Why crypto projects go wrong: a quick reality check

Before diving into crypto scams how to avoid them, it helps to understand why this space is so fragile. Crypto mixed open‑source code, anonymous teams and 24/7 global markets with almost no gatekeepers. That’s great for innovation, but it also means anyone can launch a token, write a flashy thread on X, pump the price and disappear. Early waves of ICOs in 2017, then DeFi and NFT manias, all followed the same pattern: hype, FOMO, weak risk controls, and poor basic due diligence from users. The goal isn’t to avoid crypto entirely, but to treat every new project like a tiny startup with no regulation and to test it as ruthlessly as a skeptical investor would.

Short historical backdrop: patterns that keep repeating

From Mt. Gox collapse to OneCoin, Bitconnect and countless rug pulls, the story is similar: asymmetric information and blind trust. In 2017 ICOs promised “Ethereum killers” with barely a whitepaper and collected billions. In 2020–2021, yield farming and algorithmic stablecoins offered unsustainable APYs until tokenomics imploded. Each cycle adds new jargon but recycles old strategies: ponzi-like referral schemes, insider pre‑mines, fake partnerships and forged audits. Understanding these historical episodes is practical, not academic: when you see the same mechanics reappear with a new narrative, alarms should go off. A mental library of past failures is one of the strongest defenses you can build as a retail participant.

Core principles: how to spot crypto scam projects early

When you think about how to spot crypto scam projects, break it into four buckets: people, code, incentives and market behavior. People: who is behind the project, can you verify identities, past work, and are they reachable outside Telegram? Code: is the smart contract open‑source, audited by known firms, and is upgradeability or admin control transparent? Incentives: does the token model make sense mathematically, or does it rely on endless new buyers? Market behavior: is volume organic or mostly from one exchange or suspicious wallets? Instead of trusting any single signal, you want confluence: multiple independent checks pointing in the same direction before you risk capital.

Operational checks you should actually perform

Treat every new protocol like untrusted software plus an unknown financial counterparty. Start with the basics: read the docs and whitepaper, but focus less on buzzwords and more on concrete mechanisms: where do yields come from, who holds admin keys, how are fees distributed? Look up the repository on GitHub or similar; empty or recently forked repos are a warning sign. Search the team members on LinkedIn, GitHub and previous projects; no digital footprint is not proof of fraud, but it sharply lowers your trust level. For safe cryptocurrency investments for beginners, size positions so a total loss wouldn’t damage your broader finances; curiosity is fine, but never confuse experimentation with long‑term savings.

Red flags checklist: quick mental filters

You don’t need to be a solidity engineer to apply basic filters. A few practical red flags you can run through in minutes:

– Guaranteed high returns, especially “risk‑free” yields well above market rates

– Vague or plagiarized whitepaper, heavy buzzwords without clear mechanism design

– Anonymous team plus no external audit plus time‑locked or opaque admin keys

– Sudden token listings, thin liquidity, and extreme price moves on low volume

– Heavy reliance on referrals, influencers, or “exclusive early access” marketing

Use these as “stop and slow down” triggers: not automatic proof of fraud, but strong signals to pause and investigate more deeply before committing funds or providing personal data.

