Most people look at an exchange and think, “Fees? Logo? Done.” Then they wonder why deposits take hours and withdrawals eat half the profit. This guide is about slowing down just enough to check how an exchange really treats your money when it goes in and out. We’ll keep the tone informal, but the goal is very practical: by the end, you should be able to open any exchange page and quickly judge whether it deserves your deposits and withdrawals at all.

Basic tools you actually need

To test a centralized exchange properly, you don’t need a PhD or a room of monitors. What you do need is a small toolkit: a non-custodial wallet where you control the seed phrase, a block explorer (like Etherscan, Blockchain.com or similar for the network you use), a simple spreadsheet or notes app, and a stable internet connection. With these, you can track how fast your deposits land, how quickly withdrawals get broadcast on-chain, and what fees you’re really paying. This is how you quietly do your own centralized exchange comparison deposits and withdrawals instead of trusting marketing slogans and random Twitter threads.

Besides tools, you’ll need a tiny “test budget” you’re prepared to lose if something goes wrong. Think of it as money spent on education: maybe $10–20 in a major coin like BTC, ETH, or USDT on the network you prefer. That amount is enough to send several small deposits and withdrawals to see where delays or hidden fees show up.

Step-by-step: from first deposit to full withdrawal

Start with research before sending anything. Look for whether the platform is regulated in any major jurisdiction, how long it has been operating, and whether it has a history of freezing accounts without explanation. When influencers say “this is the best centralized crypto exchange for beginners”, treat it as an opinion, not a fact. Go directly to the exchange’s help center and fee pages. Find three specific things: minimum deposit amounts for your chosen coin, deposit confirmation requirements (for example, “3 network confirmations”), and detailed withdrawal fees by network. If any of that is hard to find or buried under vague marketing copy, that’s already a red flag.

Once you like what you see on paper, test a tiny deposit. Copy the deposit address on the exchange, paste it into your wallet, and send the smallest reasonable amount. Do not rush to send everything. Watch the transaction on the block explorer: check the time it was broadcast, how many confirmations it needs, and the moment it appears as “credited” on the exchange. Note the actual minutes between “sent” and “available for trading”.

Now reverse the flow. After the deposit arrives, immediately ask for a small withdrawal back to your personal wallet. This is where exchanges quietly reveal their true nature. A crypto exchange with lowest withdrawal fees but extremely slow processing can be more expensive than a slightly pricier platform that sends funds out within minutes. Again, monitor the withdrawal on the block explorer. You’re looking for the delay between clicking “withdraw” and seeing the transaction broadcast on-chain, not just the time until it reaches your wallet. This helps you separate blockchain congestion from exchange-side delays.

If the first test went well, repeat with another network or another coin. For example, compare USDT on Ethereum vs USDT on a cheaper chain like Tron or an L2. You’ll quickly see why many people care more about fast and cheap withdrawals than about flashy interfaces. This hands-on cycle—research, tiny deposit, tiny withdrawal—is the practical core of how to choose a crypto exchange for safe deposits without gambling everything on the first try.

What to check beyond speed and fees

Speed and price matter, but they’re not the full story. Exchanges can be fast today and problematic tomorrow. Look at how clearly they communicate: do they have real-time status pages showing deposit and withdrawal issues? Are there clear warnings when a specific network is under maintenance? Scroll through recent community feedback: specific comments about “ETH withdrawals stuck for two days” or “LTC deposits disabled with no explanation” are more useful than generic praise. Also, test support in a low-stakes way: send a simple question about limits or KYC requirements and note how long it takes to get a coherent, human answer. That responsiveness becomes critical when something goes wrong with your funds.

Security-wise, pay attention to how many options you have: strong two-factor authentication, withdrawal address whitelisting, anti-phishing codes, login alerts. Top reliable crypto exchanges with fast withdrawals typically also push users towards these protections, because they know that speed without safety is a liability. If an exchange makes 2FA optional and never nudges you to enable it, that’s not a great sign.

