Why safety matters more than APY in 2025

If you’re new to crypto, lending platforms can look incredibly tempting.

“Deposit USDC, earn 8% APY, no lockup.” In a world where your bank gives you 1–2%, that sounds like free money.

But after Celsius, BlockFi, Voyager and FTX all blew up between 2022–2023, we learned the hard way: high yield without real risk control is just slow-motion disaster.

This crypto lending platform safety guide for beginners is about one thing: helping you avoid being exit-liquidity for someone else’s reckless bets — and still earn reasonable yield.

We’ll walk through how to choose a secure crypto lending platform, what red flags to avoid, and where this whole space is heading by 2030.

—

What “crypto lending” really is (minus the marketing)

In plain language, crypto lending platforms do one or more of these:

1. Take your crypto deposits

2. Lend them out to:

– Traders (margin, leverage, arbitrage)

– Institutions (market makers, funds)

– Smart contracts / DeFi strategies

3. Earn interest or trading fees

4. Give you a slice of that income as yield

The danger: you are effectively an unsecured creditor for most centralized platforms. If they blow up, you stand in line in bankruptcy court, hoping to get cents on the dollar. That’s exactly what happened with Celsius and BlockFi.

So when you look for the *best safe crypto lending platforms*, don’t start with APY. Start with one question:

> “If everything goes wrong at this company, what happens to my money?”

If the answer is vague, you walk.

—

Step-by-step: how to evaluate risk of crypto lending platforms

Let’s go through a practical checklist you can actually apply.

You don’t need to be a lawyer or a quant. Just methodical.

1. Who exactly are you dealing with?

Before you send a single USDT, you want to know:

– Legal entity: Full company name, registration number, jurisdiction

– Team: Real people with real names, LinkedIn, past track record

– History: How long in business? Survived 2022–2023? Any hacks or insolvencies?

Platforms that survived the big blowups and didn’t halt withdrawals during market stress deserve extra points. For example, some conservative lenders in 2022 capped yields at 4–6% on stablecoins, refused to lend to 3AC-style funds, and as a result kept withdrawals open 24/7 while competitors locked users in.

Red flags:

– Only a brand name, no legal entity

– Anonymous founders for a centralized service

– No office, no real-world presence, just a Twitter account and a Telegram group

If you can’t figure out who could be sued if things go south, assume no one will be held responsible.

—

2. Regulation, licenses and legal protections

Not all regulation is equal, but some is better than none.

Look for:

– Registration as a Virtual Asset Service Provider (VASP) or equivalent

– Local securities / lending licenses where relevant

– Clear statement whether your account is:

– Custodial (they hold assets for you)

– A loan (you lend them funds)

– An investment product (may be treated as a security)

In 2025, a few jurisdictions — Singapore, EU (MiCA), Hong Kong, UAE — have decent frameworks for crypto businesses. If a platform is based in a loosely regulated offshore haven and targets beginners with high yields, be extra skeptical.

Also check:

– Do they allow US customers? If not, why?

– Have they settled or are they fighting with regulators (like BlockFi vs SEC in 2021)?

Reality check:

Regulation does not make a platform automatically safe. Celsius had licenses too. But lack of any visible oversight is a big downside, especially if you’re hunting the safest crypto interest accounts for beginners.

—

Technical detail: what to check in terms & conditions

Look specifically for clauses about:

– Ownership of assets – Do you retain title or are you “lending” to them?

– Use of collateral – Can they rehypothecate (re-lend) your coins?

– Priority in bankruptcy – Are you senior, junior, or just another unsecured creditor?

– Right to halt withdrawals – Under what conditions can they freeze your account?

If the document literally says “We can use, pledge, rehypothecate your assets for our own purposes,” you’re not using a savings account. You’re funding a hedge fund.

—

3. Transparency of reserves and lending book

The central question: Do they have the assets they claim to have, and how are they deployed?

What you want to see:

– Regular proof-of-reserves (PoR) audits by a real firm

– Ideally proof-of-liabilities too (so they can’t hide debt while showing full wallets)

– Clear breakdown:

– X% in cold storage

– Y% lent to institutions

– Z% used as liquidity on exchanges / DeFi

Since late 2023, better platforms publish Merkle tree PoR where you can independently verify your account is included in the audited snapshot. Some even publish on-chain addresses for main reserves.

Red flags:

– “We’re working on a proof-of-reserves solution” for years

– One-time attestation from 2022, nothing since

– Auditor no one has heard of, no report download, only a blog summary

If they can’t prove assets and liabilities in a verifiable way, assume the worst-case scenario.

