If you’ve ever watched people brag about airdrop gains on X and thought “what am I missing?”, this guide is for you. Evaluating eligibility and risk isn’t magic; it’s a repeatable process you can actually systematize. The trick is to think like a skeptical accountant and a curious hacker at the same time: verify, log, simulate, and only then commit real money or time. Below we’ll walk through tools, a step‑by‑step workflow, and ways to debug what went wrong when your address gets nothing while others cash out.

Essential tools: your basic airdrop lab setup

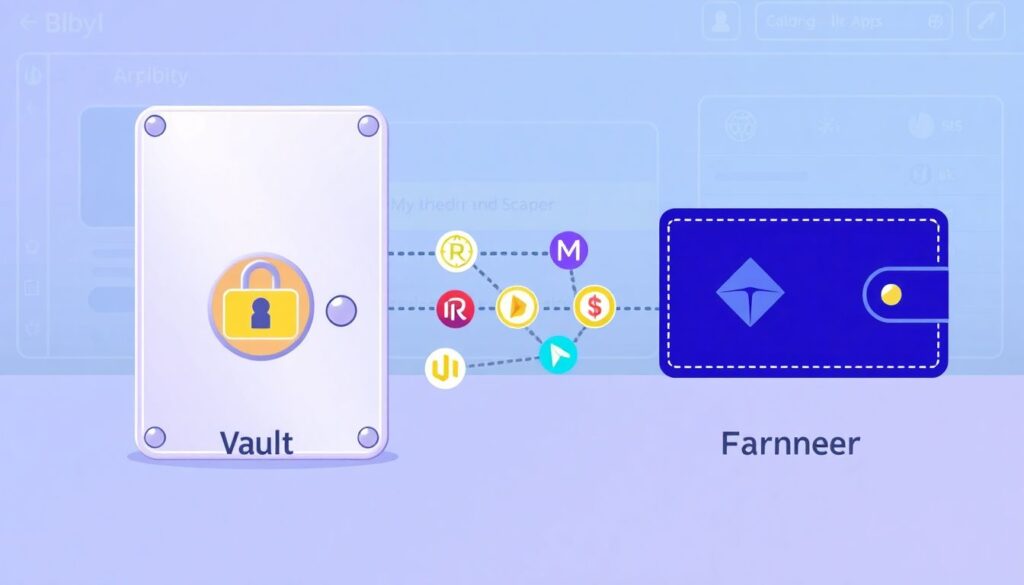

Before you dive into any airdrop hunting guide for beginners, set up a clean technical base. You want at least two wallets: a long‑term “vault” and a separate “farmer” wallet that touches experimental dApps. Use audited, well‑known wallets like Rabby or MetaMask, plus one hardware wallet to park anything valuable. Add block explorers (Etherscan, Arbiscan, Solscan), portfolio dashboards such as DeBank or Zapper, and a password manager to keep all the chaos from leaking into text files or screenshots. This toolkit helps you track exactly what you did for each project and later reconstruct whether you were realistically eligible or just hoping for a miracle.

Advanced tools and “paranoid mode” protections

As your activity grows, copy‑pasting addresses into random sites becomes a security liability, so upgrade into what I’d call “paranoid mode”. Use a dedicated browser profile and a separate OS account just for airdrop work to isolate extensions and cookies. Add approval management tools like Revoke.cash or similar dashboards to routinely clean up token and NFT approvals on all chains. Consider using a read‑only “watcher” wallet on your phone, keeping signing devices offline unless needed. This setup won’t guarantee safe crypto airdrops with low risk, but it dramatically reduces the surface area for rug pulls, malicious contracts, and phishing pop‑ups masquerading as support staff or partners.

Information filters: where you find airdrops (and where you don’t)

Most people hunt via Twitter threads and Telegram groups, but the real edge comes from combining sources and filtering aggressively. Prioritize protocol documentation, governance forums, and early investor decks where teams often hint at token plans long before influencers arrive. Cross‑check any “best new airdrops to claim now” thread with on‑chain data: real TVL, unique active addresses, and treasury size. Ignore channels that push ten “secret” drops a day; they’re either guessing or shilling. Instead, subscribe to a small set of sober‑minded newsletters and Discords where people show transaction hashes, not just screenshots of hypothetical future wealth.

How to structure your own crypto airdrop farming strategy

Most threads focus on random clicking, but a better crypto airdrop farming strategy looks like a portfolio of experiments. Allocate small, fixed budgets per ecosystem—say, Optimism, Base, Solana—and design weekly tasks for each: bridge, lend, swap, LP, vote, and provide feedback. Treat every protocol as a mini‑case study: what problem does it solve, how do they measure activity, and what behaviors are most “valuable” to them? Rather than chasing every campaign, maintain a living list of 10–15 projects you interact with repeatedly. This pattern of sustained, varied use gives you a much higher chance of landing serious allocations than a thousand shallow one‑click interactions.

