Why token distribution and holders matter more than the hype

When you look at a new coin, it’s tempting to focus on the logo, the narrative and the potential “x100”. But if you skip the boring part — who owns the tokens and how they’re spread — you’re basically flying blind.

Token distribution and holder structure tell you:

– Who can dump on you

– How much power insiders have

– How vulnerable the project is to manipulation

This is your beginner guide to assessing a token’s distribution and holders, in plain language and with practical steps — plus the common mistakes newbies keep repeating.

—

Key concepts: speak the same language as the data

What is token distribution?

Token distribution is simply how all existing tokens are split between wallets and groups of stakeholders: team, investors, community, treasury, exchanges, etc.

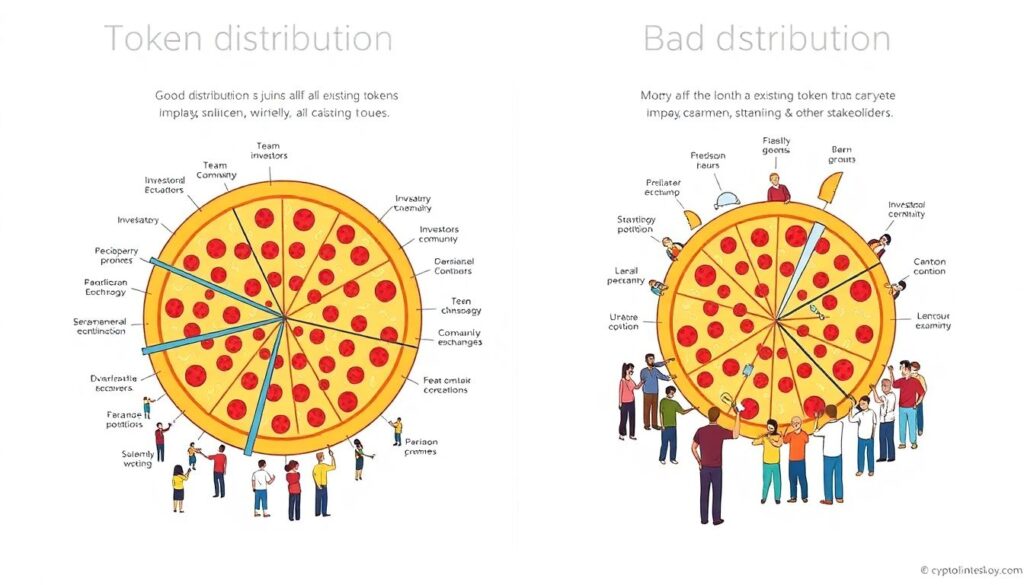

If you imagine all tokens as a pizza:

– Good distribution: pizza sliced into many pieces and shared widely.

– Bad distribution: three people are holding most of the pizza, and you’re fighting over crumbs.

Text diagram:

– Healthy setup

– Wallet A – 3%

– Wallet B – 2.5%

– Wallet C – 2%

– Many wallets with 0.1–0.5%

– Risky setup

– Team wallet – 35%

– Private sale – 30%

– Exchange wallet – 20%

– Public holders – 15%

You don’t need perfection. You do need to avoid obvious landmines.

—

Who are “holders” in practice?

Holders are all wallets that have a non-zero balance of a token. But not all holders are equal:

– Retail holders – regular users and small investors. Many small wallets.

– Whales – addresses with a large share, often >1–2% of supply.

– Team / foundation wallets – controlled by the project.

– CEX / exchange wallets – custodial wallets holding tokens for thousands of users.

– Smart contracts – liquidity pools, staking contracts, bridges and vaults.

Newbies often lump everything together as “oh, lots of holders, must be safe”. That’s a trap. You need to know *what type* of holder you’re looking at.

—

Locked, vested and circulating supply

You’ll constantly see these terms in dashboards and crypto token distribution analysis tools, so let’s define them clearly.

– Total supply – maximum number of tokens that can ever exist (according to contract).

– Circulating supply – tokens that are currently liquid and tradable on the market.

– Locked tokens – tokens that sit in smart contracts or wallets and cannot be moved (until some condition is met).

– Vested tokens – tokens gradually released over time, usually to team or investors.

If circulating supply is small and a huge chunk is locked for later, you must understand *when* those locks end. Otherwise you walk into a time-bomb.

—

Step 1: How to check crypto token holders before investing

Find the token contract and explore on-chain

First, you need the official token contract address. Get it from:

– The project’s official website or docs

– Their official X (Twitter), Discord, Telegram

– Reputable aggregators like CoinGecko or CoinMarketCap

Then open it in a blockchain explorer:

– Ethereum: Etherscan

– BNB Chain: BscScan

– Polygon: Polygonscan, etc.

On the token page, look for:

– “Holders” tab – list of all wallets and their balances.

– “Analytics / Token distribution” section – often shows charts or diagrams.

Newbie mistake #1:

Trusting any contract address from random tweets or messages. Always verify the address through multiple official sources before you even look at holders.

