Why cross-chain liquidity is both powerful and dangerous in 2025

If you’re active in crypto in 2025, you’re almost guaranteed to use cross‑chain bridges or liquidity layers, even if you don’t realize it. Apps quietly route swaps through bridge aggregators, restaking layers secure multiple networks, and rollups need to move value back and forth all the time. That convenience comes with real complexity: fragmented liquidity, opaque security models and, frankly, a long history of catastrophic bridge hacks. Navigating this landscape safely is less about memorizing one “best practice” and more about understanding how these systems actually move your assets under the hood, so you can judge risk instead of trusting marketing claims.

The basic mental model: what actually happens when you bridge

Most bridges don’t literally “send” your coins from one chain to another. Instead, one of two things usually happens. Either your assets are locked in a contract on the source chain and a synthetic or wrapped representation is minted on the destination chain, or there is a liquidity pool on both sides and your tokens are effectively swapped: you deposit token A on chain X, and someone else’s token A (or an equivalent asset) is released to you on chain Y. When people ask how to transfer crypto between blockchains safely, what they’re really asking is how to choose among these implementation models without exposing themselves to unnecessary contract risk, validator collusion, or economic attacks that can drain those pools.

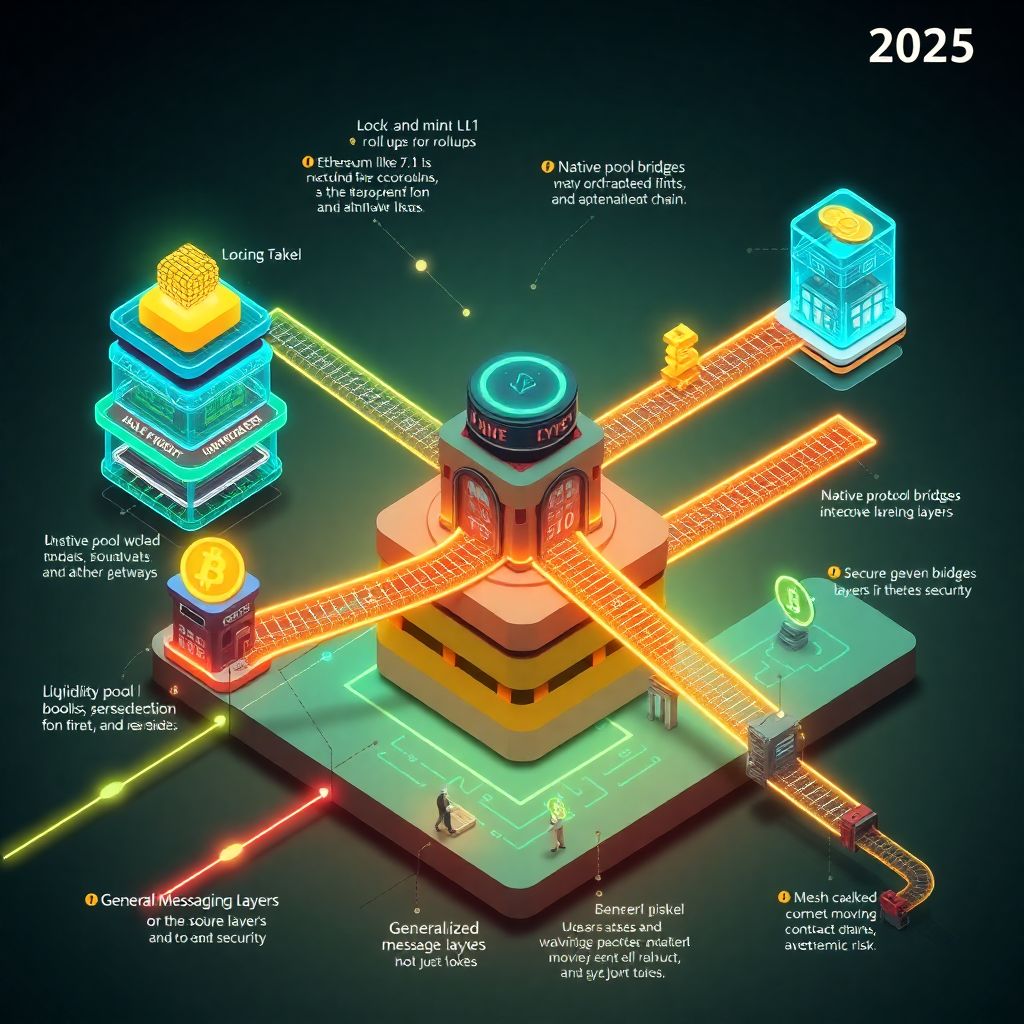

Main approaches to cross-chain bridges and liquidity

1. Lock‑and‑mint bridges (wrapped assets)

In a classic lock‑and‑mint bridge, you send token X on chain A to a bridge contract, which locks it. The bridge’s off‑chain or on‑chain consensus mechanism then authorizes the minting of a wrapped version of X on chain B. This is how early wrapped BTC models worked and how many generic message‑passing bridges still operate. The security model is highly concentrated: if the contract holding locked assets or the bridge’s validator set is compromised, the backing collateral can be drained while wrapped tokens remain in circulation, effectively becoming unbacked IOUs. The upside is high capital efficiency, because the bridge does not require pre‑provisioned liquidity on every chain pair and can support many assets quickly.

2. Liquidity pool–based bridges (AMM or orderbook style)

Liquidity bridges rely on pools of assets that are pre‑deposited on both chains. When you bridge, you are really doing a cross‑chain swap: you give up token X on chain A and receive token X (or an equivalent asset) from the destination pool on chain B. The bridge tracks pool balances and may rebalance using arbitrage or incentives. This design spreads risk: there is less reliance on a huge honeypot of locked collateral, but the pool contracts and the off‑chain coordination logic are still critical attack surfaces. For traders, this model tends to give more predictable execution and easier ways to compare cross-chain bridges fees and speed, since slippage and gas costs are visible and can be modeled.

