Why real‑world utility and demand matter more than hype

In 2025, the market has mostly learned the lesson of 2021–2022: tokens without real usage eventually trend to zero, no matter how loud the marketing. If you want a practical beginner guide to researching crypto projects before investing, the first thing to accept is that price is a lagging indicator. What really drives long‑term value is whether a token solves a concrete problem *and* whether people actually need to hold or spend that token to solve it. This is what “real‑world utility and demand” means in practice, and if you can learn to spot it, you’re already ahead of most retail traders who still chase whatever’s trending on X and Telegram instead of doing basic due diligence.

Step 1: Understand the problem the token claims to solve

Before you even look at charts, ask a very simple but powerful question: “If this token disappeared tomorrow, who would care?” A solid crypto fundamental analysis guide for beginners starts from the use case, not from the ticker. Utility tokens should exist because they enable access to some network, resource or service that can’t be provided as efficiently with traditional systems or a simple database. That might be permissionless access to liquidity (DeFi), censorship‑resistant transfers (payments), verifiable ownership (NFTs, RWAs), or automated coordination (DAOs). If the whitepaper or website can’t describe the problem in one or two clear paragraphs, and instead hides behind buzzwords like “AI‑powered Web3 synergy,” treat it as a massive red flag.

Real‑world example: DeFi vs. pointless reward tokens

Compare two types of projects that launched in the last cycle. On one side you have decentralized exchanges like Uniswap or dYdX, where the token controls protocol fees, governance, and sometimes staking that secures the system. Liquidity providers and power users actually need the token for voting or for higher yield, and protocols paid out billions of dollars in swap fees between 2020 and 2024. That’s real economic activity. On the other side, you had thousands of “reward” tokens that were only used to farm more of themselves. No actual demand outside speculation, no real fees, no external cash flow. As soon as emission incentives decreased, volume evaporated and prices collapsed 90–99%. Same market, very different level of utility.

Technical block: Mapping use case → token necessity

When you read a whitepaper, explicitly map each major feature of the product to whether a token is actually required: (1) Access: is the token needed to pay for gas, storage, bandwidth or transactions? If yes, that’s a strong base utility; if no, the token might be bolt‑on. (2) Security: is the token staked to secure a network (PoS, restaking, data availability)? Slashing risk plus lockups can create structural demand. (3) Governance: do key parameters (fees, emissions, upgrades) require token voting, and are voters rewarded? Governance alone is weak utility unless high‑value decisions are genuinely on‑chain. (4) Incentives: are rewards denominated in the same token and funded from real protocol revenue instead of pure inflation? If there is no credible link between usage and token sinks, the design is fragile.

Step 2: Decode the tokenomics, not just the buzzwords

Once you understand the problem and the product, you need to look at how value actually flows between users, the protocol and token holders. Many beginners ask how to evaluate crypto token utility but skip tokenomics because the charts and math look intimidating. In reality, you just need a few key checks: total supply, emission schedule, who gets new tokens, and which mechanisms burn or lock them. From 2017 to 2023, some of the best crypto tokens with real world use cases still underperformed for years because early investors or teams held 50–70% of supply and dumped on every rally. So utility alone doesn’t save a project from bad distribution; you need both workable economics and a credible vesting plan that doesn’t constantly flood the market.

What to look for in 2025 token models

Today, common designs include revenue‑sharing tokens, fee‑burn tokens, and restaking or shared‑security tokens. Good protocols usually publish detailed dashboards: monthly revenue, fee breakdown, and exactly how much value is redirected to token holders. For example, from 2022–2024 several L2 networks grew daily transaction counts to millions, but fees were almost entirely burned or held by centralized sequencers instead of benefiting the token. Retail holders discovered that “high usage” didn’t translate into price because the value capture route was weak. When you analyze a token now, explicitly ask: “If protocol revenue doubles, what *numerical* effect does that have on the token?” If you can’t trace the path in on‑chain data and documentation, you probably won’t capture that growth.

