screen‑sharing during calls or streaming

– Before selling or giving away a device, wipe it with secure erase, not just “factory reset”

– Don’t store highly sensitive docs on your phone unless absolutely necessary

– Turn off automatic file downloads in messengers on your main trading machine

– Use a separate standard user account on your computer for browsing and experiments; keep the vault accessible only from a more restricted account

These are boring to read, but very effective in practice.

—

How professionals handle sensitive documents today

Larger funds, OTC desks, and exchanges have already industrialized this process.

Many modern crypto security services for traders and institutions offer:

– Threat modeling tailored to your trading style and jurisdictions

– Design of a secure document workflow (from onboarding to archiving)

– Periodic security reviews of devices and access policies

– Training for staff and high‑net‑worth individuals

Even if you don’t pay for those services, you can copy their principles:

– Least privilege: each person sees the minimum necessary docs

– Segmentation: different tasks done on different devices or user accounts

– Logging: track who accessed what and when (even at a basic level)

– Regular review: every quarter, delete outdated copies and revoke unneeded access

—

Looking ahead: how document security in crypto will evolve by 2030

The way we handle documents around crypto trading in 2025 is already changing fast. Expect several strong trends over the next 3–5 years:

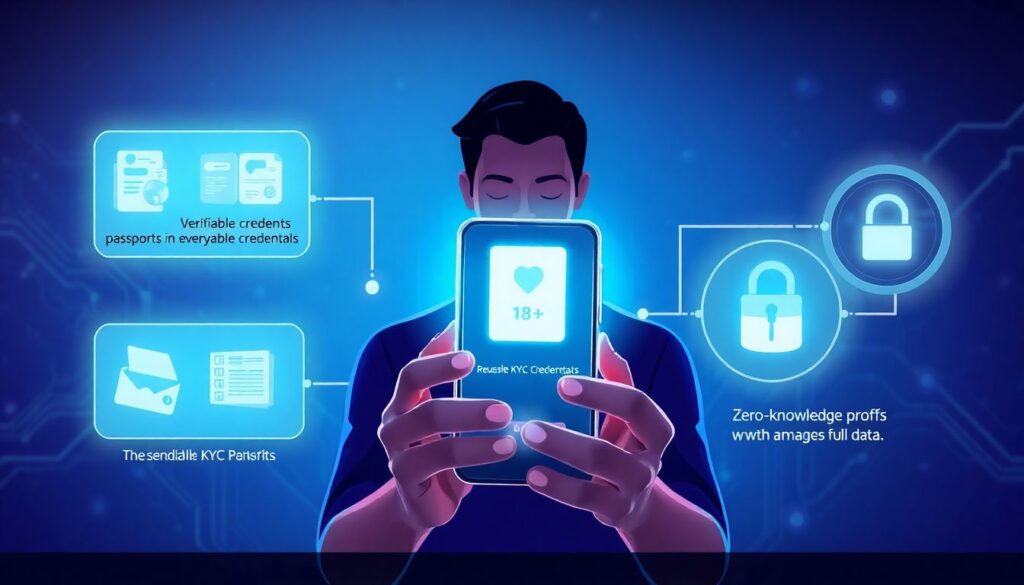

1. Fewer raw document copies, more verified credentials

Instead of sending PDFs of passports to every platform, users will increasingly use:

– Verifiable credentials stored in secure wallets

– Reusable KYC providers that vouch for your identity without exposing all your details

– Zero‑knowledge proofs, where you can prove you’re over 18 or from a certain region without revealing your name or address

That will sharply reduce the number of high‑risk document copies floating around, at least with professional platforms.

2. Native encryption by default

OS‑level encryption is already standard, but we’ll see:

– More default‑encrypted directories specifically for “ID & finance”

– Tighter integration of encryption with mainstream cloud services

– Built‑in alerts when you try to upload passports or KYC docs to insecure destinations

In other words, systems will try to stop you from making obvious mistakes.

3. Smarter monitoring and “digital smoke detectors”

Identity‑theft tooling on the attacker side keeps improving; defensive tools will react:

– Consumer‑grade monitoring that correlates: exchange login patterns, dark‑web leaks, and unusual uses of your ID numbers

– Automatic suggestions to rotate documents or freeze credit if something looks suspicious

– Greater overlap between traditional credit‑monitoring tools and crypto‑focused identity protection

In practice, you’ll get more “something’s off, check this now” alerts — and they’ll be more accurate.

4. Regulation will force better hygiene

Regulators are slowly catching up with crypto. Expect:

– Stricter rules on how exchanges store and delete KYC docs

– Larger fines for leaks involving passport and tax data

– Standardized disclosures about a platform’s document retention and encryption

As a trader, this helps you: even if you don’t change your habits, the baseline security of the services you use will gradually improve.

5. Attackers will target individuals more, not less

On the downside, as big exchanges harden their systems:

– Phishing, SIM‑swapping, and extortion targeting individual traders will grow

– “Identity+document” bundles on underground markets will become more valuable

– Social‑engineering attacks will increasingly use real fragments of your documents to gain trust

So personal discipline and a clear document‑security strategy will remain essential, even if infrastructure gets better.

—

Bringing it all together

Securing sensitive documents while trading crypto doesn’t require a PhD or an enterprise budget. It boils down to a handful of deliberate choices:

– Know what you’re protecting and where it lives

– Encrypt first, then store or sync

– Keep a clean, logical structure inside a hardened vault

– Share only what’s needed, through channels that deserve your trust

– Combine technical measures with identity monitoring and good habits

Treat your identity documents and reports with the same respect you give your private keys. Coins can be moved; a compromised identity stays with you for years.