—

Read holder concentration like a human, not a robot

Once you’re on the “Holders” page, you’ll usually see a list like:

– Top 1 – 28%

– Top 2 – 16%

– Top 3 – 11%

– Top 10 – 70%

– Top 50 – 88%

Ask yourself:

– Are top wallets mostly contracts/exchanges, or unknown individuals?

– Does one address have a totally insane share (e.g. 50%+ of supply)?

– Are there many mid-sized holders (0.1–1%) or just a few giants plus tons of dust?

Numbers in isolation are useless. Think in terms of who can realistically crash the market with a sell.

Newbie mistake #2:

Panic when they see a big “holder” without realizing it’s just a DEX liquidity pool or a CEX wallet.

—

Step 2: Understanding whales and concentration risk

Spotting dangerous concentration

A few large holders can be okay if:

– They’re locked or vesting transparently.

– They belong to known entities (team, DAO treasury, exchange).

– There’s a clear tokenomics model explaining them.

Red flags:

– 1–3 unknown wallets holding >40–50% of circulating supply.

– Several new wallets funded from one main wallet (classic whale splitting).

– “Owner” or deployer wallet still controls a huge portion with no lock.

Text diagram: dangerous pattern

– Deployer wallet – 35%

– Wallet 0xabc… – 12% (funded from deployer)

– Wallet 0xdef… – 11% (funded from deployer)

– Wallet 0x123… – 10% (funded from deployer)

– Public float – the rest

This looks like “many whales”, but in reality it may be one whale pretending to be multiple holders.

—

Tools that make this easier

Instead of clicking around blindly, use crypto token distribution analysis tools that visualize holder concentration and label known wallets. Some dashboards:

– Combine on-chain data with tagging (exchanges, bridges, contracts).

– Show “Top 10 / Top 100 holders share”.

– Display charts over time (is one whale accumulating or exiting?).

You don’t have to become a data scientist. But regularly checking these charts before buying is a habit that saves you from obvious traps.

—

Step 3: Tokenomics and vesting – who gets what, and when

Reading tokenomics like an investor, not a fan

Tokenomics is the economic blueprint of the token: who gets tokens, how they’re released, and why they exist at all.

High-level categories:

– Team & advisors

– Private / seed investors

– Community / airdrops

– Ecosystem / grants

– Liquidity & market making

– Treasury / foundation

When people talk about the best tokenomics platforms for investors, they usually mean sites that:

– Parse token allocations from docs and on-chain.

– Show a release schedule over time.

– Warn about upcoming unlocks.

You want:

– Reasonable team allocation (often 10–20%, not 40–60%).

– Clear vesting (e.g. 1-year cliff, then linear over 3–4 years).

– Community and ecosystem not being totally sidelined.

Newbie mistake #3:

Getting excited because “circulating supply is small, huge upside!” — without realizing that 5–10x more tokens will hit the market over the next year.

—

Vesting schedules and unlock cliffs

Look for token unlock timelines in:

– Whitepaper / litepaper

– Docs section

– Official token announcements

Things to check:

– Are there big cliffs when a huge percentage unlocks at once?

– Are team and investors unlocking in sync with community growth, or much earlier?

– Are vesting contracts on-chain and verifiable, or just promises in a PDF?

Text diagram: scary unlock

– Month 0: 10% circulating

– Month 6: +20% team unlock

– Month 9: +20% private sale unlock

– Month 12: +30% ecosystem unlock

If you buy at Month 5, you’re potentially facing a wave of supply from people who paid less than you and are heavily in profit.

—

Step 4: Separating real users from technical addresses

Distinguishing exchanges, contracts and real wallets

On a holders page, you’ll usually see:

– Named exchanges (Binance, OKX, Coinbase, etc.)

– Unnamed big addresses (could be CEX, could be whale)

– Smart contracts (Uniswap pool, staking, bridge)

– Regular EOA wallets (end-user wallets)

Why this matters:

– Exchange wallets represent thousands of users, not one whale.

– Liquidity pools must hold many tokens; they’re not “whales” in the normal sense.

– Bridges can hold huge balances because they connect chains.

Tips:

– Check the address label in the explorer (often says “Binance 8”, “Uniswap V2: Pair”, etc.).

– For unlabeled addresses, inspect transaction history:

– Many small deposits and withdrawals → likely exchange or service

– Interacts with DEX router frequently → might be a liquidity pool

– Only a few large movements → more likely a whale or team wallet

Newbie mistake #4:

Calling a token “super centralized” because one “holder” has 25%, without noticing it’s literally the main CEX or primary DEX pool.

—

Using a token distribution tracker for new crypto projects

New tokens often don’t have many labels yet. A token distribution tracker for new crypto projects can help by:

– Tagging owner/deployer addresses.

– Flagging if trading is disabled/enabled.

– Showing how many wallets bought right after launch.

– Tracking whether the deployer is adding/removing liquidity.

For very early projects, pay extra attention to:

– Owner privileges (can the owner mint, pause trading, blacklist wallets?).

– Liquidity ownership (is liquidity locked, or can the team pull it?).

– Rapid concentration (a new address absorbing most tokens post-launch).

—

Step 5: Using platforms and dashboards like a pro

What to expect from analysis platforms

Modern analytics dashboards can speed up everything in this crypto due diligence guide token holder analysis. Many of them offer:

– Holder concentration charts:

– Top 1, 3, 10, 100 holders as % of supply.