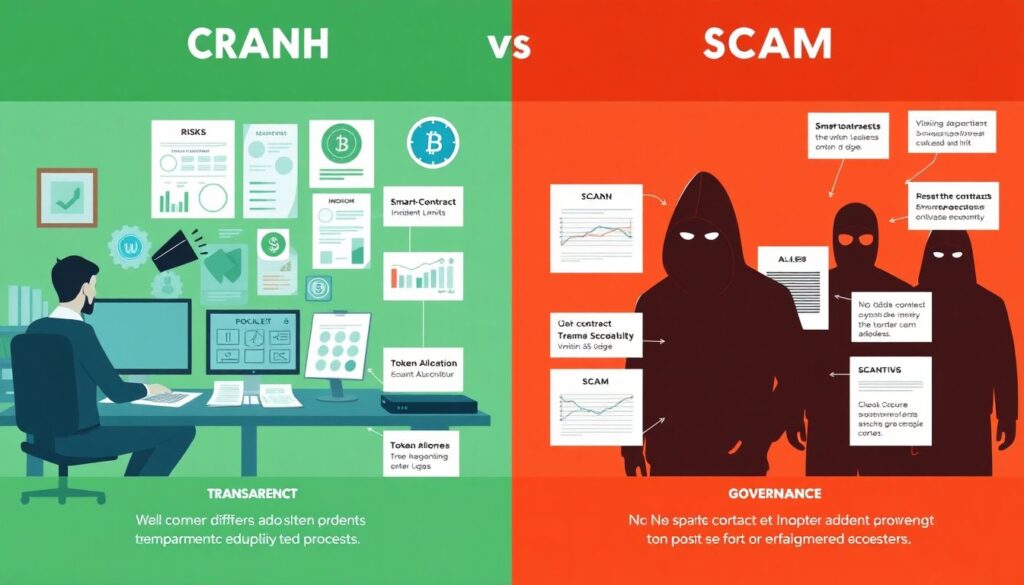

Legit crypto projects vs scams: concrete contrasts

Comparing legit crypto projects vs scams in practice helps more than abstract theory. Legit teams usually over‑explain risks, document smart‑contract limits and disclose prior incidents. They publish detailed token allocations, vesting schedules and governance processes; you can verify contract addresses independently. Scam projects, in contrast, optimize for narrative: slick websites, countdown timers, aggressive airdrop campaigns and influencer shilling but shallow technical content. When the market dips, serious projects keep communicating, ship updates and sometimes reduce promises. Low‑effort frauds go silent, delete channels, or pivot narratives overnight. Watching how a team behaves under stress is often more revealing than any static document or code audit.

Practical due diligence: step‑by‑step workflow

To make this usable, turn your research into a repeatable mini‑playbook you follow every time. Start with a five‑minute scan: website, docs, team, tokenomics overview, and contract link. If it passes, move to a deeper phase: read at least one full technical document, check explorers (Etherscan, etc.) for holder distribution, and look at on‑chain history of team wallets if public. Search independent reviews, not just sponsored content. Finally, simulate worst‑case scenarios: what happens if liquidity providers exit, if the token price halves, or if the oracle fails? If the project cannot survive basic stress tests on paper, it’s not your job to “give it a chance”; you can simply skip and preserve capital and attention for better setups.

Examples of common traps and how to sidestep them

Consider a typical “innovative yield” token that promises 500% APY. A closer look shows rewards are paid only in the same token, with no external revenue; it’s just inflation until new buyers stop arriving. Another pattern: “community presale” where you must send stablecoins to a wallet, with no immutable contract and no clear vesting, just screenshots from Telegram. Both are avoidable by enforcing a simple rule: if you can’t explain in plain language where returns originate and how funds are custodied, you don’t invest. Instead, reallocate that risk budget toward battle‑tested protocols where economics rely on real fees or clearly modeled incentives, not vague future adoption claims.

Misconceptions that quietly increase your risk

Several myths make people vulnerable without realizing it. One: “doxxed team means safe” — reality: many failed or malicious projects had fully public founders. Two: “audited means secure” — audits reduce risk but cannot guarantee absence of logic flaws, governance abuse or social engineering around the code. Three: “if big influencers or funds are in, it must be legit” — large players also chase momentum and can exit faster than you. For those chasing safe cryptocurrency investments for beginners, a healthier mindset is: nothing is truly safe here, only more or less understood; your job is to know what you’re betting on and cap downside in advance.

Crypto security tips for investors: personal hygiene

Beyond project analysis, your own operational security matters just as much. Use hardware wallets for meaningful sums and treat browser wallets as hot, expendable environments. Never sign blind transactions; always expand “data” in your wallet and check you’re not granting unlimited approvals to unknown contracts. Maintain separate wallets for experimentation and for longer‑term positions. Be extremely conservative with screen‑sharing, remote‑control tools, and files from strangers; much “support” in chats is social engineering. If you remember only one of these crypto security tips for investors, let it be this: assume every DM, link and airdrop is malicious until proven otherwise, not the other way around.

Pulling it together into a sustainable approach

Instead of hunting a secret formula for crypto scams how to avoid them, build a simple, repeatable system: small position sizes, strict research steps, strong wallet hygiene and a willingness to say “no” often. Think in terms of portfolio resilience: even if one bet fails completely, your overall capital and mental bandwidth stay intact. Over time you’ll recognize patterns faster; what once took hours of analysis will become an instinctive “pass” in minutes. And that’s the real edge in this market: not predicting the next 100x, but systematically filtering out landmines so that when you do find something worthwhile, you’re still in the game and able to act with clarity and confidence.