Technical block: Quick quantitative sanity checks

Do three simple calculations. (1) Fully‑diluted valuation (FDV) = token price × max supply. Compare FDV to annualized protocol revenue; a rough rule: if FDV is 200–300× larger than yearly revenue and growth is slowing, upside is limited. (2) Sell pressure = monthly unlocked tokens × price. If team + investors unlock tokens equal to 10–20% of average monthly trading volume, sustained upward moves are hard. (3) Real yield = (revenue to token holders – emissions) / market cap. If emissions massively exceed revenue, holders are effectively being diluted to subsidize users, which is only acceptable during early high‑growth phases where adoption metrics are clearly exploding, not flat.

Step 3: How to check real demand for a cryptocurrency

Utility and tokenomics are theory; demand is what people actually do on‑chain. When you want to know how to check real demand for a cryptocurrency, ignore social media follower counts and instead go straight to usage metrics. Core questions: How many unique addresses interact with the protocol each day or month? What is the dollar value of transactions or total value locked (TVL)? Are active users and volume growing over a six‑month window, or just spiking around airdrop farming events? Projects with real traction tend to show a pattern of volatile but upward‑trending usage curves even during bear markets, while pure narrative tokens show a single parabolic spike, then decay.

Practical tools and data in 2025

Today it’s much easier for beginners to access on‑chain data than it was five years ago. Dashboards on Dune, DefiLlama, TokenTerminal, Artemis and others allow you to track fees, users, TVL and emissions without writing a single line of code. A realistic how to evaluate crypto token utility process in 2025 means bookmarking a few of these, plugging in a token, and watching three time series: active addresses, fees/revenue, and token price. If price pumps while revenue and users are flat or declining, speculation is driving the move. If revenue and users trend up steadily while price lags, you might have a fundamentally improving asset still under the radar, which is far more attractive for a patient investor willing to hold through volatility.

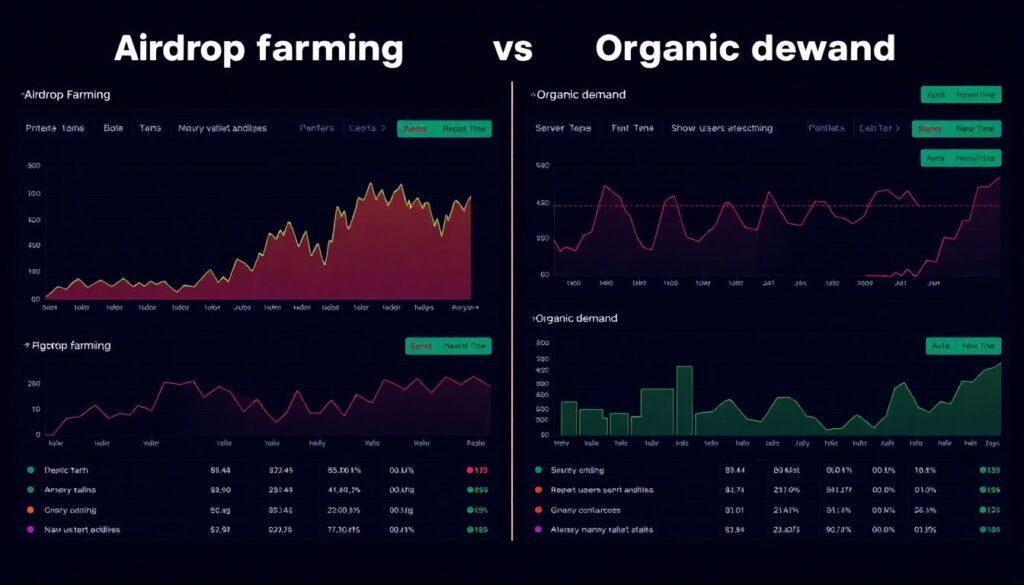

Technical block: Distinguishing “airdrop activity” from organic use

On‑chain, airdrop farming often looks like: sudden surge in new addresses, lots of tiny transactions, heavy interaction with only a narrow set of contract functions, and then a sharp falloff after a snapshot date. Organic demand, by contrast, shows repeat users, more varied contract calls, and new wallets continuing to appear even when no incentives are announced. For example, during the 2023–2024 restaking boom, many protocols saw huge spikes in TVL driven by large “whale” addresses splitting capital; after rewards dropped, TVL fell 60–80%. If you subtract incentivized campaigns and activity still looks strong, that’s a genuinely healthy signal.