– Distribution breakdown:

– Exchanges, contracts, team, treasury, whales, retail.

– Unlock / vesting timelines:

– Future supply increases.

– Alerts:

– Whale movements, large transfers, concentrated buying or selling.

That’s what people really mean when they search for crypto token distribution analysis tools – sites that hide the complex on-chain data behind easy-to-read visualizations.

You don’t need to use ten dashboards. Pick a couple of the best tokenomics platforms for investors and learn them well. Depth beats quantity.

—

Simple manual checklist before you buy

Before entering any new coin, run through a quick mental checklist:

– Holders:

– Are top wallets mostly exchanges and contracts, or unknown whales?

– Does any single address own more than ~20–25% of circulating supply?

– Tokenomics:

– Is there a clear allocation breakdown and vesting schedule?

– Are there any massive unlocks coming soon?

– Liquidity:

– Is liquidity deep enough for your position size?

– Is liquidity locked or controlled by the team?

– Behavior:

– Are large holders accumulating or dumping recently?

– Do new wallets keep showing up, or is activity dying?

If you can’t answer most of these in a few minutes, you’re not ready to invest in that token yet.

—

Common beginner mistakes when analyzing holders

Mistake 1: Confusing “many holders” with “safe project”

A token with 100,000 holders can still be heavily controlled if:

– One whale owns 40% of supply.

– Top 10 wallets control 80–90%.

Newbies often see a big “Holders: 150,000” number on a site and assume decentralization. Always check the distribution curve, not just the holder count.

—

Mistake 2: Ignoring time – looking only at a single snapshot

Distribution changes. Whales move. Team vesting unlocks. Markets rotate.

If you only look at the current holder list, you miss:

– A whale slowly exiting over the last month.

– A new whale accumulating heavily.

– Team wallets sending to exchanges before a major news event.

Whenever possible, look at:

– Holder stats over time.

– Large transfers & their direction.

– Repeated patterns (e.g. team selling on monthly unlocks).

—

Mistake 3: Not reading vesting details or unlock announcements

Many beginners:

– Don’t know there is a vesting schedule.

– Don’t realize upcoming unlocks are public.

– Are surprised by “sudden” price drops that were entirely predictable.

Train yourself to automatically ask:

– “Where is the vesting schedule?”

– “When is the next big unlock?”

– “Who unlocks then — team, investors, or community?”

If you find no clear info, treat that as a risk by default, not a minor detail.

—

Mistake 4: Trusting tokenomics images without on-chain verification

Nice graphics in a PDF mean nothing if:

– There is no on-chain vesting contract.

– Team wallets are fully liquid from day one.

– Allocation doesn’t match the real holder list.

Cross-check:

– Whitepaper allocation vs. real distribution in the explorer.

– Vesting claims vs. token contract functions.

– Team wallets vs. vesting contract addresses.

If the story on paper and the story on-chain don’t match, believe the chain.

—

Mistake 5: Overcomplicating or undercomplicating the process

Two opposite errors:

– Overcomplicating:

– Trying to model everything like a hedge fund.

– Spending days in spreadsheets but never making decisions.

– Undercomplicating:

– “Looks cool, lots of followers, let’s ape.”

– Checking only price and chart, ignoring holder structure.

You want a simple, repeatable routine:

1. Contract → explorer → holders.

2. Check top holders, labels, and concentration.

3. Read tokenomics and vesting.

4. Glance at whale behavior and unlock timeline.

5. Decide on risk and position size.

—

How to gradually level up your holder analysis

Start simple, then refine your intuition

You don’t need to master everything at once. Start with:

– Spotting obvious red flags:

– One unknown wallet with 50% supply.

– No vesting, no lock, but huge team share.

– Avoiding meme tokens with insane owner privileges:

– Unlimited mint, blacklist, trading control.

Then slowly:

– Learn to read contract labels and transaction history.

– Use one or two analytics dashboards consistently.

– Compare distribution for different types of projects:

– Blue-chip DeFi vs. meme coins vs. new L1s.

—

Compare with known benchmarks

To build intuition, pick a few established projects and examine their distribution:

– Look at how top 10 holders compare.

– See how team and investors are vested.

– Check how the distribution evolved from launch to maturity.

Comparing your new token to these benchmarks helps you see:

– Is this project in the same ballpark?

– Or is it completely off (e.g. way more centralized, no locks, weird allocations)?

—

Wrapping up: make holder analysis a habit, not a one-time task

Assessing token distribution and holders is not about perfection. It’s about avoiding obvious structural risks:

– Centralized control by a few whales.

– Massive hidden unlocks.

– Misleading tokenomics that don’t match on-chain reality.

If you follow a basic checklist, use a couple of reliable analytics platforms and stay skeptical of shiny graphics without data, you’re already ahead of most new investors.

Next time before you buy:

– Check who really holds the token.

– Understand when more tokens will appear.

– Decide if you’re comfortable being in the same room as those whales.

That’s how you turn “beginner” into “prepared” in the world of token distribution and holder analysis.