—

Technical detail: why PoR without PoL is not enough

– Proof of reserves (PoR) shows: “We control X BTC, Y ETH, Z USDC.”

– Proof of liabilities (PoL) shows: “We owe clients A BTC, B ETH, C USDC.”

Without PoL, a platform could borrow coins right before the snapshot, show big reserves, then return them later — exactly what some exchanges did before collapsing.

In 2025, the more serious players use:

– On-chain wallets with signed messages

– Merkle trees for anonymized user balances

– Third-party auditors verifying both sides of the balance sheet

—

4. How is the yield generated, exactly?

If a platform offers:

– 10–20% APY on stablecoins in 2025

– With no lockup, no explanation, and “low risk” language

…that’s not income, that’s bait.

Ask:

– Who borrows the funds? Market makers? Traders? DeFi protocols?

– Are loans overcollateralized? By how much?

– Are they doing directional bets (e.g., long BTC with leverage), or mostly arbitrage / market-making strategies?

Reasonable numbers in the current environment (early–mid 2025):

– Stablecoins (USDC/USDT): 3–7% APY on conservative platforms

– BTC/ETH: 1–4% APY, sometimes more if lent to margin traders

– Anything above ~8–10% consistently for “low risk” products needs a detailed, believable explanation.

Real-world example pattern from 2020–2022:

– Platforms offering 3–6% on stablecoins: mostly survived

– Platforms offering 12–20%+ without clarity: many imploded or froze withdrawals

High yield is not automatically bad — but it must be traceable to a credible strategy.

—

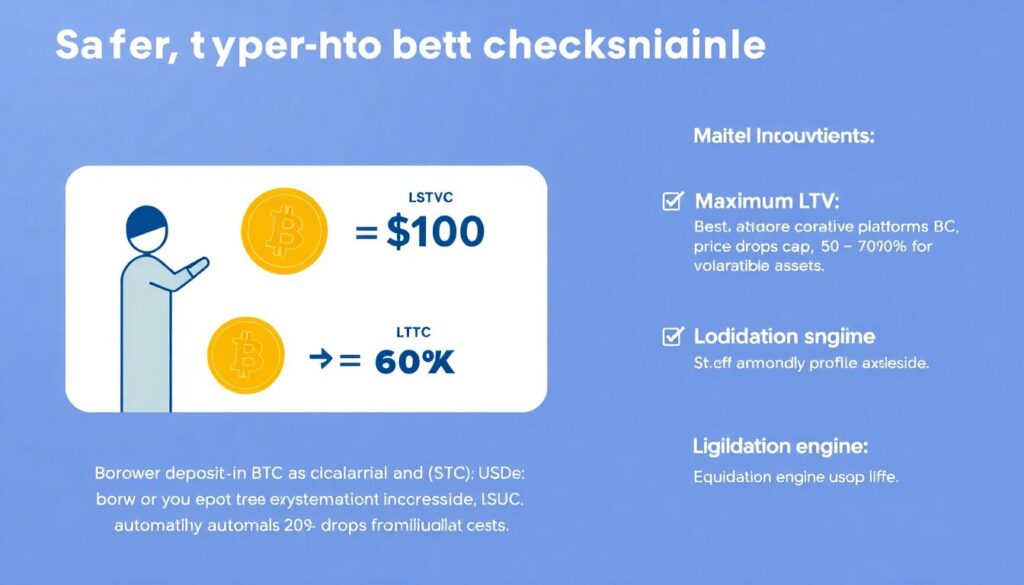

Technical detail: overcollateralization and LTV

Safer lending models usually rely on overcollateralized loans:

– Borrower deposits $150 in BTC

– Borrows $100 in USDC (Loan-to-Value, LTV = 66%)

– If BTC price drops, system auto-liquidates collateral

Check:

– Maximum LTV: conservative platforms cap at 50–70% for volatile assets

– Liquidation engine: is it on-chain (DeFi) or internal (CeFi)?

– Stress testing: any evidence they simulate 40–60% daily drops?

If they allow 80–90% LTV on altcoins, that’s begging for trouble in a crash.

