Understanding Crypto Price Alerts: Core Concepts and Functions

Crypto price alerts are automated notifications triggered when a digital asset reaches a predefined price threshold. These alerts can be delivered via push notifications, SMS, email, or API callbacks, providing traders and investors with real-time market insights. The primary goal is to reduce latency in decision-making when market conditions change rapidly. Alerts are typically configured using conditional logic, such as “Notify me when BTC > $70,000” or “Alert when ETH drops below $1,800.” By leveraging these conditions, users can respond proactively to market volatility without continuously monitoring charts or order books.

Types of Price Alerts and Their Strategic Applications

There are several types of price alerts, each suited for different trading strategies. Static price alerts activate when an asset hits a specific price. These are useful for breakout strategies or psychological resistance levels. Dynamic thresholds, like trailing alerts, adjust based on market movement—e.g., alerting if a coin drops 5% from a local high. Volume-based alerts combine price and trade volume data to detect anomalies or potential pump-and-dump schemes. Another advanced method is volatility-based alerting, which triggers notifications during abnormal standard deviation increases over a moving average. These nuanced alert types enable more precise risk management and can be integrated into automated trading systems via APIs.

Visualizing Alerts in a Market Context

Imagine a graph plotting price over time with horizontal lines indicating user-set alert thresholds. When the price intersects one of these lines, an alert is triggered. This visual representation—akin to support and resistance levels—helps understand how alerts correspond to market behavior. For example, if BTC consistently bounces off $30,000, a user might set an alert slightly above and below that level to capture breakout or reversal conditions. Such diagrammatic interpretations can be integrated into trading dashboards like TradingView or Coinigy, where alerts are overlaid on real-time candlestick charts for immediate context.

Comparative Analysis: Alerts vs. Traditional Monitoring Tools

Compared to traditional market monitoring methods, such as manual chart tracking or periodic reporting tools, crypto price alerts offer significant advantages in responsiveness and scalability. Manual monitoring is time-intensive and prone to human error, especially in 24/7 markets like crypto. On the other hand, bots and algorithmic trading scripts may be too complex or rigid for casual investors. Alerts represent a middle ground—flexible, accessible, yet powerful. While news feeds and sentiment analysis tools provide macro context, they cannot substitute for real-time price-based triggers. Alerts can also be integrated with these tools, creating hybrid systems that combine price action with sentiment volatility.

Unconventional Uses of Crypto Price Alerts

Beyond traditional trading, price alerts can serve innovative functions. One approach is arbitrage monitoring—setting alerts on multiple exchanges to detect price discrepancies of the same asset. For instance, if ETH trades at $1,900 on Binance and $1,920 on Kraken, an alert can flag the arbitrage opportunity. Another novel application is using alerts to monitor correlation breakdowns. If BTC and ETH generally move together, but ETH diverges unexpectedly, a correlation alert could indicate a sector-specific shift. Additionally, alerts can be used in DAO or governance token voting strategies—triggering notifications when token prices cross thresholds that affect voting power or staking incentives.

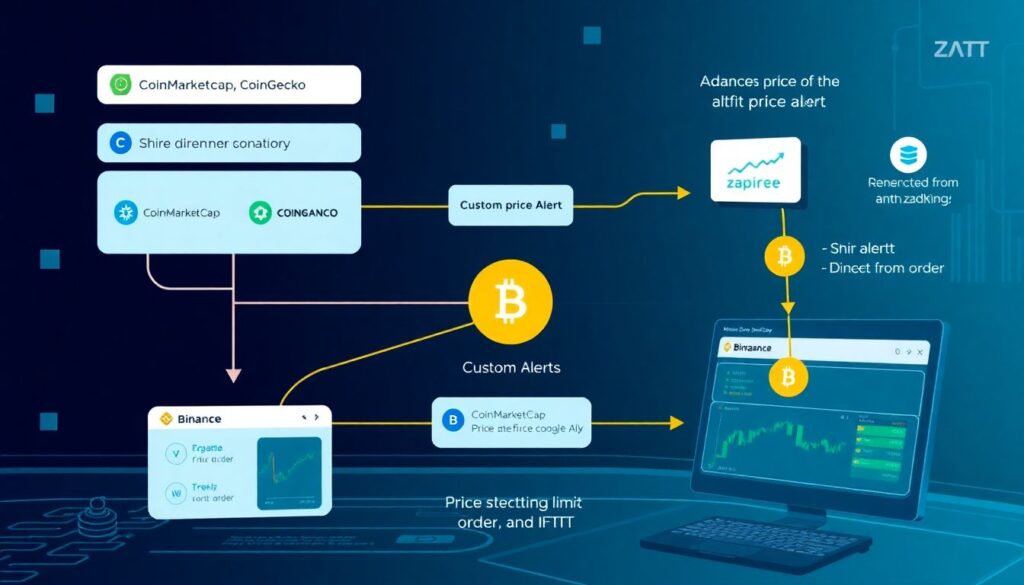

Integration with APIs and Automation Pipelines

Advanced users can integrate price alerts via APIs offered by platforms like CoinMarketCap, CoinGecko, or directly from exchanges (e.g. Binance API). Combining alert systems with webhook automation tools like Zapier or IFTTT enables custom workflows—for instance, triggering a limit order when a price alert fires, or sending a Slack message to a trading team. More complex pipelines may involve Python scripts listening for webhook payloads, parsing JSON data, and executing decisions via trading bots. This programmatic approach allows for real-time, automated responses to market conditions without manual intervention, dramatically improving trade execution latency and consistency.

Security and Privacy Considerations

While price alerts offer efficiency, their implementation must prioritize security. Alert services that require exchange API keys must follow strict token handling protocols, including encryption at rest and in transit, and should offer IP whitelisting. For browser-based alerts, users should verify HTTPS connections and avoid granting excessive permissions. Notifications sent over unsecured channels like SMS may leak sensitive information, so secure messaging platforms or end-to-end encrypted APIs are preferred for critical trade signals. Additionally, storing alert data locally or on private servers minimizes exposure to third-party risks and ensures compliance with data protection standards.

Conclusion: Maximizing Value from Price Alert Systems

To extract the full value from crypto price alerts, users should treat them as components within a broader trading infrastructure. They are most effective when configured with precision, contextualized with technical indicators, and integrated into automated decision-making flows. By using diverse alert types—static, dynamic, and correlation-based—traders can anticipate market shifts and capitalize on inefficiencies. Moreover, creative applications like arbitrage detection and DAO monitoring demonstrate that alerts are not merely passive tools but active agents in strategic execution. In volatile and non-stop markets, mastering price alert systems is not optional—it is a competitive necessity.