Step 4: Evaluate competitive landscape and moats

Real‑world utility doesn’t exist in isolation; you also need to know whether ten other projects are doing the same thing better. A rational crypto fundamental analysis guide for beginners suggests asking: “Why this token and not a competitor?” Look at switching costs, integrations, and developer ecosystems. A lending protocol that’s integrated with a dozen major DeFi apps, has $2–3B in sticky TVL and is used as collateral across chains has far stronger network effects than a clone with $30M in TVL and no integrations. Likewise, L1 or L2 chains with many production dApps and live enterprise pilots have stronger moats than chains that mainly host meme coins and speculative NFTs with no recurring usage.

Case study: Real‑world assets (RWAs) and payments

Some of the clearest examples of best crypto tokens with real world use cases have come from stablecoins, payment networks, and RWA platforms. Between 2020 and 2024, stablecoin on‑chain volume frequently surpassed $1–2 trillion per quarter, with USDC and USDT acting as de facto rails for cross‑border transfers and DeFi liquidity. People and businesses used them because they were cheaper and faster than banks. RWA protocols tokenizing U.S. Treasuries grew on‑chain T‑bill exposure to tens of billions of dollars by 2025, giving non‑U.S. holders access to dollar yields previously hard to reach. In these systems, demand for the underlying tokens is directly related to access to yield, compliance wrappers, and integration with CeFi and TradFi platforms, which you can actually measure.

Technical block: Moats, composability, and lock‑in

To judge long‑term demand, analyze moats in three technical dimensions. (1) Composability: how many other contracts or dApps depend on this protocol’s token or liquidity as a building block? Each dependency increases switching friction. (2) Data/network effects: oracles, identity graphs, and reputation systems become more valuable as more users and data feed into them, often making it difficult for a new entrant to replicate trust history. (3) Regulatory positioning: in 2025, KYC‑friendly and compliant RWA platforms enjoy a strategic advantage for institutional capital; check licenses, jurisdictions and third‑party audits, as they affect which large players can legally adopt the token and sustain demand over years.

Step 5: Governance, transparency, and execution risk

Even if a token has solid utility and growing demand, governance can make or break its future. Poorly designed DAOs can be captured by whales, make reckless treasury decisions, or under‑invest in development, all of which eventually show up in price. When following any how to evaluate crypto token utility checklist, include a non‑technical question: “Who is really in control here, and how have they behaved over the last two years?” Read past governance proposals, check how many wallets actually vote, and whether the core team responds to critical issues promptly. Projects that survived the bear market usually did so because teams adapted tokenomics, cut unnecessary incentives, and prioritized sustainability over short‑term pumps.

Red flags that beginners often miss

Beginners tend to over‑weight charismatic founders and under‑weight structural risks. Watch out for opaque multisig wallets controlling large treasuries, frequent proposal changes to unlock team tokens faster, and over‑centralized infrastructure (single sequencer, single oracle provider, non‑upgradable contracts controlled by one company). In 2022–2023 several “decentralized” projects halted their chains after exploits or market crashes, revealing that safety guarantees were marketing more than reality. Strong governance frameworks specify in advance how emergencies are handled, how upgrades are approved, and how minority token holders can contest or exit if they disagree with changes.

Technical block: On‑chain governance metrics

Quantitative governance health checks: (1) Voter concentration: if the top 5 addresses control >50–60% of voting power, governance is effectively centralized. (2) Participation rate: sustainable systems tend to have 10–20% of circulating voting power participating in major proposals; <1–2% indicates apathy. (3) Proposal throughput: too many proposals that never pass often signal chaos, whereas zero proposals for months can mean stagnation. Many explorers and analytics platforms now expose these metrics directly, allowing you to factor “governance quality” into your investment thesis instead of treating it as an afterthought.