—

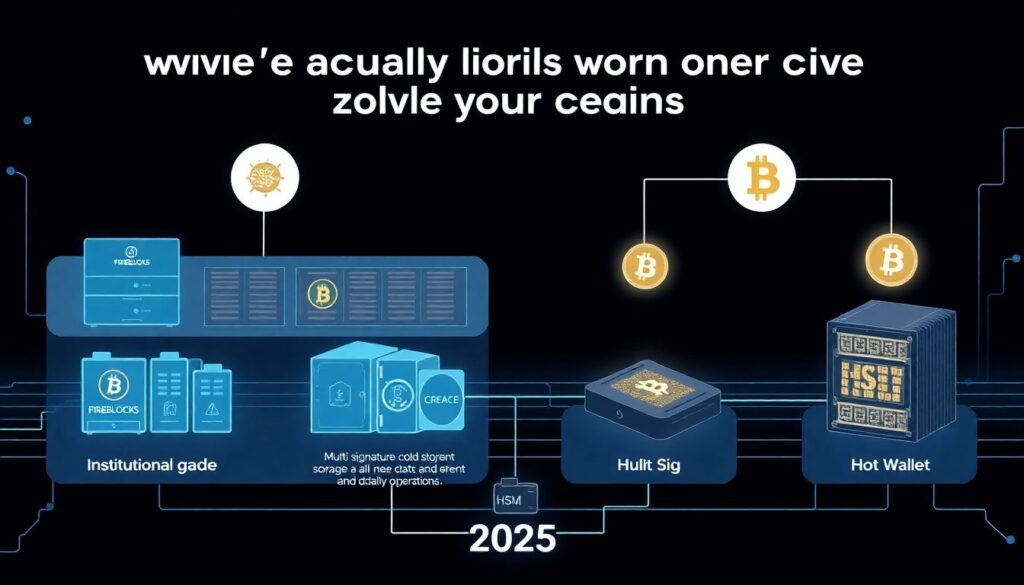

5. Custody, security and insurance

Who actually holds your coins, and how secure is that setup?

Better setups in 2025 usually involve:

– Institutional-grade custodians (e.g., Fireblocks, Copper, etc.)

– Multi‑sig cold storage for most assets

– Hot wallet only for active withdrawals and operations

– Hardware Security Modules (HSMs) and strict internal controls

Insurance is often oversold. Look for:

– What exactly is insured? Theft? Hacking? Insider fraud?

– Maximum coverage (e.g., “$100M crime policy”) vs. total client assets (maybe several billions)

– Does the policy name the platform or just the custodian?

You should treat “We are insured” as a nice bonus, not a guarantee.

—

Centralized vs DeFi lending: different risks

By 2025, many beginners split assets between:

– Centralized lending platforms (CeFi) – apps and websites, KYC, support

– DeFi lending protocols (on-chain) – Aave, Compound, Spark, etc.

Each has its own risk profile.

CeFi: business and governance risk

Pros:

– Simpler UX, mobile apps, fiat on-ramps

– Customer support, some regulatory oversight

– Often clearer tax reports

Cons:

– You rely on a company’s honesty and risk management

– Opaque books if no strong PoR/PoL

– Bankruptcy risk where you’re an unsecured creditor

The BlockFi and Celsius collapses were not smart contract bugs — they were human and governance failures: poor risk controls, rehypothecation, leverage, concentration in a few risky borrowers.

—

DeFi: smart contract and protocol risk

Pros:

– On-chain, transparent collateral and loan positions

– No KYC on most protocols

– Often real-time visibility into reserves and utilization

Cons:

– Smart contract bugs or governance exploits

– Oracle manipulation attacks (price feeds)

– User error: wrong network, wrong contract, phishing

The big protocols like Aave and Compound have survived multiple cycles, audits, and billions in volume. Still, exploits in smaller protocols and yield farms routinely cost users millions.

If you’re comparing how to choose a secure crypto lending platform vs using DeFi, it often comes down to:

– Do you trust code and open governance more?

– Or do you prefer human support, even if it’s a new failure mode?

Many cautious users do a mix.

—

Technical detail: how to sanity-check a DeFi lending protocol

At a basic level, look at:

– Total Value Locked (TVL) – Larger TVL, longer history → generally more battle-tested

– Audit history – Who audited, when, any critical issues found/fixed?

– On-chain concentration – Are most deposits one or two whales?

– Collateral parameters – LTV, liquidation thresholds per asset

You don’t need to read Solidity, but you can check:

– Official docs and GitHub

– Governance forums (is there real discussion, or is it dead?)

– Whether the protocol is on multiple networks and how v2/v3 upgrades are handled

—

A simple 7‑point checklist for beginners

Use this 10‑minute process before sending funds anywhere:

1. Identity & track record

– Real company, real people, survived at least one major downturn.

2. Regulation & jurisdiction

– Some regulatory framework, clearly stated legal structure, no shady “international business company” mystery.

3. Reserves & liabilities transparency

– Ongoing proof-of-reserves and, ideally, proof-of-liabilities with named auditor.

