What Is Token Burning? A Simple Yet Powerful Concept

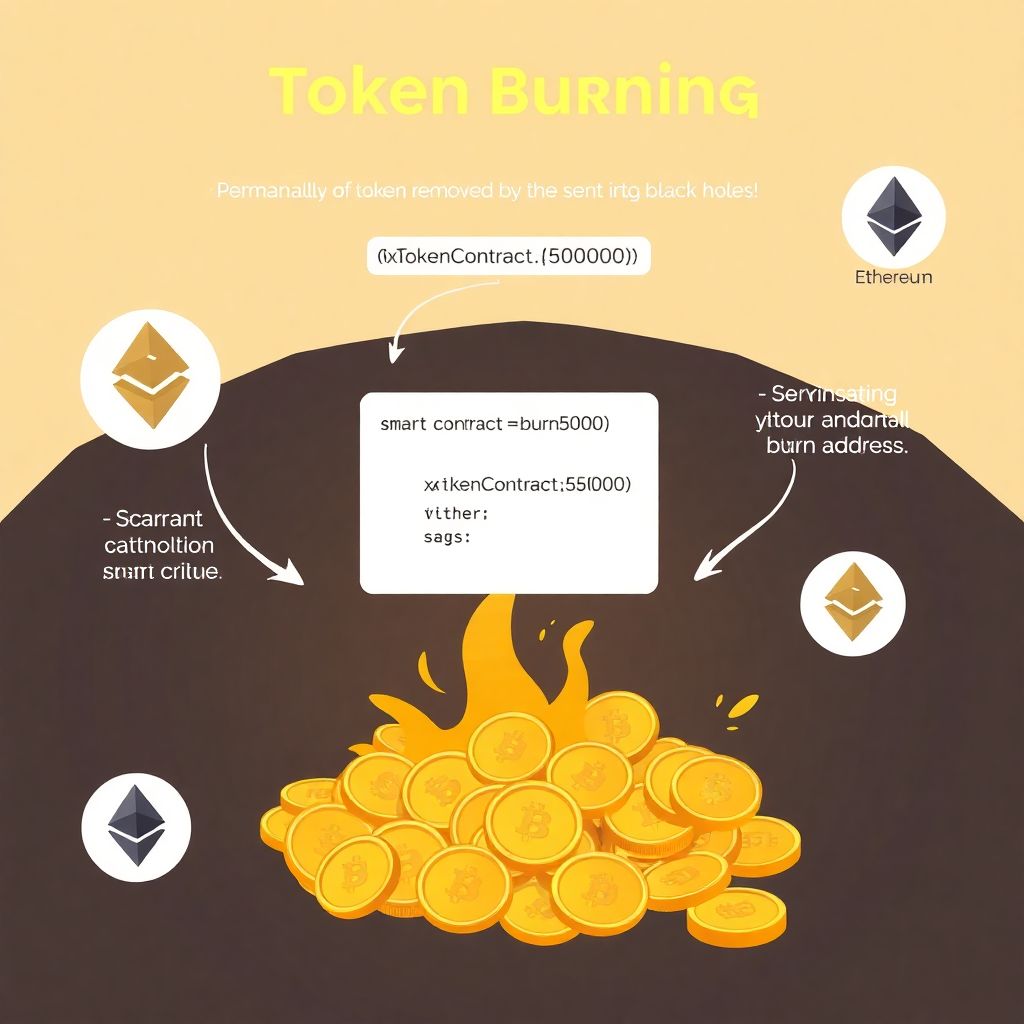

Token burning might sound like something destructive, but in the world of blockchain, it’s a strategic and often beneficial economic move. At its core, token burning refers to the process of permanently removing a certain number of tokens from circulation. These tokens are sent to a so-called “burn address” – a wallet with no known private key – making it impossible to retrieve or use them again.

The goal? To reduce the total supply of tokens, thereby creating scarcity. In theory, if demand remains constant or increases, the value of each remaining token should rise. This is similar to stock buybacks in traditional finance, where a company repurchases its own shares to reduce supply and increase shareholder value.