Troubleshooting slow or failed deposits

When a deposit is “stuck”, start with the basics instead of panicking. Open the block explorer and confirm that the transaction actually exists and has enough confirmations for that network. If the explorer shows “unconfirmed” for a long time, it’s usually a network fee issue, not the exchange. If it’s fully confirmed on-chain but not visible in your exchange account, check whether you used the correct network and address type. For instance, sending coins to a BTC SegWit address when the exchange only supports legacy addresses can cause delays or even permanent loss. Misaligned networks are unfortunately common: sending USDT-ERC20 to a USDT-TRC20 address is a classic mistake that even experienced users make.

If everything appears correct but the deposit is missing for more than the usual timeframe (say, double the time of your earlier test), contact support and attach the transaction hash, timestamps, and screenshots. Having those details ready usually speeds up the response, because you’re showing you already did your homework.

Troubleshooting withdrawal problems

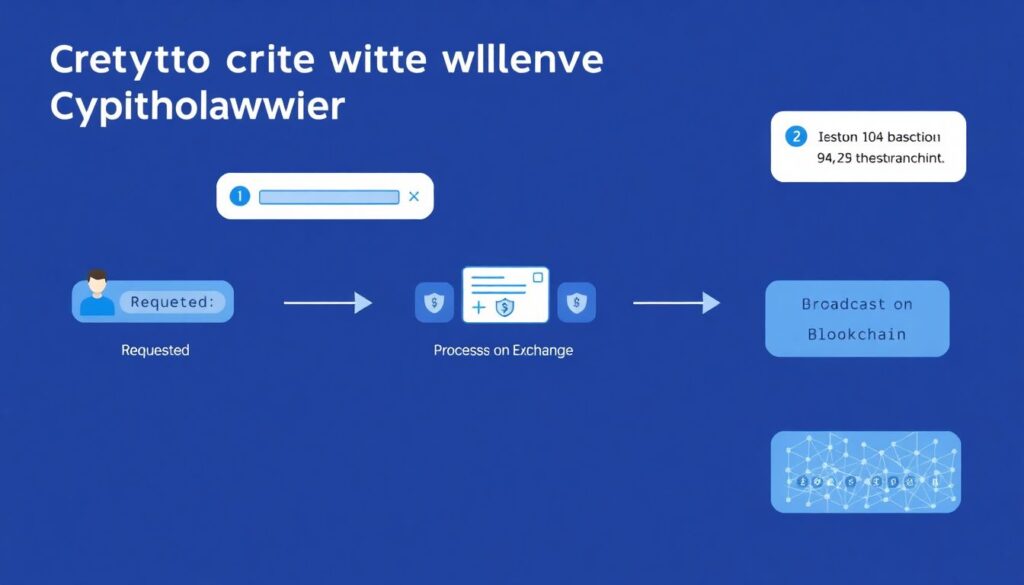

With withdrawals, always separate three stages: “requested”, “processing” on the exchange, and “broadcast” on the blockchain. If the transaction hash doesn’t exist yet, the delay is on the exchange’s side, often due to internal risk checks, manual reviews, or temporary withdrawal limits. That’s one reason to test with small sums first: you find out how aggressive their risk system is before moving serious capital. If the transaction is broadcast but stuck unconfirmed, it’s likely a low network fee or congested network; in this case, switching to another coin or network next time might be smarter than fighting support.

When a withdrawal fails or is cancelled, carefully read the explanation: sometimes you’ve hit a daily limit, sometimes KYC level is too low, and sometimes a specific region is blocked. Here again, your earlier research pays off. An exchange that clearly documents limits and shows transparent error messages is easier to work with than one that simply says “withdrawal failed, try later”. Over time you’ll build a mental shortlist of platforms whose behavior you can predict, effectively your own list of top reliable crypto exchanges with fast withdrawals instead of relying only on reviews.