Putting it all together: a simple workflow for beginners

If you’re looking for a practical beginner guide to researching crypto projects before investing, build a simple repeatable workflow. Start with the story: what problem, for whom, and why crypto is the right tool. Move to tokenomics: supply, emissions, who gets what, and how revenue reaches token holders. Then check demand: active users, fees, TVL, and growth trends from analytics dashboards. Layer on competitive context: are there entrenched rivals, unique partnerships, or hard‑to‑replicate integrations? Finally, review governance and execution: track record, transparency, and responsiveness under stress. Even if you only spend 30–60 minutes per project, this structure will filter out 80–90% of low‑quality tokens that depend purely on hype.

Example: Walking through a hypothetical project

Imagine a new L2 that promises “AI‑enhanced DeFi” and a token that “powers the ecosystem.” Applying this workflow, you’d first notice the vague problem statement and lack of real users. Tokenomics reveal 45% of supply allocated to team and investors, with aggressive unlocks starting three months after TGE. On‑chain metrics show most activity is testnet farming, and mainnet has fewer than 1,000 daily active users and negligible fees. Competition analysis shows half a dozen existing L2s with deeper liquidity and proven throughput. Governance docs are thin, multisig signers are anonymous, and no audits are published. You don’t need advanced math to conclude that long‑term demand is extremely unlikely to match the fully‑diluted valuation being marketed.

Technical block: Building your personal “go/no‑go” checklist

To avoid analysis paralysis, formalize your process into a checklist with numeric thresholds. For instance, require at least six months of live mainnet data, positive fee trend over three consecutive quarters, no more than 40% of supply controlled by insiders, and a clear route for token value capture you can draw as a flow diagram. As you gain experience, you can refine the weights: some investors care more about cash‑flow potential, others about strategic positioning. The point is to remove as much emotion as possible and let a consistent framework guide your decisions, especially when social media sentiment is extremely bullish or bearish.

Outlook to 2030: How token utility and demand will evolve

Looking ahead from 2025, the bar for token design is rising quickly. Regulators in the U.S., EU, and Asia are distinguishing more clearly between payment tokens, securities, and pure utility tokens, pushing projects to justify why a token exists beyond fundraising. Over the next five years, you can expect more tokens to represent real‑world assets (equity, credit, IP, commodities), with on‑chain cash flows audited in near real time. That will make valuation more like traditional finance: discounted cash flow models, sector multiples, and standardized reporting. At the same time, consumer‑facing apps in gaming, creator economies, and micro‑payments will abstract away most wallet complexity, so users may not even know which chain they’re on—only that holding or staking a token unlocks specific benefits, discounts or governance rights.

Emerging trends that will shape demand

Three big trends are likely to dominate. First, restaking and shared security will tie many smaller app‑chains and services into a handful of large base tokens, concentrating economic security and, therefore, demand in those assets. Second, state‑level and corporate adoption of tokenized deposits and stablecoins will normalize crypto rails for millions of users who don’t identify as “crypto natives,” steadily increasing baseline demand for infrastructure tokens that secure these payments. Third, data and AI markets may increasingly use tokens to meter access to proprietary datasets or model inference, which could create entirely new categories of utility tokens tied directly to bandwidth and compute usage rather than speculative narratives.

What this means for beginners entering now

For someone starting in 2025, the upside is that information is more available and tools are better, but competition is tougher and obvious inefficiencies close faster. Learning how to evaluate crypto token utility and real demand is no longer optional if you want to survive multiple market cycles; it’s the baseline skill set. Focus on projects where you can clearly see who the users are, what they pay for, and how that payment flows back to the token. If you keep grounding your decisions in measurable utility and demand instead of noise, you’ll be aligned with where the crypto space is actually heading—not just where the loudest narratives are pointing this week.