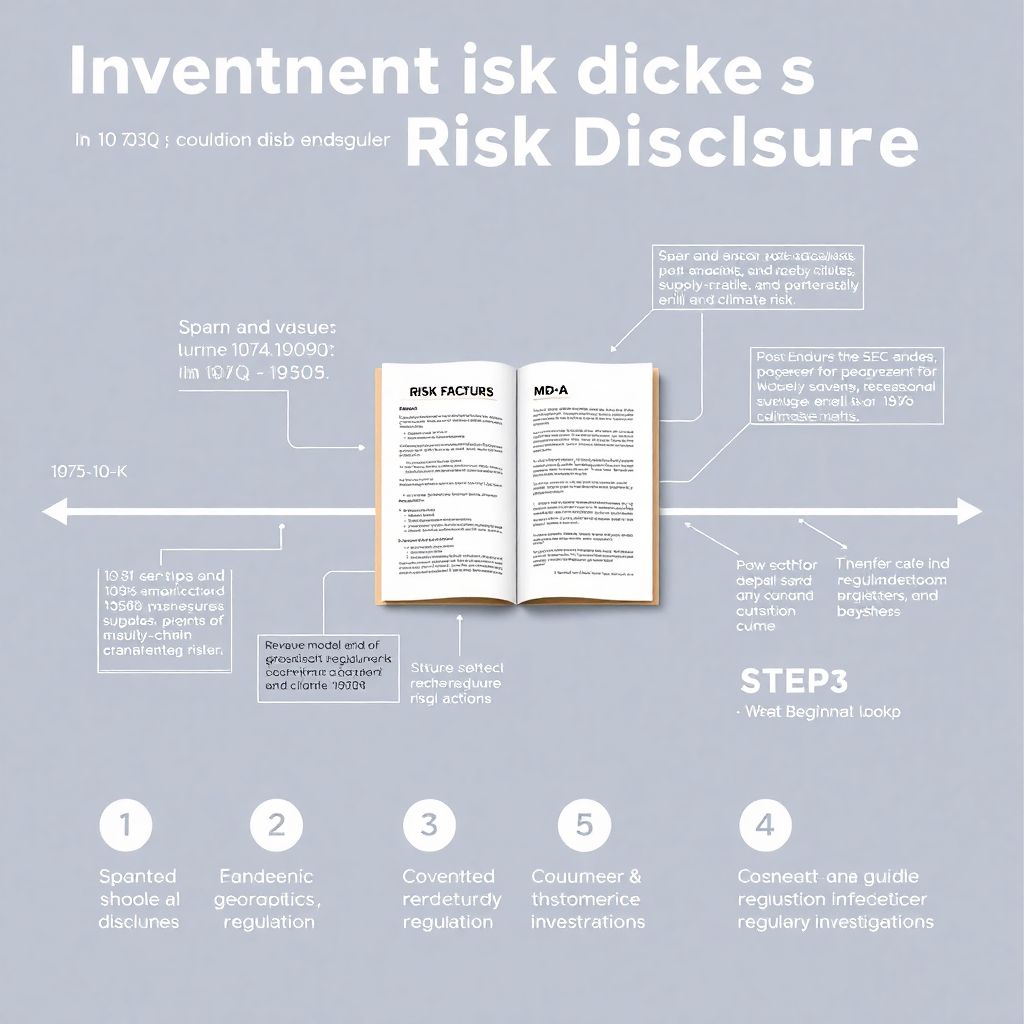

Why risk disclosures matter more than ever

Risk sections used to be an afterthought that most retail investors skipped. In the 1970s–1990s, disclosures in annual reports were sparse, often limited to a few vague sentences about “market fluctuations.” After Enron and the dot‑com bust, regulators forced companies to spell out risks in more detail, and the SEC’s MD&A and 10‑K requirements tightened. Post‑2008 crisis and especially after 2020, risk factors expanded to include pandemics, cyber‑attacks, supply‑chain fragility and climate exposure. In 2025, learning how to evaluate investment risk disclosures for beginners is not a “nice to have”; it’s survival gear in a market where one hidden risk can erase years of returns overnight.