3. Native bridge and canonical gateway designs

Some ecosystems like Ethereum and major L2s use “native” bridges defined at the protocol or rollup level. These leverage light clients, fraud proofs, or validity proofs to verify cross‑chain messages. In rollup‑to‑L1 bridges, for example, the main risk is often economic (liquidity while you wait for challenge or proof windows) rather than a third‑party multisig. Native designs typically serve as the reference implementation that other aggregators build on top of; they are not always user‑friendly or fast, but they are usually the most robust from a pure trust‑assumption standpoint, because they inherit security directly from the underlying consensus rather than from a separate validator set.

4. Interoperability protocols and “generalized” messaging layers

A newer trend is generalized cross‑chain messaging: instead of just moving tokens, these systems pass arbitrary instructions between chains. Token bridging becomes just one use case of a more flexible message bus. This adds expressive power but also enlarges the attack surface, because bugs in message verification or misconfigured contracts on any connected chain can have cascading effects. These protocols often run their own validators, or integrate with restaked security networks, creating a shared security layer that many dApps depend on. In 2025, a lot of cross‑chain liquidity is actually routed over such generalized systems, even when the UI just shows a “bridge” button.

Security trade‑offs and where things usually break

Smart‑contract risk and upgrade powers

Most historical bridge exploits did not involve exotic cryptography; they were simple contract logic bugs, missing access controls, or overly powerful admin keys. When evaluating cross-chain bridge security risks and protection, look first at the governance model: who can upgrade the bridge, pause it, or move funds? A non‑upgradable contract with fully on‑chain light‑client verification is the gold standard from a security purist’s perspective, but in practice many production bridges use upgradable proxies and guardians to react to emergencies. That flexibility is a double‑edged sword: it allows patching bugs quickly, but it also creates a centralized point of failure if a small group controls the keys or if key management practices are weak.

Validator sets, oracles and trust assumptions

For off‑chain or semi‑off‑chain bridges, you are trusting a validator set or oracle framework to correctly attest that an event happened on the source chain. If a threshold of validators colludes, is bribed, or gets compromised, they can forge messages and steal funds. Some networks mitigate this through economic security: validators must stake a large amount of value that can be slashed for misbehavior. Others rely on social trust or reputational moats. When you evaluate the best cross-chain bridge for crypto from a security standpoint, ask what the economic cost of corruption is: how much would an attacker need to spend or control to realistically override the system and exfiltrate assets at scale?