4. Yield explanation

– Simple, understandable story of where returns come from, with realistic numbers for 2025.

5. Lending & collateral policies

– Overcollateralized loans, conservative LTVs, risk concentration limits.

6. Custody & security

– Reputable custodians, mostly cold storage, clear incident history, realistic (not magical) insurance.

7. Withdrawal behavior & user reports

– No history of unexplained withdrawal freezes, responsive support, honest status updates during market stress.

If a platform fails 2–3 of these points, it’s probably not among the best safe crypto lending platforms — no matter how slick the app looks.

—

Practical example: comparing two fictional platforms

Imagine you’re deciding between:

– Platform Alpha

– 5% APY on USDC

– 2.5% on BTC

– Based in EU, MiCA‑regulated VASP

– Monthly PoR/PoL, auditor reports downloadable

– Uses institutional custodian, max LTV 60%, no degen altcoin collateral

– Platform Beta

– 14% APY on USDC

– 9% on BTC

– Registered in a tiny offshore island

– No audits, only “we’re fully backed” marketing

– Unclear about borrowers, uses own hot wallets, allows 85% LTV on volatile tokens

Alpha is boring. Beta is exciting.

As 2022–2023 proved again and again, boring tends to pay you back, exciting tends to blow up.

—

How much to allocate, and from where?

Even the safest crypto interest accounts for beginners carry risk.

A reasonable approach in 2025:

– Keep emergency cash and essential savings in traditional banking or money‑market funds

– Use a small portion of your net worth (e.g., 5–15%) for crypto yield strategies

– Within that, diversify:

– Some in CeFi lending (conservative platforms)

– Some in DeFi blue-chip protocols

– Some simply in cold storage, no yield, just long-term holding

Never feel pressured to “optimize every satoshi.”

Zero yield with zero counterparty risk on part of your stack is a perfectly rational choice.

—

Red flags that should make you close the tab

Watch for:

– “Guaranteed return” language

– Referral programs that look like MLM (high payouts for bringing friends)

– Confusing “staking” terms for what is clearly unsecured lending

– No downside scenarios explained in docs

– APYs that do not change when market conditions obviously do

If a platform markets itself as one of the best safe crypto lending platforms but can’t explain how to evaluate risk of crypto lending platforms or how they handle black‑swan events, that mismatch is your warning.

—

Where crypto lending safety is heading (2025–2030)

To wrap up, let’s look forward. The landscape is shifting fast.

1. Regulation will get stricter, but clearer

By 2030:

– More countries will force platforms to separate custody, trading, and lending into distinct regulated entities (similar to traditional finance)

– Interest products will increasingly be treated as securities, with disclosure requirements

– Retail users may get investor protection schemes in some jurisdictions (limited coverage, but better than nothing)

This won’t kill crypto lending, but it will likely squeeze out the most reckless players.

—

2. Hybrid CeFi–DeFi models will dominate

We’re already seeing platforms in 2025 that:

– Use DeFi protocols (Aave, Compound, on-chain money markets)

– But wrap them in a friendly mobile app

– Provide KYC, tax docs, and fiat ramps on top

Under the hood, yield is on-chain, transparent and auditable.

On the surface, it feels like a normal fintech app.

For beginners, this may become the default: a CeFi interface with DeFi plumbing, giving you better visibility into what’s happening with your coins.

—

3. On-chain proofs become normal, not a nice-to-have

By the late 2020s, expect:

– Real-time dashboards showing:

– Platform reserves

– Active loans and collateralization metrics

– Liquidity buffers

– Independent monitoring services that watch dozens of platforms and issue risk scores in near real time

This will make how to choose a secure crypto lending platform much more data-driven and less trust-based.

—

4. Lower yields, but higher reliability

As the industry matures and more capital flows in:

– The easy arbitrage and “early adopter” premium shrinks

– Yields may come closer to traditional fixed-income plus a modest risk premium

– The focus shifts from “10%+ APY” to “2–5% you can actually depend on”

For long-term users, that’s a good trade: less drama, fewer bankruptcies, more boring income.

—

Final thoughts: safety is a habit, not a checkbox

Staying safe with lending platforms isn’t about finding “the one perfect place” and forgetting about it. It’s about:

– Questioning where yield comes from

– Reading the fine print at least once

– Watching how platforms behave during stress, not just bull markets

– Diversifying across custody types and counterparties

If you follow the checklist in this article, you’re already ahead of most newcomers who just chase numbers on the screen.

In 2025 and beyond, the platforms that win will be the ones that treat safety as a feature, not an afterthought — and the users who win will be the ones who treat risk evaluation as a routine, not a one-time task.