What Layer 2 Actually Is — Without the Buzzwords

Layer 2 is a set of technologies built on top of existing blockchains to fix their biggest pain point: they’re too slow and too expensive when demand spikes. Instead of replacing Ethereum or Bitcoin, layer 2 scaling solutions move most activity off the main chain, then periodically send compressed proofs back down. You can think of it as clearing thousands of micro‑transactions off‑chain, while using the base layer as a final court of record.

Why Scalability Became a Survival Issue

When NFT and DeFi mania hit, Ethereum fees regularly jumped above $50 per transaction, and even simple swaps could stall. That’s the core of the layer 2 vs layer 1 blockchain scalability debate: layer 1 gives security and decentralization, but struggles to handle mass usage. If blockchains are ever going to serve payments, gaming, and real‑world assets for hundreds of millions of users, they need higher throughput without sacrificing finality and security. Layer 2 is the pragmatic answer.

How Layer 2 Scaling Solutions Work in Practice

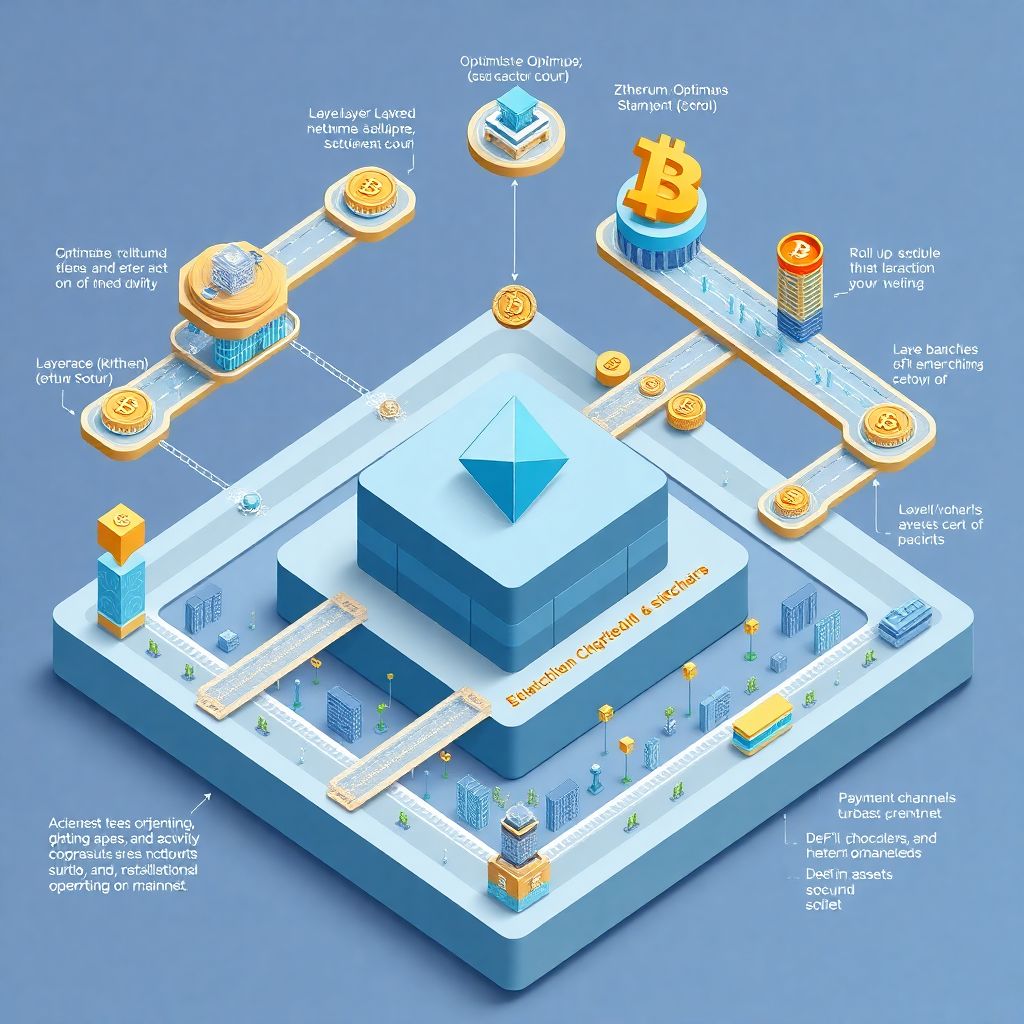

Most layer 2 systems follow one of two main models: optimistic rollups or zero‑knowledge (ZK) rollups. Both batch thousands of transactions and submit a single proof to the base chain, cutting fees dramatically. Optimistic rollups assume transactions are valid unless challenged in a dispute window, while ZK rollups use cryptographic proofs to guarantee correctness. This is why many analysts expect rollups, not alternative L1s, to dominate long‑term scaling.

Key Types of Layer 2 Today

– Optimistic rollups (Arbitrum, Optimism, Base)

– ZK rollups (zkSync, Starknet, Scroll)

– Payment channels and sidechains (Lightning Network, Polygon PoS – hybrid approach)

Each design makes a different trade‑off between speed, cost, and complexity of implementation, which is why an ethereum layer 2 solutions comparison always ends up being more nuanced than “which is cheaper today”.