How Token Burns Actually Work (Technical Deep Dive)

Token burns are executed via smart contracts. Here’s a simplified breakdown of the process:

1. A certain amount of tokens is identified for burning.

2. The tokens are sent to a verifiable, irretrievable address (often called a “black hole”).

3. The blockchain records the transaction, making the burn transparent and immutable.

Technical Example:

In the Ethereum ecosystem, a burn transaction might look like this:

“`

0xTokenContract.burn(5000);

“`

This command calls the `burn()` function in the token’s smart contract, reducing the total supply by 5,000 tokens.

Some blockchains, like Binance Smart Chain or Ethereum, also implement automatic burning mechanisms. For instance, Binance Coin (BNB) uses a quarterly burn system based on trading volumes on Binance Exchange.

Why Projects Burn Tokens: Incentives and Economics

Token burning isn’t just a flashy gimmick. It often serves multiple strategic purposes:

– Deflationary Pressure: Reducing supply can increase token value over time.

– Investor Confidence: A project that burns tokens shows long-term commitment to value creation.

– Utility and Governance: Some protocols require burning tokens to access certain features or vote on proposals (e.g., VeChain or Terra Classic).

A real-world example is Shiba Inu (SHIB), which introduced a burn portal to encourage community-led burns. In 2022 alone, over 410 trillion SHIB tokens were burned — roughly 41% of the total supply — largely driven by community initiatives.

Common Mistakes Beginners Make With Token Burns

Understanding the mechanics is one thing; avoiding common pitfalls is another. Here are some frequent errors beginners make:

1. Assuming All Burns Increase Price

Not all token burns lead to price spikes. If a project burns tokens but has negligible demand or utility, the burn will have little to no effect on value. Token economics is a balance between supply and demand — removing supply without addressing demand is like trying to inflate a balloon with a hole in it.

2. Confusing Manual and Automated Burns

New investors often misunderstand the difference between scheduled (manual) burns and algorithmic (automatic) ones. For example, Ethereum’s EIP-1559 upgrade introduced automatic base fee burning for every transaction. This is a fundamentally different mechanism than, say, Binance’s quarterly burns based on revenue.

3. Ignoring Transparency and Verification

Some shady projects claim to burn tokens but never actually do. Always verify burns on a blockchain explorer. For instance, you can check BNB burns on BscScan using their official burn address:

`bnb1burn0000000000000000000000000000000000000`.

If a project doesn’t provide a verifiable burn address or transaction hash, that’s a red flag.

4. Overlooking Tokenomics as a Whole

Burning is just one part of a token’s economic model. Beginners often fixate on burns while ignoring other crucial elements like inflation rate, staking rewards, lock-up periods, and governance structures. A well-balanced tokenomics model considers all these factors in harmony.

Case Study: Binance Coin (BNB) and Its Burn Strategy

BNB is one of the most well-known examples of an effective burn strategy. Initially, Binance committed to burning 100 million BNB (50% of its total supply). These burns occur quarterly and are based on trading volume on the Binance Exchange.

By Q1 2024, Binance had burned over 44.8 million BNB. The burns are transparent, with each transaction publicly verifiable. The result? A steady increase in BNB’s value over time, supported by strong utility across the Binance ecosystem — from trading fee discounts to DeFi applications.

The key takeaway: BNB’s burn strategy works because it’s supported by real demand and ecosystem utility, not just supply reduction.

How to Evaluate a Project’s Burn Mechanism

When analyzing a project’s burn policy, consider these questions:

– Is the burn transparent and verifiable on-chain?

– Is there a clear schedule or formula for burns?

– What is the token’s utility beyond burning?

– Is demand growing or stagnating?

– Does the project have a sustainable economic model?

If the burn is just a marketing stunt without underlying utility or demand, it’s unlikely to have meaningful long-term impact.

Final Thoughts: Token Burns Are Tools, Not Magic

Token burning is a powerful mechanism — when used wisely. It can help align incentives, reduce inflation, and build community trust. But it’s not a silver bullet. Beginners should avoid getting caught up in hype and instead focus on the fundamentals: utility, demand, transparency, and sound token economics.

If you’re diving into crypto investing or launching your own project, understand that burning tokens is just one piece of the puzzle. The real value lies in creating something people actually want to use.

Stay skeptical, stay curious — and always verify on-chain.