Liquidity, slippage and MEV‑driven execution risk

Even if the core security is solid, user experience can be degraded by low liquidity, high slippage and MEV extraction. Bridges that depend on third‑party market‑makers or AMMs can have volatile pricing, especially for long‑tail assets. In 2025, sophisticated searchers monitor cross‑chain flows to arbitrage or back‑run bridge transactions. Poorly designed routing might expose you to unfavorable rates or stuck transactions if liquidity dries up mid‑route. Secure cross-chain liquidity solutions therefore need not only sound verification but also robust mechanisms for rebalancing pools and protecting users from predatory execution, such as quote guarantees, sub‑account routing or integrated slippage protections.

How to choose a bridge or liquidity layer in practice

Key criteria for everyday users and power users

Picking a bridge isn’t just about the brand name. It’s a multi‑dimensional decision where you trade off security assumptions, UX, cost and speed. At a minimum, analyze the underlying mechanism (native, lock‑and‑mint, liquidity pool, generalized messaging), the maturity and audit history of the codebase, and how decentralized the validator or guardian set really is. Also, inspect whether the wrapped or bridged asset you receive is widely accepted: some DeFi protocols only trust canonical assets, while others accept multiple wrapped versions, which can fragment liquidity and introduce subtle risks if one wrapper loses backing.

Step‑by‑step checklist for safer cross‑chain moves

1. Identify the true origin and destination assets, not just the tickers. Check whether the token you’ll receive is canonical, wrapped, or a synthetic representation and who controls its minting.

2. Research the bridge’s security model. Look for recent audits, public post‑mortems, and whether they disclose incident response plans or bug bounties.

3. Evaluate the trust assumptions. Understand who runs validators or guardians, how they are chosen, and what on‑chain or social mechanisms can punish misbehavior.

4. Compare UX trade‑offs. Some bridges are slower but safer (e.g., native rollup exits), while others offer instant liquidity via market‑makers. Choose according to size and urgency of your transfer.

5. Simulate the transfer with a small amount. Before moving serious capital, test routing, fees, and confirmations end‑to‑end to see whether reality matches the marketing.

Reading between the lines of audits and marketing claims

Audits are necessary but not sufficient. A single audit report from a small firm on a rapidly changing codebase offers limited assurance; you want to see multiple independent reviews, formal verification where relevant, and a public culture of disclosing and fixing issues. Marketing materials that aggressively advertise TVL and speed while downplaying governance and upgrade powers are a red flag. When you see claims about being the “most decentralized” or the “safest,” try to map those claims back to verifiable facts: are contracts verified on‑chain, are governance processes transparent, and is there a documented history of handling real‑world incidents responsibly?

Economics of fees, latency and route selection

Cost components you actually pay when bridging

Users often focus on headline fees and ignore hidden costs. Your total cost includes gas on the source and destination chains, protocol fees, potential MEV slippage, and sometimes dynamic premiums for fast liquidity. That’s why it’s crucial to compare cross-chain bridges fees and speed as a combined metric rather than just looking at a percentage fee. A route that appears cheaper on fees might force you through illiquid pools with significant price impact, while a slightly more expensive route with deeper liquidity yields a better effective rate after execution. Aggregators can help, but they themselves introduce routing logic risk and additional smart‑contract exposure.

Speed vs. finality and why “instant” is not always better

Speed in cross‑chain systems is constrained by finality assumptions. Native bridges often require waiting for economic or cryptographic finality, which can take minutes to hours, especially when fraud‑proof windows are involved. Liquidity providers offering “instant bridging” are essentially taking the finality risk on your behalf in exchange for a yield spread. This is not inherently bad, but it means you’re trusting their balance sheet and risk‑management controls. For large transfers, many institutions in 2025 knowingly prefer slower, more direct routes that align with L1 consensus, rather than outsourcing finality risk to under‑capitalized middlemen chasing volume.

Concrete strategies for safer cross‑chain usage

Risk‑tiering your transfers

Treat cross‑chain moves as a spectrum, not a binary yes/no. For small experimental transfers, it can be reasonable to use faster, more convenient routes with slightly weaker guarantees, as long as the contracts are well‑known and battle‑tested. For significant size—anything that would materially hurt you if lost—stick to bridges that inherit security from major L1s or canonical protocol bridges wherever possible, even if that means accepting longer wait times and slightly higher gas costs. Combine this with basic hygiene: use hardware wallets, verify contract addresses from multiple sources, and never follow bridge links from random social media posts.