Where to find risk information and how to read it

If you’re looking at a public U.S. company, the single best entry point is a guide to understanding project risk factors in SEC filings, especially Form 10‑K and, for interim updates, Form 10‑Q. The dedicated “Risk Factors” section, plus Management’s Discussion and Analysis (MD&A), form the backbone of narrative risk reporting. For private projects or startups, you’ll see similar content in pitch decks, whitepapers, or offering memoranda, but often with less structure. A practical beginner tutorial on reading 10‑K risk disclosures starts with three passes: a quick skim for themes, a focused read on the most material threats, and then cross‑checking those against the financial statements and footnotes.

What makes a risk factor actually “material”

Not every scary sentence in a filing is worth equal attention. Historically, companies have sprinkled in boilerplate language (“we may be affected by economic downturns”) to reduce litigation risk. The trick is to separate generic phrasing from project‑specific exposure. Regulators focus on “material” risks: items that a reasonable investor would consider important in making a decision. When you build your own project risk assessment checklist for investors, flag anything that (1) ties directly to revenue or cost structure, (2) mentions regulatory investigations or non‑compliance, or (3) references customer or supplier concentration by name or percentage. These are the disclosures that have a real probability of hitting cash flow.

Step‑by‑step process for beginners

1. Identify the project scope: revenue model, geography, key partners and regulators.

2. Read the “Risk Factors” headings only, to map the territory before diving into details.

3. Highlight any risk linked to legal actions, liquidity, refinancing, or covenant breaches.

4. Compare repeated risks across several years’ filings; growing length or specificity is often a red flag.

5. Translate narrative into numbers: estimate potential impact on margins, growth rates or capital needs.

This method answers how to analyze financial risk disclosures before investing in a way that stays systematic instead of driven by fear or hype.

Quantifying risk: from words to numbers

Since the 2010s, institutional investors have pushed issuers toward more quantitative risk disclosure: scenario analysis, stress tests, and sensitivity tables. While beginners won’t model every scenario, you should still ask, “What would this risk do to revenue, costs, or dilution?” For instance, if a filing warns that losing a top customer supplying 25% of revenue is possible, mentally haircut future revenue assumptions by that amount and test whether the business still looks viable. Over 70% of large‑cap companies now include some form of quantitative risk commentary, and by 2030 regulators are expected to nudge mid‑caps in the same direction, making numerical interpretation an essential literacy skill.

Economic context and sector‑specific exposure

Risk doesn’t live in a vacuum; it’s intertwined with macroeconomic cycles. In low‑rate eras (like 2010–2021), leverage and refinancing risk were easy to ignore. After the 2022–2024 rate hikes, credit spreads widened and companies with floating‑rate debt saw interest expense spike, forcing many 2025 disclosures to highlight refinancing uncertainty. Sector matters, too: tech issuers overweight cyber and data‑privacy risk, energy companies discuss commodity and environmental regulation, while fintech and crypto projects emphasize compliance and counterparty risks. When you read disclosures, mentally place them against the current macro backdrop—growth, inflation, and policy trends—to judge whether the narrative underestimates or realistically reflects economic headwinds.

Impact on industry practices and future trends

The cumulative effect of scandals, crises and rapid technological shifts has transformed how industries speak about risk. ESG, climate and AI‑governance disclosures, once niche, are now creeping into even small‑cap 10‑Ks and private placement memoranda. As data tooling improves, expect more structured, machine‑readable risk taxonomies by 2030, enabling investors to benchmark issuers against peers in near real time. For beginners, using any modern guide to understanding project risk factors in SEC filings is just the start; the next frontier will be comparing how consistently a company talks about the same risk across channels—annual reports, earnings calls, and investor presentations—to detect understatement, drift, or sudden defensive shifts in tone.