Numbers That Show Layer 2 Is No Longer Experimental

By late 2024, Ethereum layer 2 networks collectively hold tens of billions of dollars in total value locked, with daily transaction counts routinely surpassing Ethereum mainnet itself. Arbitrum and Optimism each process hundreds of thousands of transactions per day, often at a cost under $0.10. Meanwhile, Bitcoin’s Lightning Network has grown to thousands of nodes and tens of thousands of channels, quietly handling small payments. The story has shifted from “will this work?” to “how fast will it scale from here?”.

Economic Effects: Fees, Liquidity, and New Business Models

The economic argument for L2 is straightforward: lower fees and higher throughput expand the addressable user base. When a DEX can execute trades for cents instead of dollars, smaller accounts become viable. Liquidity spreads across more venues, and projects can experiment with micro‑payments, pay‑per‑use APIs, and high‑frequency strategies that made no sense on congested layer 1. At the same time, MEV patterns, validator incentives, and revenue models start to move upwards into the L2 stack.

Who Actually Benefits Financially

– Users: cheaper swaps, bridges, and NFT mints

– Builders: more predictable gas costs and UX closer to Web2

– Investors: exposure to new fee‑generating tokens and sequencer revenue

For regulators and traditional finance, this also changes the calculus: stablecoins and tokenized assets on L2 suddenly become realistic for retail‑scale usage.

Impact on the Broader Digital Asset Industry

As best layer 2 crypto projects mature, they reshape how teams launch and scale protocols. Many new DeFi platforms skip mainnet at launch and go straight to L2 to avoid user friction. GameFi and social apps, which need thousands of tiny interactions per user, have effectively no choice but to live on L2 or on specialized app‑chains. Infrastructure players — oracles, indexers, custodians — now treat L2 as first‑class networks, not experimental add‑ons. This shifts innovation away from competing L1s and toward a shared security model anchored in Ethereum or Bitcoin.

Common Newbie Mistakes With Layer 2

Newcomers often assume all L2s are identical and safe “because they’re on Ethereum”. In reality, each network has different trust assumptions: some rely on multisigs, some on upgradeable contracts, others on still‑evolving cryptography. Another frequent error is ignoring bridge risk. Users rush to move funds through the first bridge they see, without checking audits or custody models, then are shocked when a bridge exploit wipes out their capital.

Typical Missteps You Want to Avoid

– Treating every L2 token as a guaranteed “next Ethereum”

– Forgetting that withdrawal times on optimistic rollups can take days

– Mixing testnet and mainnet networks and sending funds to the wrong chain

– Chasing airdrops without understanding protocol risk or lockups

Many beginners also misread block explorers, panic when they don’t see their assets on the main chain, and blame “lost funds” when they’re simply viewing the wrong network in their wallet.

Investing in Layer 2: Reality vs Hype

When people search how to invest in layer 2 cryptocurrencies, they often expect a simple list of tickers. That mindset is risky. L2 exposure can come from several angles: native tokens of rollup projects, governance tokens of protocols that dominate a specific L2, or infrastructure players like sequencer operators and data‑availability layers. Each carries different correlations to market cycles, fee revenue, and regulatory risk. Blindly buying anything “L2‑related” is closer to gambling than strategy.

Things to Check Before Putting Money In

– Security model: who can pause, upgrade, or censor the network?

– Revenue and usage: are fees and active users growing, or is it just incentives?

– Roadmap realism: is there a credible path to decentralizing sequencers?

– Dependency risk: how tied is the project to a single ecosystem bet?

From an analyst’s perspective, sustainable value usually tracks real gas usage and recurring protocol fees, not short‑lived farming campaigns or speculative narratives.

Layer 2 vs Layer 1 Blockchain Scalability: The Strategic View

The debate isn’t “which one wins” but “what each layer is optimized for”. Layer 1 is increasingly the settlement and security layer, where high‑value finality matters most. Layer 2 scaling solutions handle day‑to‑day activity, experimentation, and UX. This modular architecture lets different components evolve at different speeds: L1 remains conservative and slow to change; L2 can iterate rapidly, adopt new cryptography, and spin up specialized environments for gaming, DeFi, or enterprise. In macro terms, that’s a more resilient and upgradeable stack.

Forecasts: Where Layer 2 Is Going Next

Most credible forecasts expect L2 transaction volume to be multiple times larger than L1 volume within a few years, with rollups absorbing the bulk of consumer‑facing activity. As ZK tech matures, we’ll likely see privacy‑preserving L2s for institutional use and streamlined account abstraction that hides crypto complexity from end users altogether. Over time, the question won’t be which are the best layer 2 crypto projects, but which ones integrate most smoothly with compliant stablecoins, real‑world asset platforms, and existing banking rails.

Why This Matters for the Future of Digital Assets

If digital assets are ever to resemble actual infrastructure rather than a niche trading playground, they must handle millions of low‑value transactions reliably and cheaply. Layer 2 is the piece that makes that credible. It lets Ethereum and Bitcoin keep their conservative, battle‑tested cores while still scaling to social networks, global payments, and complex financial products. For newcomers, the task is to respect the risks, avoid the beginner traps, and treat L2 not as a shortcut to quick gains, but as the backbone of the next phase of the crypto economy.