How to qualify for crypto airdrops without over‑spending

Teams don’t reward random existence; they reward behavior that signals commitment. When analyzing how to qualify for crypto airdrops, look at what previous incentives in that niche have favored: for DEXs it’s often trading volume and LP positions, for L2s it’s bridging and gas used across many contracts, for social apps it’s content creation and referrals. Then simulate “eligibility tiers” for yourself: what would a light, medium, and heavy user of this app actually do? Try to reach at least the medium tier consistently across a few projects instead of maxing one protocol and ignoring the rest. It’s cheaper, and it spreads your optionality.

Step‑by‑step workflow: from idea to on‑chain action

To keep things practical, you can follow a repeatable weekly loop rather than reacting to every new rumor. A simple process could look like this: scout 2–3 new protocols, read their docs, decide if they’re token‑probable, then design 3–5 on‑chain actions that mimic sincere usage. Log everything in a simple sheet: protocol, chain, address used, actions completed, date, and costs. Over time you’ll see patterns: which actions precede real drops, what kind of gas spend is typical for winners, and which ecosystems keep rewarding early adopters. That’s the backbone of a personal framework instead of chaotic gambling on hype and screenshots.

– Discover and shortlist projects (docs, investors, community health)

– Define 3–5 meaningful actions per project (not just one swap)

– Execute, log costs, and set a reminder to re‑engage weekly

Evaluating risk: financial, technical, and reputational

Risk in airdrops isn’t just “can I get hacked?”. There’s also the risk of wasting months on projects that never launch or give negligible rewards. When you evaluate each candidate, look at three layers. Financial: how much gas and capital must you lock, and what is the worst‑case loss if the token never appears? Technical: are contracts audited, is code open‑sourced, do block explorers show sane activity? Reputational: do founders have previous projects, or is everything anonymous with recycled avatars and obviously farmed engagement? You don’t need perfection, but stack enough positives that the upside justifies your time and ETH spent.

Non‑obvious, low‑risk tactics most farmers ignore

Some of the best opportunities are boring because they don’t feel like “farming”. Joining testnets early, writing concise bug reports, or participating in governance on small DAOs can quietly build eligibility. Teams increasingly try to weed out sybil farmers and reward contributors instead. Consider leaving thoughtful comments in Discord, answering other users’ questions, or submitting small pull requests to docs. These actions are cheap, hard to fake at scale, and often end up on internal “contributor lists” used later for allocations. It’s not glamorous, but it’s a clever way to position yourself for safe crypto airdrops with low risk and real community ties.

Troubleshooting: why you didn’t get the drop

At some point, you’ll be sure you nailed a campaign and still get zero. Treat this like debugging code, not personal tragedy. First, verify eligibility criteria: snapshot date, chains included, minimum thresholds, anti‑sybil rules. Then compare your address activity to a confirmed winner using block explorers: did they bridge more, trade more pairs, or hold positions longer? Finally, consider that teams sometimes quietly exclude users with patterns that look like bots: dozens of tiny, identical interactions across clone wallets. By systematically reverse‑engineering these misses, you refine your approach instead of rage‑quitting each time your expectations aren’t met.

– Re‑read official eligibility posts and cross‑check snapshot dates

– Compare your on‑chain behavior to known eligible wallets

– Log what was *missing* and update your future playbook

Fixing common operational mistakes

Beyond strategy errors, simple operational slips frequently ruin otherwise good runs. Using the wrong chain, forgetting to claim on time, or interacting only with wrapped assets when the criteria required native tokens are classic examples. To counter this, create a claim calendar and a short pre‑interaction checklist: correct RPC, correct network, and confirmation that your address actually executed the required actions, not just approved them. If claims require signing with specific wallets, avoid shuffling assets at the last minute, which can flag you as suspicious. Small habits like these remove many of the “I almost had it” stories from your personal archive.

Spotting genuinely promising, not‑yet‑obvious airdrops

Instead of just scanning hashtags for the best new airdrops to claim now, look upstream. Track ecosystems where big funds are quietly active, monitor hackathon winners that receive follow‑on grants, and review governance proposals that mention “points”, “loyalty programs”, or “future token incentives”. These signals often predate marketing campaigns by weeks or months. Combine this with your own lightweight research on user pain points: if a protocol solves something real and shows sticky usage without a token, any later airdrop is likelier to have value. That shift—from chasing announcements to anticipating incentives—turns you from a follower into an early, informed participant.

Bringing it all together into a repeatable personal system

In the end, an airdrop plan is just another personal system: tools, habits, and feedback loops. Tie your notes, dashboards, and on‑chain activity into a single routine you can run in a few focused hours per week. Review what worked quarterly: which ecosystems paid off, how much gas you spent, and where your assumptions failed. Adjust your allocations, retire low‑yield patterns, and double down on behaviors that repeatedly led to rewards. Over time, this practical, evidence‑driven approach outperforms random hype‑chasing, and your own logs become the most reliable airdrop hunting guide for beginners—custom‑built around how you actually operate in crypto.