Institutional practices trickling down to advanced users

In 2025, institutional players that manage cross‑chain liquidity typically implement layered controls: policy‑based wallets, multisig approvals for large transfers, on‑chain allowlists of approved bridges, and continuous monitoring for abnormal flows. Advanced retail users can adopt lighter versions of these patterns: maintain a shortlist of vetted bridges, separate wallets by risk level, and keep logs of large transfers with transaction hashes and route details. Over time, we’re seeing more wallets and portfolio managers bake in these institutional patterns as configurable policies, so the user doesn’t have to manually enforce every rule.

Current trends in 2025: convergence, restaking and shared security

Rise of liquidity and bridge aggregators

One major shift by 2025 is that most users no longer interact with a single bridge directly. Instead, dApps and wallets route through aggregators that query multiple bridges, estimate rates and risk, and pick a path. This is convenient but also concentrates systemic risk: a bug or mis‑configuration in a popular aggregator can propagate to many end‑users at once. On the other hand, aggregators are in a good position to encode best practices, like blacklisting compromised routes or throttling exposure to newly deployed contracts. From a security perspective, this adds a meta‑layer you need to consider: you are now trusting both the aggregator and the underlying bridges.

Restaking‑based security and modular interoperability

Restaking frameworks have become a core building block for secure cross-chain liquidity solutions in 2025. Validators can opt in to secure multiple cross‑chain protocols with the same staked capital, earning extra yield but also taking on more slashing risk. For users, this can be positive if it meaningfully raises the economic cost of corrupting a bridge; however, it also couples the fate of many protocols together. A critical bug or governance failure in the restaking layer could affect multiple bridges at once. The modular trend—separating execution, settlement, and data availability—extends to interoperability: you might see one layer handling message verification, another handling routing, and yet another managing liquidity incentives.

Regulatory and compliance‑aware routing

Regulators are paying far more attention to cross‑chain flows than in earlier cycles, especially where bridges have been used for laundering hacked funds. Some 2025‑era bridges integrate on‑chain compliance tools, risk scoring, or blacklist propagation mechanisms. That may limit permissionless access in some cases but also makes these routes more palatable for institutional capital. Over the next few years, expect a divergence between fully permissionless bridges focused on censorship‑resistance and semi‑permissioned ones optimized for compliant capital and fiat on/off‑ramps. Your choice of route will increasingly encode a stance on these trade‑offs.

Looking ahead: the next phase for cross‑chain liquidity

Consolidation and “hidden” interoperability

Over the next three to five years, the average user is likely to see less of bridging directly. As UX improves, wallets and dApps will abstract away chains entirely, presenting a single balance and executing cross‑chain steps behind the scenes. The underlying infrastructure will likely consolidate around a handful of high‑assurance interoperability layers plus niche specialized bridges for certain ecosystems. Because of that abstraction, security incidents may become more systemic: a failure in a dominant interoperability layer could ripple across hundreds of apps that all assumed it was safe. The best defense will be architectural redundancy and explicit diversification across multiple message and liquidity layers.

Better formal verification, standardization and insurance

The tooling for formally verifying cross‑chain protocols is getting more mature. By 2030, it’s plausible that serious bridges will ship with machine‑checked proofs for core properties like “no mint without lock” or “no message finality without sufficient stake.” Industry standards for bridge interfaces, message formats, and security disclosures are also emerging, making it easier for developers and auditors to reason about complex systems. On top of this, we’re already seeing parametric insurance products and on‑chain coverage markets specifically targeting bridge risk, which could allow users and protocols to offload some tail risk in a transparent way instead of relying purely on informal social backstops.

Putting it all together

Navigating the complexities of cross‑chain liquidity safely in 2025 is less about finding a magical “safe” bridge and more about developing a clear mental model of how different designs work, what they assume, and how they can fail. If you understand whether you’re using a native bridge, a lock‑and‑mint wrapper, a liquidity pool, or a generalized message bus, you can map that to concrete risks: contract bugs, validator collusion, economic imbalances, or governance capture. From there, you can make informed trade‑offs on each transfer, size your exposure, and pick routes that match your risk tolerance and time horizon. The ecosystem is evolving toward deeper abstraction and shared security; those trends will make cross‑chain usage smoother, but they also raise the stakes. Staying safe means treating interoperability as critical infrastructure, not a black box, and continually revisiting your assumptions as the technology and its threat landscape keep changing.